Alex Cheong Pui Yin

7th July 2021 - 7 min read

On 28 June 2021, Prime Minister Tan Sri Muhyiddin Yassin announced that a second six-month loan moratorium will be made available to all individual borrowers (B40, M40, or T20) and microentrepreneurs under the latest PEMULIH stimulus package. Running from July 2021 onwards, it is intended to offer some relief to Malaysians who are struggling financially following the implementation of a prolonged lockdown period to combat the spread of the Covid-19 pandemic.

As of today, applications for the new PEMULIH moratorium are officially open. In this article, we will share some crucial details that you should take note of before making your decision to apply for the moratorium.

What is available under Pemulih Loan Moratorium?

There are three forms of assistance that are being provided to borrowers and credit cardholders, depending on their needs and preferences:

- Full deferment of loan instalments for 6 months

- 50% reduction in monthly instalment payment for a period of 6 months

- Conversion of outstanding credit card balances to instalment plans for up to 36 months, with a fixed interest rate of 13% p.a.

In general, the first two aids will be made available for most credit facilities, namely housing loans and mortgages, personal loans, hire purchase and vehicle financing, ASB financing, as well as term loans and overdrafts. That said, it’s best that you check in with your respective banks to confirm whether your credit facility or loans are eligible for their assistance packages.

Meanwhile, the third aid – which offers the conversion of outstanding credit card balances to instalment plans – has actually been around for quite a while. It was rolled out alongside the first automatic moratorium back in April 2020, and has been extended since to assist cardholders who are unable to consistently repay their credit card debts.

Aside from the above standard aids, a number of banks also appear to have offered some “differentiated” or additional packages. For instance, CIMB customers with auto financing or hire purchase loans will be able to choose between a 3-month or 6-month moratorium (with no option for a 50% reduction in monthly instalment payments). UOB, on the other hand, has a special assistance option for customers with conventional mortgage and term loans, allowing them to only pay for the interest portion of their loans for six months (with a 6-month extension of the loan tenure).

Most banks also state that they are ready to speak to any borrowers who need other tailored financial assistance packages. Borrowers are encouraged to reach out to them if the second moratorium does not suit their needs, noting that alternative help – such as existing targeted repayment assistance (TRA) packages or rescheduling and restructuring (R&R) – are also available.

To find out more about the specific aids that are being provided by each individual bank, here are their Covid-19 support pages listed below:

– Affin Bank Berhad / Affin Islamic Bank Berhad

– Bank Pertanian Malaysia Berhad (Agrobank)

– Al Rajhi Banking & Investment Corporation (Malaysia) Berhad

– Alliance Bank Malaysia Berhad / Alliance Islamic Bank Berhad

– AmBank (M) Berhad / AmBank Islamic Berhad

– Bank Muamalat Malaysia Berhad

– CIMB Bank Berhad / CIMB Islamic Bank Berhad

– HSBC Bank Malaysia Berhad / HSBC Amanah Malaysia Berhad

– Hong Leong Bank Berhad / Hong Leong Islamic Bank Berhad

– Kuwait Finance House (Malaysia) Berhad

– Malayan Banking Berhad / Maybank Islamic Berhad

– OCBC Bank (Malaysia) Berhad / OCBC Al-Amin Bank Berhad

– Public Bank Berhad / Public Islamic Bank Berhad

– RHB Bank Berhad / RHB Islamic Bank Berhad

– Standard Chartered Bank Malaysia Berhad / Standard Chartered Saadiq Berhad

– United Overseas Bank (Malaysia) Bhd

Interest Will Accrue During The Moratorium Period

All banks have emphasised that taking the loan moratorium will incur additional financing cost, since interest will still accrue during the deferment period. As mentioned earlier by Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz, accrued interest and any penalty charges will not compound during the moratorium period. Similarly, the tenure of the loan will also be increased based on your existing loan – some borrowers may see their tenures extended by six months, while others may have longer extensions.

As such, borrowers are advised to continue with their existing loan repayment, and only consider the loan moratorium if they face severe cash flow issues.

On top of this, borrowers should also note that each bank has been given the flexibility to set their own terms and conditions with regard to the specific treatment of the interest during the moratorium. In other words, these terms are not set by Bank Negara Malaysia (BNM), the Association of Banks in Malaysia (ABM), or the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) beyond the general assistance packages mentioned in the previous section. Consequently, one borrower’s repayment terms may be different to another – you will need to speak to your respective banks to find out what’s available for your specific loan(s).

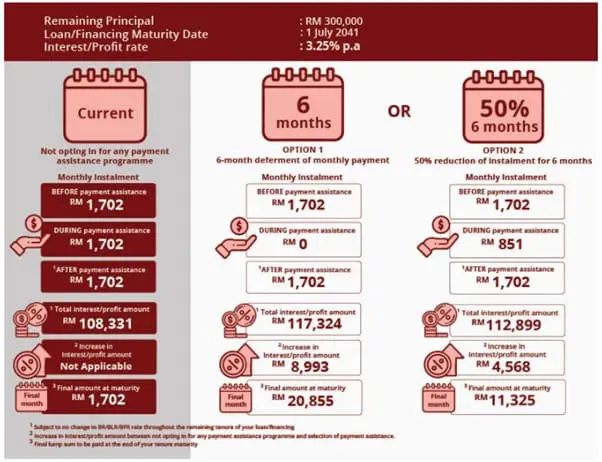

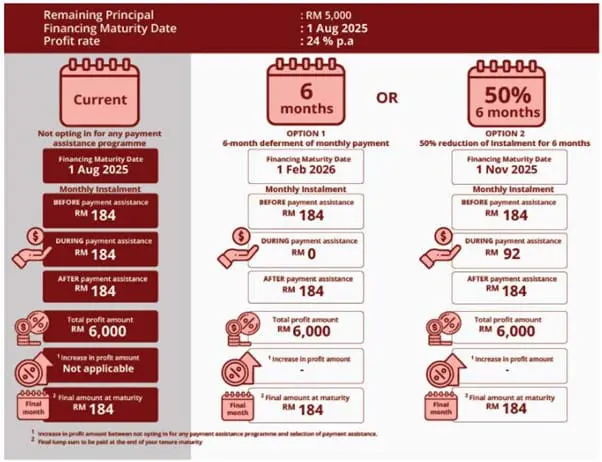

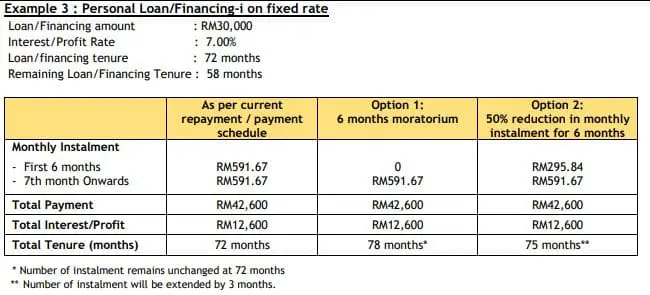

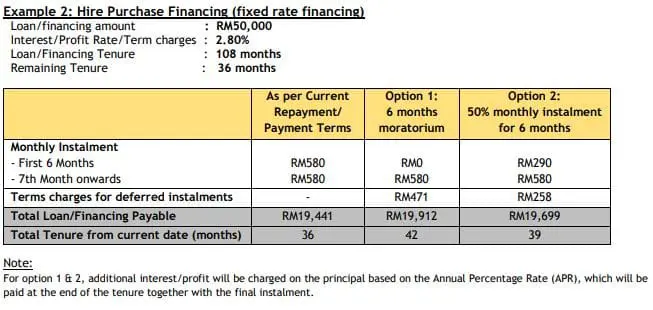

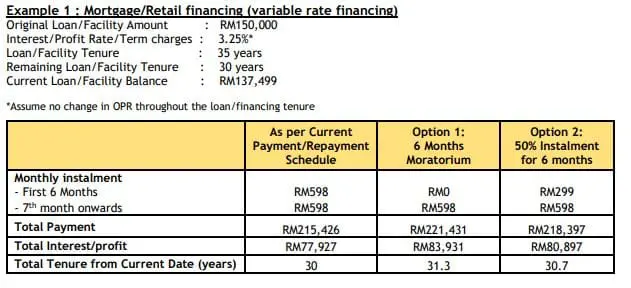

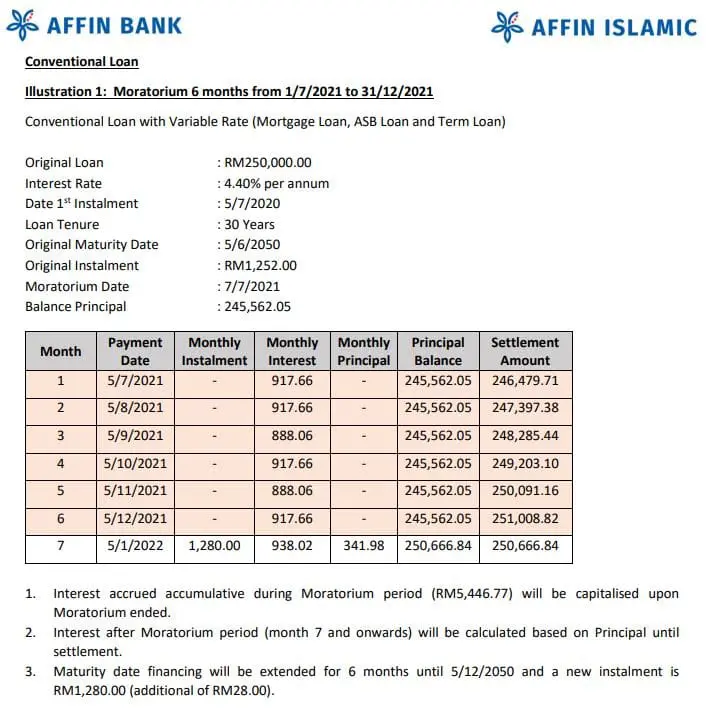

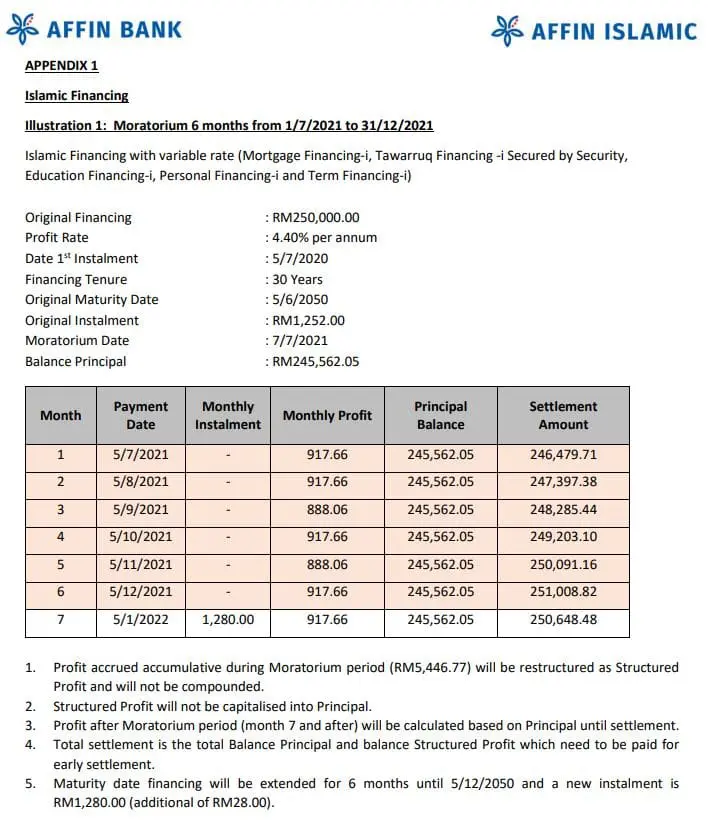

Here are some examples by several banks on interest calculations to give borrowers a clearer picture of the additional financing costs (if any) should they take up the loan moratorium:

CIMB Bank

Maybank

RHB Bank

Affin Bank

How to apply for Pemulih loan moratorium?

Prior to applying, check to make sure that you meet the prerequisite requirements in order to be eligible for the assistance packages offered, specifically:

- Approval date for the customer’s financing account must be before 30 June 2021 or 1 July 2021 (depending on banks).

- Your financing account should not be in arrears exceeding 90 days from the date of the application.

- You should not be declared bankrupt.

If you qualify for the moratorium assistances, then you can begin the application process. Typically, most banks will have a dedicated Covid-19 support page and online form that you can access to kickstart the process. In some cases, you may be required to first go through a verification process (such as Public Bank) or log into your online banking account before you can proceed (such as Maybank – available only starting from 20 July 2021).

In general, the only form only requires you to provide the usual personal details, such as your name, MyKad number, mobile number, and email. You may also be asked to share details about your loans (e.g. your loan account number, credit card number, or if you have any existing standing instructions with the banks). Finally, make sure to inform the bank of your preferred moratorium package before submitting your form.

Aside from online applications, banks also offer other channels to apply. You can email or call the bank for assistance. It is also possible for you to walk in to a branch to apply, but note that some branches may not be open during the EMCO/FMCO, while many banks also require you to schedule an appointment in order to visit the branch.

Alternatively, some banks may also reach out to borrowers via SMSes and emails. You can then reply them via these channels to take the loan moratorium.

Finally, the banks have confirmed that borrowers will not need to provide documentations (such as proof of loss of income or unemployment) during the application process, although certain parties may be required to sign a self-declaration form. That said, there may be some follow-up enquiries after that if your respective bank deems it necessary.

***

Given the financial struggles of many Malaysians during this difficult time, the PEMULIH moratorium can be a seen as a temporary band aid to help ease cash flow issues. Just like before, this aid will not be recorded in CCRIS, which means it will not affect your credit health. If you need help, it is available for you – but note that there are additional costs incurred, so you must consider the option carefully.

We are taking a closer look at the banks’ FAQs and will be sharing our analysis and recommendations on the Pemulih loan moratorium very soon.

Comments (0)