Alex Cheong Pui Yin

9th April 2024 - 12 min read

(9 April 2024: Article updated to reflect latest indicative interest rates.)

Fixed deposit (FD) accounts have almost always been the default long-term savings option for many people, primarily because it is risk-free with guaranteed returns. As we’re sure you aware, however, it also comes with quite a bit of drawbacks – which is why many Malaysians have begun looking for other savings alternatives.

One popular option that has cropped up is “cash management solutions”, in addition to several other existing conventional instruments that you can also tap into. In this article, we’ll explore these alternatives.

Disadvantages of FDs

While a perfectly viable savings option, there are some drawbacks to FDs. Banks often require “fresh funds” (i.e. not from any of your accounts with the bank) in order to enjoy the best rates available – this figure is usually RM10,000. Given the nature of FDs, these funds will be “locked” for the duration of the FD.

If you decide to make premature withdrawals, you may lose either some or all the interest earned, as an early withdrawal penalty. This depends the banks’ T&Cs, of course, and will differ between each bank.

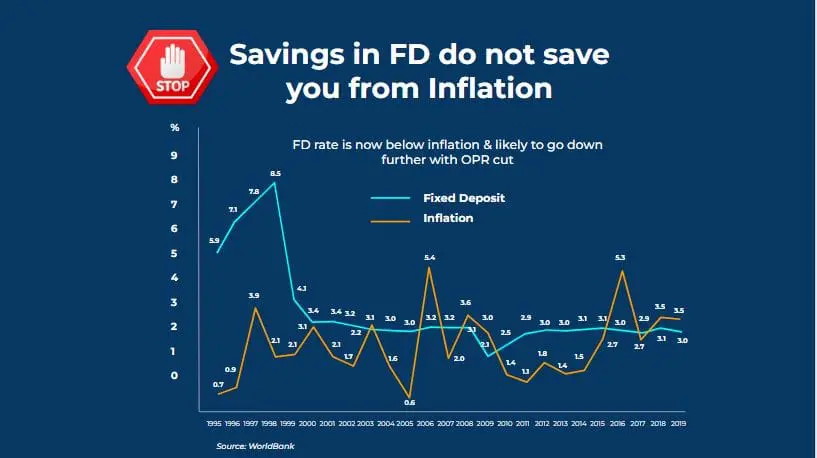

Most importantly, FDs are no longer able to consistently beat inflation. As you can see from the graph below, FD savings prior to year 1999 used to be able to earn you interest rates that are well above the inflation rate. From year 2000 onwards, however, FD rates often dipped beneath the inflation rate. In fact, recent FD rates are hovering at an average of 3.30% (12-month tenure).

Given this development, many have begun turning elsewhere for options with more flexibilities, if not higher returns.

Cash management solutions: How they work

Instead of FDs, a growing number of individuals are shifting to something called “cash management solutions”, which tap into money market funds (MMFs) to deliver returns that are on par or higher than FDs. MMFs, meanwhile, are mutual funds that invest in a mix of cash and short-term debt securities – including fixed income instruments, as well as notes from banks or even government bonds. At the risk of oversimplifying, you can think of MMFs as lenders who are lending money to relatively “secure borrowers”.

Since the debt securities that MMFs invest in are typically backed by banks and governments, they are widely considered to be one of the least volatile – and therefore, safest – investment options available. Also, these debt securities invested in can be as short as one to seven days, which explains the low risk too (as well as the relatively low returns).

However, the main reason they are growing in popularity is in the way cash management solutions address the disadvantages of FD:

| Advantages | Disadvantages |

| – High liquidity: Unlike FDs, you can withdraw anytime without incurring penalties – Potentially higher yield: Depending on the MMF that your cash management solution invests in, it is possible to reap higher returns than FDs – Low entry requirement: FDs typically require you to deposit a minimum of RM500 or RM1,000 for good or promo rates; meanwhile, minimum deposits for cash management solutions can start from just RM1 – Convenience: Most cash management solutions are housed within a robo advisor or app, and the sign-up process is relatively simple with the eKYC procedure | – Not guaranteed returns: While it is considered low-risk, there is no absolute guarantee on returns, with also a very small possibility of losing money – No protection: FDs are protected by Malaysian authorities (such as Perbadanan Insurans Deposit Malaysia (PIDM) or the Malaysian government) but funds in cash management solutions are not |

Cash management solutions in Malaysia

Now that you have some idea as to how cash management solutions work, let’s delve into four options that are currently available in the market for Malaysians.

1) FSMOne Cash Management Fund (CMF)

FSMOne is a popular online trading platform where Malaysians can find various investment instruments, including funds, stocks, bonds, and exchange-traded funds (ETFs). It also offers investors a cash management fund which they can utilise as a “parking facility”, with the RHB Cash Management Fund 2 serving as its underlying fund.

If you’re an existing FSMOne investor who also purchases unit trusts on the platform, there is also another benefit to parking your cash in the FSMOne CMF. Purchasing unit trusts on FSMOne using your funds in CMF allows for same-day processing (as long as you place the order before 3pm), compared to up to three business days if using funds from other sources (FPX transfer, etc).

| Key information | Details |

| Indicative interest rate | 3.418% p.a. |

| Minimum investment amount | RM100 (subsequent minimum investment amount also at RM100) |

| Withdrawal period | Within two business days (request made before 3pm) |

| Charges/fees | – No sales charge – Expense ratio of 0.4% p.a. |

2) Kenanga Digital Investing (KDI) Save

KDI Save was launched alongside an investment instrument KDI Invest just in mid-February 2022. Despite that, the platform saw an overwhelming response, crossing RM100 million in asset under management (AUM) within just two months after launch.

KDI Save’s popularity is attributed to the fact that it offers one of the highest returns among cash management solutions currently. Coupled with the fact that it does not impose any fees, it’s easy to see why KDI Save was so well-received.

Note that to access KDI Save, you’ll need to first sign up for a KDI account (which will also give you access to KDI Invest). Also, KDI Save is not shariah-compliant.

| Key information | Details |

| Indicative interest rate | Tiered up to 4.00% p.a. EAR |

| Minimum investment amount | RM100 (subsequent minimum investment amount RM10) |

| Withdrawal period | Within one to two business days |

| Charges/fees | – No management fees – No expense ratio fees |

3) StashAway Simple

StashAway Simple, meanwhile, is one of the earliest cash management solutions to be introduced to Malaysians – debuting all the way back in June 2020. Its is supported by two underlying funds: Principal Islamic Money Market Fund (80%) and Eastspring Investments Islamic Income Fund (20%), which means that this cash management solution is shariah-compliant.

Its projected rate is driven by the rate of returns of its underlying investments, net of all expenses and rebates. On its website, the platform shared that users will now be charged a management fee by StashAway, set at 0.15% p.a. This is on top of an expense ratio of approximately 0.1% that the fund managers charge (already embedded in the projected rate).

| Key information | Details |

| Indicative interest rate | 3.6% p.a. |

| Minimum investment amount | No minimum deposit or balance requirement |

| Withdrawal period | Within three to four business days |

| Charges/fees | – No platform management fees – No transfer or exit fees – Net expense ratio of about 0.115% p.a. |

4) Touch ‘n Go (TNG) GO+

If you’ve been using TNG eWallet all this while, there’s little doubt that you’d have heard of GO+, given that it is housed within the e-wallet and is also featured as part of your total asset. Serving as its underlying fund is the Principal e-Cash Fund.

What differentiates GO+ from other cash management solutions here is its highly liquid nature. Not only can users perform instant withdrawals from GO+ to their e-wallet balance, users can also use funds in GO+ for payment if there is insufficient e-wallet balance.

| Key information | Details |

| Indicative interest rate | 3.49% p.a. |

| Minimum investment amount | RM10 |

| Withdrawal period | – To TNG eWallet: Instant – To bank accounts: Within one business day (request made before 4pm) |

| Charges/fees | – No sales charge or switching or transfer fees – Management fee of up to 0.45% p.a. – Trustee fee of up to 0.03% p.a. |

5) Versa Cash/Versa Cash-i

Versa Cash was announced in August 2020, and then officially launched in early 2021, whereas Versa Cash-i was rolled out more recently, in April 2023. The underlying funds for Versa Cash and Versa Cash-i are the Affin Hwang Enhanced Deposit Fund and the Affin Hwang Aiiman Enhanced i-Profit Fund, respectively. So depending on your preference, you can select between the conventional or shariah-compliant option.

Versa Cash and Versa Cash-i also emphasised that their performances are on par with FDs, with daily compounding of interest and monthly payouts.

| Key information | Details |

| Indicative interest rate | – Versa Cash: 3.77% setahun – Versa Cash-i: 3.33% setahun (with occasional promotions to boost the rate up) |

| Minimum investment amount | RM10 |

| Withdrawal period | – Versa Cash: One business day (requests made before 3.30pm) – Versa Cash-i: Same day (requests made before 10.30am) |

| Charges/fees | – No sales charge – No withdrawal fees – Management and trustee fee of 0.35% p.a. (Versa Cash) or 0.32% p.a. (Versa Cash-i) |

What about other alternatives that are not money market funds?

Of course, the cash management solutions mentioned above only make up some of the options that you can consider. If you’re not so keen on cash management solutions or money market funds, here are a few other alternatives.

1) National Education Savings Scheme (SSPN)

Most Malaysians will recognise SSPN as a savings scheme by the National Higher Education Fund Corporation (PTPTN), specially designed for parents to save for their children’s education.

Instead of interest, it pays a competitive annual dividend; here’s a quick look at how SSPN has performed in the past seven years. In addition, PTPTN also regularly runs annual loyalty reward campaigns, such as the Ganjaran Kesetiaan Simpan SSPN Prime campaign for 2022 which offered depositors an additional 1% return.

But that’s not all. Another lucrative benefit to using SSPN is the fact that you get to enjoy up to RM8,000 in tax relief every year – provided that the account is under your child’s name. Therefore, SSPN offers three distinct ways to earn from your savings: annual dividends, loyalty reward campaigns, and tax relief for parents.

Funds deposited in SSPN are quite liquid. Online withdrawals are usually processed within a few business days, and if you have a Bank Islam account, instant withdrawals can even be made at the bank’s ATM machines.

If you’re interested in checking out SSPN as an option, there are two SSPN products: SSPN Prime and SSPN Plus. Essentially, SSPN Plus is marketed as an upgraded version of SSPN Prime, with added benefits such as takaful coverage for death and total and permanent disability (TPD).

2) Flexi home loan accounts

Flexi home loans are a type of housing loan that lets borrowers pay more than their monthly instalments to reduce the principal loan amount. But why “save” money in a flexi home loan account (if you have one)?

To put it simply: because it will help you to reduce the interest paid on your housing loan! The interest for housing loans are calculated based on the outstanding principal balance – so the lesser your principal loan amount, the less interest is charged. Ultimately, you’re using the loan interest mechanism in your favour; while you’re not earning interest by parking money in your home loan account, you can reduce your home loan interest charges – at prevailing loan rates (which are usually much higher than FD!)

Flexi home loans are tied to a current account, which comes with a monthly fee (about RM5 to RM10, depending on banks). As such, make sure to take into account this fee if you wish to tap into flexi home loans.

3) Fixed price funds by Amanah Saham Nasional Berhad (ASNB)

Preface: ASNB fixed-price funds are only viable as an FD alternative to bumiputera Malaysians. The main reason, as many will be aware, is the quota allocations for the fixed-price funds – it may be extremely difficult for non-bumiputera investors to re-deposit. On the other hand, bumiputera Malaysians have a larger quota and have access to three other fixed-price funds: ASB, ASB 2, and ASB 3 Didik.

ASNB has a total of 17 funds that you can invest in, with seven of them being fixed-price funds and the remaining ten being variable price funds. Here’s the full list for your reference:

| Fixed price funds | Variable price funds |

| – Amanah Saham Bumiputera (ASB) – Amanah Saham Bumiputera 2 (ASB 2) – Amanah Saham Bumiptera 3 – Didik (ASB 3 Didik) – Amanah Saham Malaysia (ASM) – Amanah Saham Malaysia 2 – Wawasan (ASM 2 Wawasan) – Amanah Saham Malaysia 3 (ASM 3) – Amanah Saham Nasional Sukuk (ASN Sukuk) | – Amanah Saham Nasional (ASN) – ASN Equity 2 – ASN Equity 3 – ASN Equity 5 – ASN Equity Global – ASN Imbang 1 – ASN Imbang 2 – ASN Imbang 3 Global – ASN Sara 1 – ASN Sara 2 |

ASNB’s fixed price funds can serve as a good savings alternative to FDs due to its unique value proposition: unlike variable price funds – whose value is constantly changing according to market conditions – the value of ASNB’s fixed price funds is fixed at RM1 per unit at all times (with no sales charge!) This means you will not need to worry about price fluctuations, which in turn, makes these funds suitable to be utilised as another option to park your money.

ASNB’s fixed price funds deliver decent dividends to investors – and consistently above FDs. You can check out the returns for some of the fixed price funds mentioned in the graphs below:

As for withdrawals, ASNB allows you to make immediate redemptions at its counters if you are redeeming funds of RM2,000 and above. In the event of massive amounts, however, ASNB may opt to pay you using cheque or bank transfers. Alternatively, you can opt for online redemptions via the myASNB portal and app, but these only let you withdraw up to RM2,000 per month.

***

Now that you’re aware of these alternative savings options, you can look beyond just FDs to help you grow your funds (and to beat inflation) with minimal risk! As always, be sure to do your due diligence and research before deciding.

Of course, if you still prefer the familiarity of savings products from banks, you can check out high-interest savings accounts available in Malaysia, or if you’d much rather stick to FDs, here’s our Best FD Accounts in Malaysia article which we update every month.

Comments (1)

Thank you. This is well researched article and had helped me make a financial decision.