Alex Cheong Pui Yin

16th March 2022 - 4 min read

Maybank has rolled out its new Maybank Personal Digital Financing, a digital personal financing solution that seeks to offer customers a hassle-free and fully digital experience from the point of application to the disbursement of cash. Available on the Maybank2u website and the MAE by Maybank2u (MAE) app, it is said to provide instantaneous approval and disbursement within 10 seconds for selected customers – making it the first of its kind in the market.

According to Maybank, the new solution is open to both new and existing customers aged between 21 and 60 years old, with the financing amount available from between RM5,000 to RM100,000 or four times their monthly salaries (whichever is lower). The interest/profit rate, meanwhile, stands between 8% p.a. to 6.5% p.a., with a repayment tenure of between two to six years.

Customers who tap into the Maybank Personal Digital Financing solution will have the flexibility to choose their preferred minimum financing amount. If they do not qualify for the requested amount, the bank can then immediately provide an adjusted financing offer that better meets the customer’s profile. For transparency, applicants will also receive all important details pertaining to their offer, including the interest/profit rate, repayment tenure, and monthly repayment amount prior to accepting it.

Maybank further said that customers are also allowed to apply without the need for supporting documents, and can receive funds within 10 seconds of approval if they meet the following criteria:

- Have a salaried account with Maybank

- Minimum annual gross income of RM42,000 (RM3,500 per month)

- Healthy credit profile and score

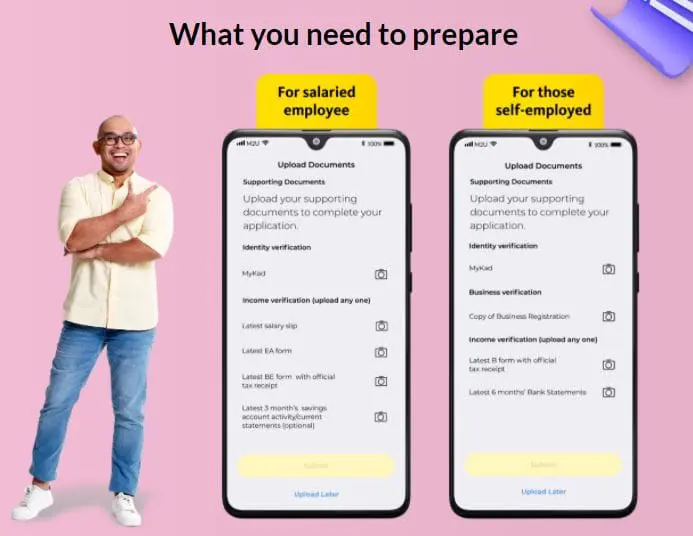

Customers who do not possess income records with Maybank, on the other hand, can apply for loans via the Maybank Personal Digital Financing as well, but they are required to go through the additional step of uploading their income documents (on top of other verification documents):

| For salaried employees (any of the following) | For self-employed individuals (any of the following) |

| – Latest salary slip – Latest EA form – Latest BE form with official tax receipt – Latest savings/current account statements (three months) (optional) | – Latest B form with official tax receipt – Latest bank statements (six months) |

Once your application is submitted, Maybank will inform you of your application status within the same day. If you meet the eligibility criteria set by the bank, the funds will be disbursed to you within one day of approval.

The group chief executive officer of Maybank’s Community Financial Services, Dato’ John Chong said that the launch of this new solution – which is available as conventional and Islamic options – will offer improved convenience and a speedier service to customers by eliminating the need for physical submissions.

“From our experience, we know that customers value speed and convenience when it comes to personal financing, as the funds could be intended for urgent use such as medical emergencies. In addition to fast disbursement, Maybank Personal Digital Financing does not require collateral or a guarantor, making it ideal for customers who need cash in hand immediately,” said Dato’ John.

Moreover, Dato’ Chong commented the solution is launched at the right time as Maybank expects consumer spending to return to pre-pandemic levels this year. “Since 3Q 2021, we have seen a growing trend among personal financing applicants requiring financial support for wedding-related costs, travel, and home down payments and renovations. This year, we expect a minimum of 30% growth in our personal financing segment, boosted by the introduction of Maybank Personal Digital Financing,” he stated.

In celebration of the launch of Maybank Personal Digital Financing, Maybank is currently running a campaign that allows customers who apply for loans via the solution to win cash prizes worth RM50,000. This includes a grand prize of RM10,000. The campaign is set to run until 15 July 2022.

The Maybank Personal Digital Financing solution is the latest in a line of digital offerings that have been rolled out by Maybank over the past two years. Other solutions include the SME Digital Financing solution and the more recent Maybank Home2u solution.

Comments (0)