Alex Cheong Pui Yin

28th July 2020 - 2 min read

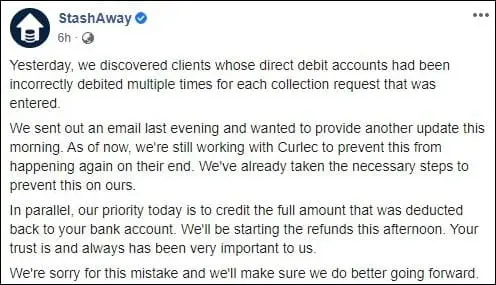

Following a technical issue that saw the bank accounts of many StashAway users being erroneously debited multiple times yesterday, the robo-advisor made a Facebook post today, stating that “our priority today is to credit the full amount that was deducted back to your account.”

According to the post – which was made at noon – StashAway has already begun the process of refunding its affected users, and that it will release an official statement over the next few days to explain the chain of events. It also apologised, and said that it is now working with its partner, Curlec, to fix the issue and to prevent this from happening again.

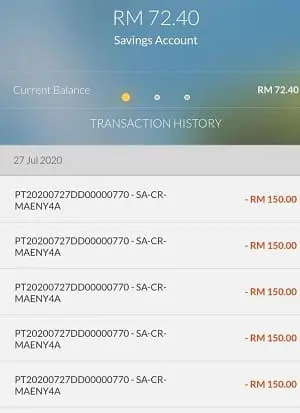

Yesterday, StashAway users who had enabled the direct debit function found themselves faced with the unpleasant surprise of drained bank accounts after a technical error caused the robo-advisor to mistakenly execute up to 27 back-to-back debit transactions. For instance, if you set up a standing instruction to automatically transfer RM150 to StashAway each month, you may have found yourself abruptly missing up to RM4,050 last evening.

(Image: Vulcan Post)

It was also noted that the issue was not isolated to a single bank; the affected StashAway accounts were linked to several different banks, including CIMB, HSBC, Hong Leong Bank, and Maybank.

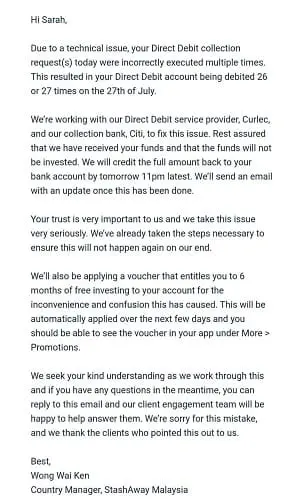

On the same day, StashAway Malaysia’s country manager, Wong Wai Ken, sent out an email to inform its users that the wealth management platform is aware of the technical problem, and that it is already striving to resolve the issue. Affected users can expect to receive the full refund by 11pm today. Wong also offered affected users a voucher that entitles them to 6 months of free investing for the inconvenience caused.

(Image: Vulcan Post)

StashAway offers investing services by providing customised investment portfolios for its users based on their financial goals and risk preferences. It is licensed by the Securities Commission Malaysia, which means that it complies with the same capital, compliance, auditing, and reporting requirements abided by most financial institutions in Malaysia.

(Source: StashAway (Facebook), Vulcan Post)

Comments (0)