Alex Cheong Pui Yin

19th January 2024 - 2 min read

StashAway has said that it will be revising the projected rate of return for its cash management portfolio, StashAway Simple from the existing 3.8% p.a. to 3.6% p.a., effective 1 February 2024. This comes as it is set to carry out a re-optimisation exercise for StashAway Simple between 22 to 25 January 2024, as well as introduce a management fee of 0.15% p.a..

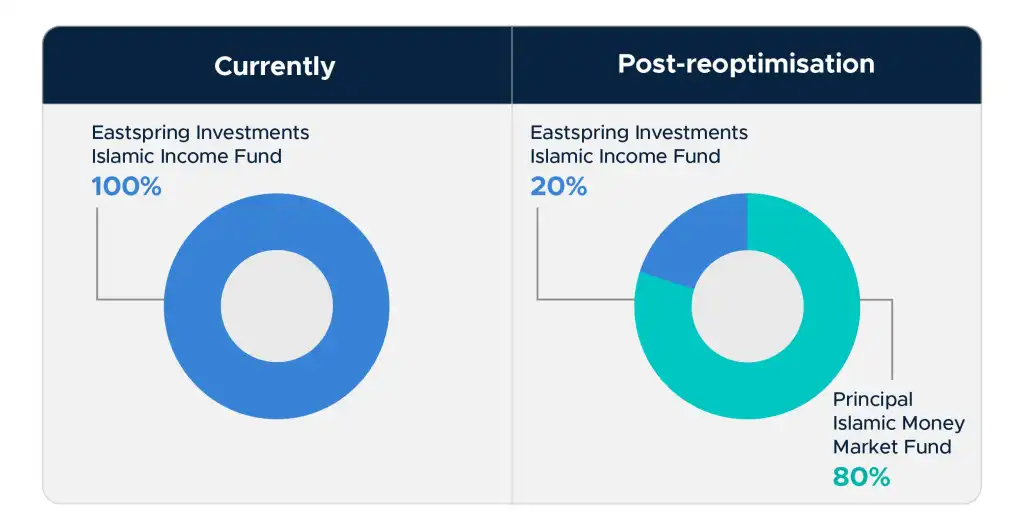

In an email to investors, StashAway explained that the re-optimisation will see the inclusion of a new fund alongside the current Eastspring Investments Islamic Income Fund so that StashAway Simple can continue to offer competitive returns. The second fund, namely the Principal Islamic Money Market Fund, will provide investors with exposure to short-term sukuk and money market funds.

StashAway also highlighted that no action is required from investors to kickstart the exercise – the process will be carried out automatically by the digital wealth management platform – and there will be no charges either. However, note that there may be slight delays if you were to make deposits and withdrawals during the period.

As for the new 0.15% p.a. management fee, StashAway did not share its reasons for introducing the charge now, but noted that the updated projected rate of return (3.6% p.a.) is already net of all fees. At present, StashAway does not impose any platform or service fees for its StashAway Simple feature – including management fee – but there is an expense ratio that is charged by the underlying fund manager.

For clarity, here’s a visual from StashAway to spell out the timeline of the upcoming changes for its StashAway Simple feature:

For those who have questions regarding these latest developments, you can reach out to StashAway’s support team at +603 9212 4356. Alternatively, you can email them at support@stashaway.my.

For context, StashAway Simple was first rolled out in 2020 with a projected rate of 2.4% p.a.. Over time, this rate has been updated accordingly, and in early 2023, it was raised up to 4.1% p.a. before being revised down to the current 3.8% p.a. some months later.

Comments (0)