Jacie Tan

28th January 2020 - 3 min read

(Image: AFP)

*UPDATE 31/1/2020: The Life Insurance Association of Malaysia (LIAM) and the Malaysian Takaful Association (MTA) have announced that all member insurers in the country will cover Wuhan coronavirus treatment in their medical insurance policies.

*UPDATE 30/1/2020: More insurance companies have released statements since the original date of publishing. This article has been updated to reflect that.

The Novel Coronavirus (2019-nCoV) – more commonly known as the Wuhan coronavirus – has been the subject of much talk in Malaysia lately. While there are only seven cases of the virus in the country so far, some insurance companies in Malaysia have confirmed that they will be extending medical coverage for cases relating to the coronavirus.

Prudential, Great Eastern, AIA, Tokio Marine, Zurich, and Etiqa are some of the insurance companies which have made express statements stating that their medical plans will cover cases of the coronavirus. Of course, this is subject to the terms and condition of each policyholder’s medical plan.

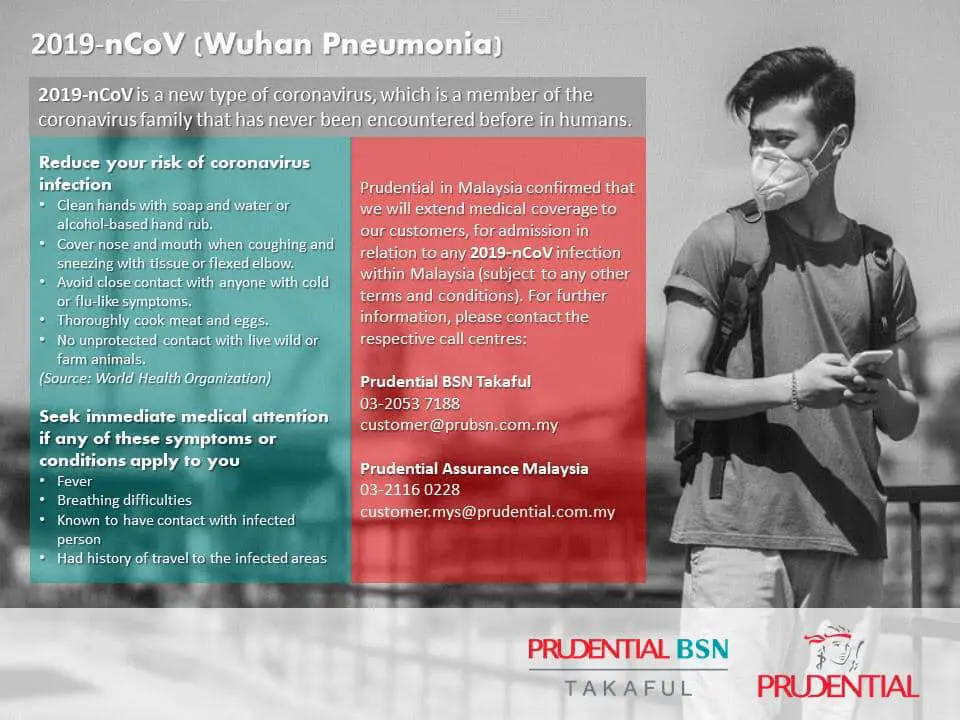

(Image: Prudential)

“Prudential in Malaysia confirmed that we will extend medical coverage to our customers, for admission in relation to any 2019-nCov infection within Malaysia – subject to any other terms and conditions,” said Prudential Malaysia in its Facebook post on 26 January. Other insurers including Great Eastern, AIA, Tokio Marine, and Etiqa have posted similar announcements to that effect on their Facebook pages.

Meanwhile, Zurich Malaysia posted a notice saying that its medical plans would “provide coverage for respiratory-related illnesses caused by the Novel Coronavirus (2019-nCoV)”, subject to terms and conditions in the respective plans.

Zurich also directly addressed the exclusion clause in most medical insurance policies that could possibly affect a claim for a coronavirus case. “Zurich will waive the standard exclusion and continue to provide coverage, should the Ministry of Health classify the 2019-nCoV as among ‘communicable diseases requiring quarantine by law’,” the insurer said.

When there was a spike in Influenza A(H1N1) cases in Malaysia in 2009, major insurance companies also decided to allow payouts on claims related to the disease in spite of the “communicable diseases requiring quarantine by law” exclusion clause.

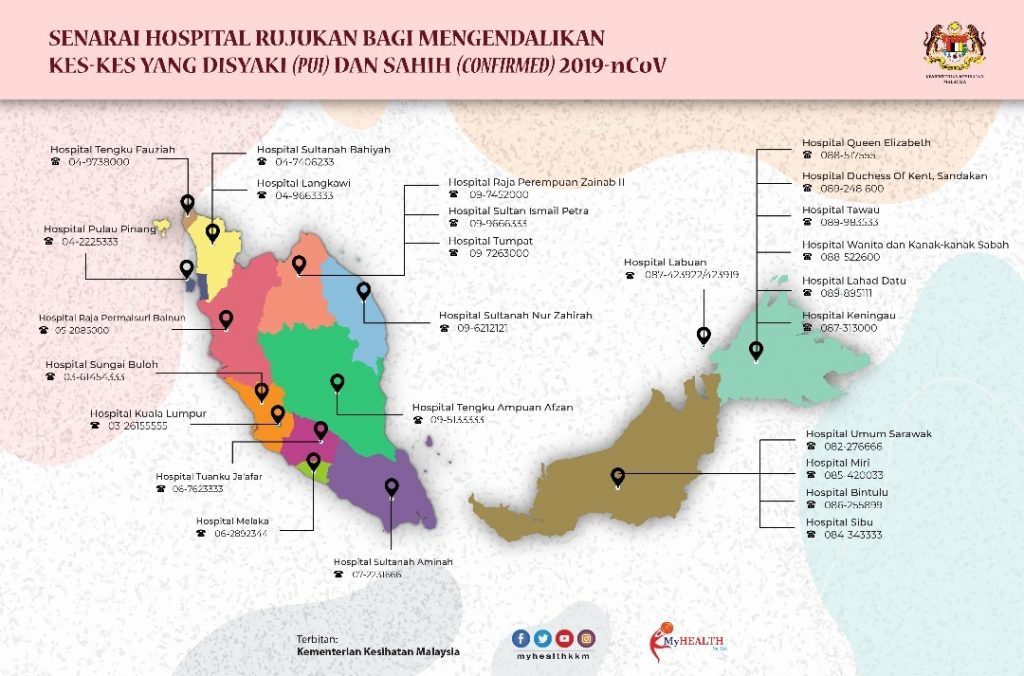

(Image: Ministry of Health)

On a related note, the Health Ministry has released a list of 26 hospitals that will serve as referral hospitals for both suspected and confirmed cases of the coronavirus in Malaysia. This means that if you need medical treatment for a suspected case of coronavirus, you can only be sent to one of these 26 government hospitals.

While most people associate medical insurance policies with treatment at private hospitals, it is also possible to make an insurance claim for treatment at a government hospital – once again, depending on the terms of your specific policy.

As stated in each insurer’s statement, policyholders with any enquiries should contact their respective insurance providers for further information on the coronavirus matter.

Comments (0)