Alex Cheong Pui Yin

25th February 2022 - 3 min read

(Updated at 5pm, 25 Feb 2022 to include information on MOEX.)

The Russia-Ukraine conflict has regrettably escalated into war as Russian military began its entry into its neighbouring country in what was called “the largest ground war in Europe since World War II”.

The global community was, understandably, stunned by the rapid development despite the tension that has been brewing between both nations for a while now. The global financial markets, too, were affected – with most major stock exchanges quickly plunging as news came out about the invasion.

Kuala Lumpur Stock Exchange (KLSE)

The FBM KLCI took a dive yesterday as soon as news began trickling out about the scale of the conflict, with investors quickly cashing out their investments. At 5pm yesterday, it closed 12.25 points (-0.77%) lower 1,573.89 after recovering from a day low of 1,565.24.

Surprisingly, the FBM KLCI recovered strongly this morning, opening at 1,586.40 – and has been gradually climbing up since. As of the time of writing, the index has risen by 22.54 points (+1.43%) to 1,596.72.

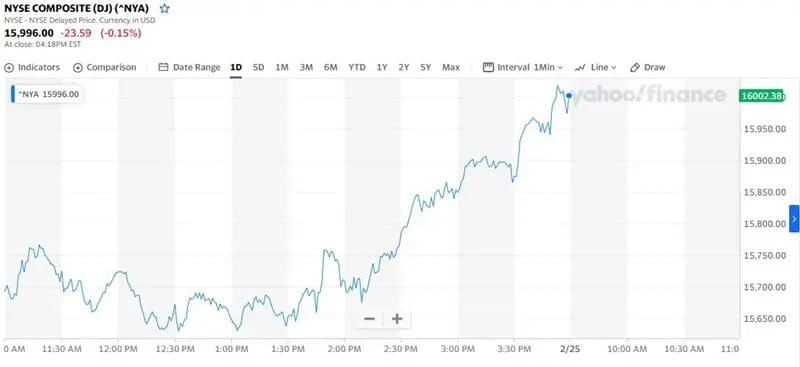

New York Stock Exchange (NYSE)

Both the Nasdaq Composite and the S&P 500 tumbled during a morning sell-off after Putin’s announcement; Nasdaq suffered a 3% drop at the open, whereas the S&P 500 dipped 1.5%. The Dow Jones Industrial Average, too, plunged more than 800 points during intraday trading.

But similar to the FBM KLCI, US stocks were also able to shake off the effects of Russia’s invasion following the announcement of a second set of sanctions against Russia from US president Joe Biden. This will further restrict Russia’s ability to conduct business in the world’s major currencies. Biden had previously already announced a first batch of financial sanctions on Tuesday, aimed at Russian financial institutions, sovereign debt, and oligarchs in the country.

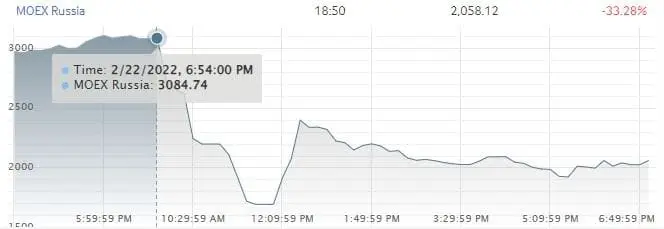

Moscow Stock Exchange (MOEX)

Russian stocks suffered a historic collapse on Thursday, with the MOEX wiping off about 45% its trading value at 1,690.13 – equivalent to more than US$150 billion in value. That said, MOEX has been seeing a massive dip since 22 February, when the Russia-Ukraine conflict began to boil and spill over.

The MOEX temporarily suspended trading on all of its markets yesterday, but quickly reversed this move soon after, saying that it will “resume trading on its market at 10am”. Interestingly, MOEX also opened on on a high note today, recovering more than 20% as compared to its closing points price on 24 February 2022. However, some economists have forecasted that “Russia will be headed for economic stagnation, if not worse”, especially since it now faces sanctions from not only the US, but also other European countries, including the UK and Germany – but this remains to be seen.

Cryptocurrency

As expected, the cryptocurrency market, too, plunged yesterday after the Russia-Ukraine conflict intensified, with the price of Bitcoin falling by more than 6% to US$34,338 and Ether by about 8.7% to US$2,300. This was a far cry from their all-time highs of US$68,990 and US$4,865, respectively – which were achieved back in early November.

However, like other global markets, the crypto market as a whole also rebounded slightly today, with Bitcoin and Ether both rising over 10% since yesterday’s lows. That said, this drop raised doubts on Bitcoin’s worth as a store of value, a claim that grew popular during the bull run last year. Yesterday, prices of Bitcoin and gold went in completely opposite directions, as gold prices briefly spiked up to US$1,950 – its highest since the end of 2020 – while Bitcoin tumbled.

***

As tensions continue to escalate in Ukraine even as Western nations threaten further sanctions, it remains to be seen if the swift recovery in the economic markets will stay its course.

Comments (0)