Alex Cheong Pui Yin

22nd October 2021 - 2 min read

Bank Negara Malaysia (BNM) has commented that it is looking to improve the efficiency of the motor claims settlement process. This will be done in collaboration with the industry, consumer associations and other relevant stakeholders.

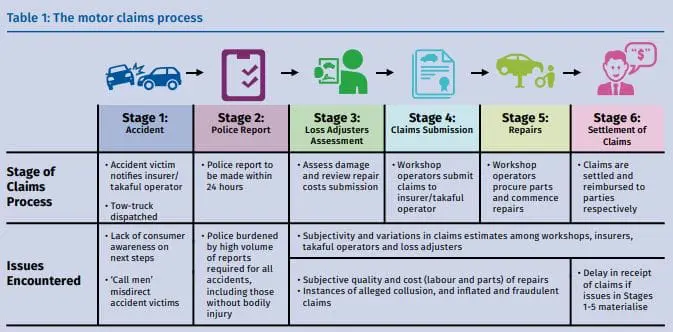

According to the director of the consumer and market conduct department for BNM, Lim Hsin Ying, a key aim to making the improvements is to reduce the turnaround time for the settlement of motor claims. Efforts to provide better information to various parties during the claims process will be made, allowing adjusters or insurers to work faster in assessing vehicles that are involved in accidents.

Additionally, BNM will also look into making the claims settlement process more transparent for the benefit of policyholders, thereby reducing the stress on those who are making claims. “A key focus of the reforms is to enhance transparency at various stages of the claims process that is vital to stemming fraud risk,” Lim further added, emphasising that this is particularly true with regard to the cost of motor repairs to drivers, such as the availability and pricing of vehicle spare parts.

Lim also commented that while the fraud intelligence system has improved over the years, fraud risk continues to remain high during the claims settlement process, often leading to prolonged investigations and negotiations. This, in turn, gives rise to a slow process and dissatisfaction among the public.

Meanwhile, consumers, too, need to do their part to facilitate the process. Lim advised motor insurance policyholders to be clear on the clauses that are contained in the policies that they plan to or have purchased. For instance, certain motor policies may require policyholders to notify or seek approval from the insurer before sending their vehicles to a non-panel workshop for repairs.

“If there is a workshop that you prefer to use, do check if your motor policy allows for repairs at your preferred workshop or whether conditions or restrictions apply,” said Lim, adding that it is mandatory for insurers to state these conditions in the policy and product disclosure sheet. She also clarified that following the rollout of the phased liberalisation of the motor tariff back in 2016, policyholders now have more options with regard to the type of features and coverage that they can sign up for.

(Source: The Star)

Comments (0)