Alex Cheong Pui Yin

28th April 2023 - 4 min read

MSIG Insurance has rolled out a new add-on called EZ-Mile for some of its comprehensive private car insurance plans, allowing both new and existing policyholders to purchase mileage-based usage plans. It seeks to offer flexibility to those who only clock in low mileages each year, enabling them to save on the premium paid via packages that match their car usage without missing out on the benefits offered by MSIG’s comprehensive motor insurance.

In a statement, MSIG explained that policyholders can choose from three mileage plans via this add-on – 5,000km, 10,000km, and 15,000km (per annum) – which are applicable to the following comprehensive private car insurance plans:

- MSIG Private Car Comprehensive Policy

- MSIG Private Car with Drivers PA

- MSIG Motor Plus

- MSIG Lady Motor Plus

Coverage provided under the EZ-Mile add-on include third-party bodily injury or death, third-party property loss or damage, loss or damage to your own car due to accidental fire or theft, and loss or damage to own car due to accident. That said, these benefits may change slightly down the road, depending on whether you are still within the total mileage allocated under your plan, or if you have exceeded them. Here’s a quick summary for your reference:

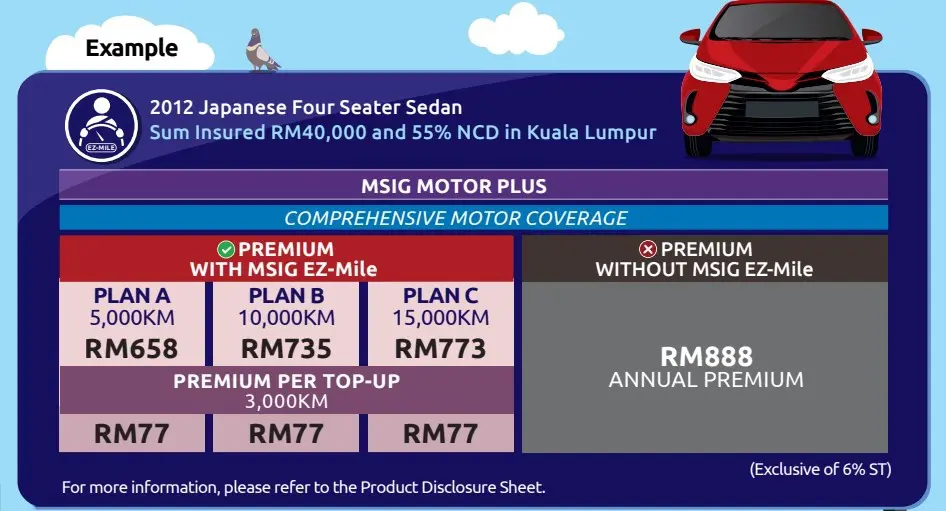

As for costs, MSIG highlighted that there will be no additional premium incurred with the add-on. Rather, you will save on the premium, as shown in the following comparison provided by the insurer:

As you may have noticed in the visual above, policyholders will also have the option to top up on their mileage if they find themselves unexpectedly in need of additional mileage for the year, or may exceed the total mileage that is allocated under their plan. You can do so at the price of RM77 for an additional 3,000km (not inclusive of SST), for an unlimited number of times during the period of your coverage.

If you do tap into the MSIG EZ-Mile add-on, you will also receive a wireless, Bluetooth-enabled device called Microtag at no charge (although there is a replacement fee of RM90 in the event of any loss or damage). This device – which will be used to measure your mileage – must be fitted into your car and paired to an app that you are required to download onto your smartphone.

The app will not only keep you informed of your remaining mileage, but also prompt you with reminders to top up on your mileage if necessary. Other features within the app include:

- Safe driving alerts, which warn you when you are texting while driving above the speed of 20km/h

- eCall feature (Automatic Accident Alert & Emergency Response), which automatically calls for assistance when it detects an impact or accident

- bCall feature (Concierge Emergency), which lets you get in touch with MSIG’s 24-hour assistance hotline in the event of a car breakdown

Chief executive officer of MSIG Malaysia, Chua Seck Guan said that the new EZ-Mile add-on will give people a good reason to drive less, and as such, reduce their carbon footprint. He also said that this is in line with MSIG’s support of the United Nation’s Sustainable Development Goals (SDGs), particularly SDG13 (Climate Action).

“In addition, we are also aware that driving behaviours have changed over the past few years primarily due to changing employment models. We recognise this trend and being responsive to customer needs, created this innovative add-on to let car users pay a premium based on how much they drive, while still providing all the benefits of a comprehensive insurance coverage. We hope this will go some way to lightening the burden of Malaysian road users,” Chua further said.

(Source: MSIG)

Comments (0)