Alex Cheong Pui Yin

3rd August 2023 - 3 min read

Maybank’s insurance arm, Etiqa has officially introduced its Tesla Ensure comprehensive car insurance package for Tesla owners in Malaysia. The package will provide a range of benefits for the insured vehicle and individual, including a personal accident (PA) coverage of up to RM18,000 for death or permanent disability due to accident, flood and special relief allowance, as well as coverage for the electric vehicle (EV) home wall charger.

Underwritten by Etiqa General Insurance Bhd and Etiqa General Takaful Bhd, here is the full list of coverage and complimentary benefits offered under the Tesla Ensure package:

| Coverage & benefits | Coverage amount/Details |

| Coverage for death or permanent disability due to accident | Up to RM18,000 |

| Compassionate benefit in the event of accidental death | RM1,000 (lump-sum payment) |

| Special relief allowance (total loss or theft of vehicle) | RM1,500 (one-time payout) |

| Special flood relief allowance (damage to vehicle due to flood) | Up to RM1,500 |

| EV home wall charger (loss or damage due to various reasons, including theft, fire, flood, lighting, and explosion) | Up to RM12,000 |

| Genuine spare part replacements (damage caused by accidents) | No additional charges on replacement parts |

| Complimentary “Drive Less Save More” add-on | Up to 30% cash rebate on your basic premium for when you drive less |

| 24-hour emergency road assistance (breakdown/repair on-site and towing) | Applicable in Malaysia, Singapore, Thailand, and Brunei |

| Nil excess | No claims excess when you make a claim (for drivers above 21 years old) |

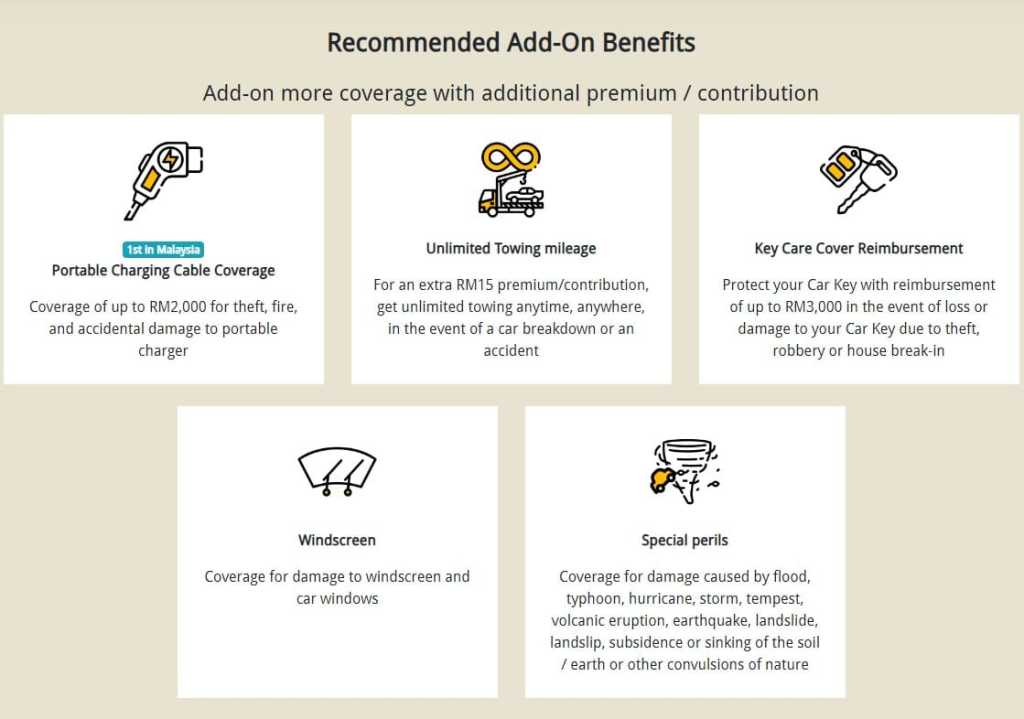

In addition to these existing benefits, those who wish to for enhanced protection for their Tesla vehicles can purchase the following add-on benefits with some additional premium or contribution:

- Portable charging cable coverage of up to RM2,000 (fo theft, fire, and accidental damage to portable charger)

- Special perils coverage for damage caused by a range of calamities, including flood, storm, and landslide

- Unlimited towing mileage in the event of a car breakdown or accident

- Key Care Cover, with reimbursement of up to RM3,000 to cover expenses incurred when repairing or replacing your car key in the event of theft, robbery, or house break-in

- Windscreen coverage for damage to your windscreen and car windows

In particular, Etiqa noted that its coverage for EV home wall charger (existing benefit) and portable charging cable (add-on benefit) is the first to be offered in Malaysia.

Group chief executive officer of Etiqa Insurance and Takaful, Kamaludin Ahmad said that the roll-out of Tesla Ensure is aimed at providing peace of mind for new Tesla owners once they’ve purchased their cars. On top of that, it is also in line with the government’s aim to grow the market for EV to 38% of Malaysia’s automotive total industry volume by 2040.

Aside from introducing Tesla Ensure via its insurance arm, Maybank has also been selected as one of Tesla Malaysia’s preferred financiers when purchasing the recently launched Tesla Model Y. The bank’s integrated automobile financing solution comes with a loan at preferential rates, as well as EV charging privileges. There is also an ongoing campaign in conjunction with Tesla’s launch in Malaysia, where selected Tesla car owners are able to win RM500 worth of gold.

Comments (0)