Jacie Tan

28th June 2021 - 2 min read

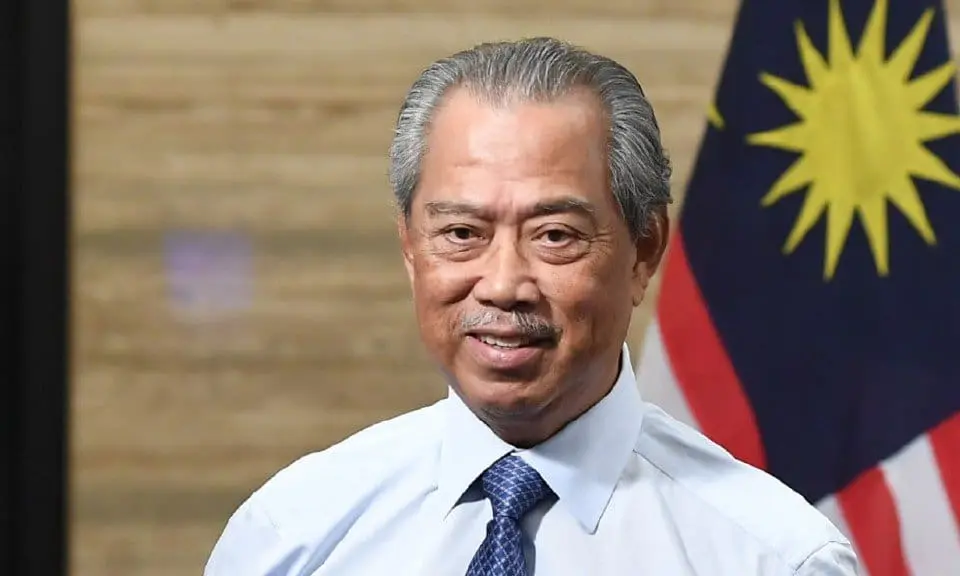

Prime Minister Tan Sri Muhyiddin Yassin has announced that a six-month loan moratorium will be made available to all individual borrowers – whether B40, M40, or T20 – and microentrepreneurs. This loan moratorium will not come attached with any conditions such as proof of loss of income or unemployment.

“With the cooperation of the banks, a six-month moratorium will be given to all individual borrowers, whether they are B40, M40, or T20, and microentrepreneurs,” said the prime minister. “There will be no more conditions like reduced income, no checks whether you have lost your job, and no need for any documentation to be produced for applications.

“You just need to apply and approval will be given automatically,” said Muhyiddin. The prime minister added that borrowers applying for this moratorium would also need to sign an agreement amending the relevant terms and conditions.

As for small and medium enterprises (SMEs), the prime minister said that the moratorium facility will also be offered to affected SMEs following checks and approvals by the banks.

“I hope that this moratorium initiative will help individual and SME borrowers in arranging their cash flow during these troubling times,” said the prime minister. “However, I would also like to advise you to use this offering wisely and if it is not necessary, do not add on other financial commitments.”

Applications for the new moratorium will open on 7 July 2021.

Comments (1)

Help with my account and send me a OCBC Credit 💳 .