Alex Cheong Pui Yin

19th September 2022 - 4 min read

Securities Commission Malaysia (SC) revealed that there was a 25% increase in the number of complaints and enquiries made in relation to investment scams within Malaysia during the Covid-19 pandemic.

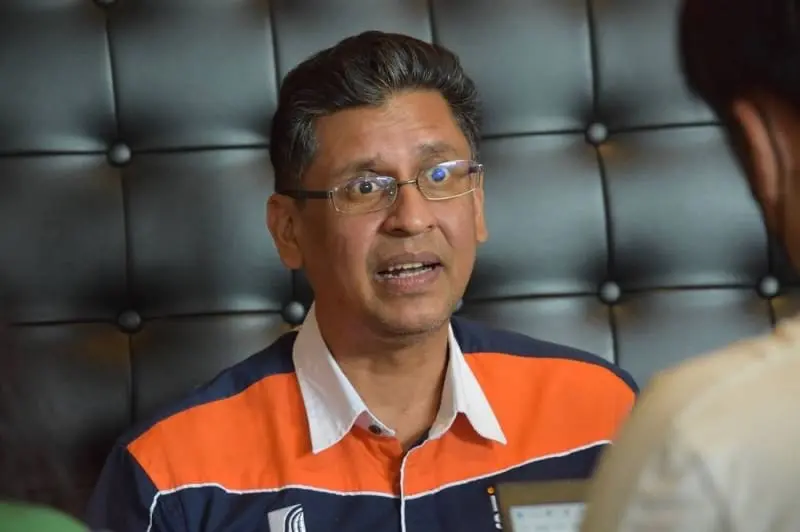

According to the general manager of the Consumer & Investor Office for the SC, Jawahar Ali Ameer Ali, a total of 1,857 complaints and enquiries related to investment scams was reported in 2021. In comparison, there were just 1,482 enquiries made in the year before.

Jawahar Ali also commented that the cases reported were mainly about scams that were promoted via social media. “My observation is that during the Covid-19 pandemic, a lot of people felt bored at home during the lockdowns or were struggling financially, so they started looking for investment opportunities as they needed more money. This created a fertile ground for the scammers,” he said.

As such, Jawahar Ali said that the SC has taken the initiative to conduct a series of nationwide educational talks – in both urban and rural areas – in a bid to educate the people about recommended anti-scam measures. These include precautions such as never depositing money into an unknown individual’s bank account.

Jawahar Ali further highlighted various other scam-related details, such as common tactics that are employed by scammers. He said that fraudsters will often attempt to convince victims with “unusually high returns” on small initial investments – as low as RM300.

“Let’s say you ‘invested’ RM300 – they [scammers] would promise you a return of RM3,000 in 24 hours. But before you could withdraw that RM3,000, they would direct you to deposit an amount meant as payment for the Inland Revenue Board’s fee, Bank Negara Malaysia charges, or administration fees,” explained Jawahar Ali.

Jawahar Ali also stressed the prevalence of clone firm scams, where scammers impersonate licensed intermediaries. “This means that the perpetrators clone the credentials of a legitimate, licensed entity to convince the victims that they are registered, when in actual fact, that’s not the case,” he said.

Furthermore, Jawahar Ali reminded that investment firms licensed by foreign authorities cannot solicit funds from Malaysians unless it is approved by the SC to do so. “Some of these companies claim to be international investment firms, but this is the myth that we are trying to dispel here. It does not matter if they’re licensed by ten different jurisdictions; most importantly, they must have a licence in Malaysia to operate in Malaysia,” he emphasised.

Jawahar Ali further noted that Facebook and Telegram have both been identified as platforms that are often used to propagate investment scams. Oftentimes, victim will be redirected to scammers after clicking on a link on these platforms.

Ultimately, Jawahar Ali said that if something sounds too good to be true, then it probably is. He also pointed out that the SC has been tasked with regulating and developing the Malaysian capital market, along with protecting investors’ rights and interests. As such, it has been proactive in educating the public about investment scams through various online and offline channels.

“Such information can be found on our official Facebook, Twitter, Instagram, and YouTube pages under the name ‘InvestSmart SC’. The Investor Alert list has also been set up on our website, which contains the names of entities that are not licensed by the SC to sell investment products in the country,” said Jawahar Ali, adding that the SC has also been conducting outreach programmes at schools.

Upcoming efforts include the Invest Smart Fest – an investor education and exhibition programme – which is slated to take place between 14 to 16 October 2022 at Kuala Lumpur Convention Centre.

(Source: Malay Mail)

Comments (0)