Jacie Tan

6th April 2020 - 4 min read

Prime Minister Tan Sri Muhyiddin Yassin has announced several additional measures under the PRIHATIN Economic Stimulus Package aimed specifically at small and medium-sized enterprises (SMEs). The extended package or “Prihatin Tambahan” is worth RM10 billion and is aimed specifically at reducing the financial burden of SMEs and ensuring job continuity in Malaysia.

Increased allocation for wage subsidy programme

The government has increased the allocation for the wage subsidy programme that was revealed in the first Prihatin Economic Stimulus Package announcement. Under the additional measures, the allocation for this programme will be expanded from RM5.9 billion to RM13.8 billion – an increase of RM7.9 billion altogether. It is expected to benefit a total of 4.8 million workers.

Under the previous version of the wage subsidy programme, the government offered a RM600 salary subsidy for three months to all employees earning less than RM4,000 a month whose employers have suffered a loss of income of more than 50% since 1 January 2020.

With the increased wage subsidy programme, the 3-month wage subsidy offered will be tiered according to the size of the company.

- RM600 subsidy for each eligible worker for companies with more than 200 employees. The subsidy will be given to a maximum of 200 employees (an increase from the 100-employee limit as announced previously).

- RM800 subsidy for each eligible worker for companies with 76-200 employees.

- RM1,200 subsidy for each eligible worker for companies with up to 75 employees.

The programme is available for employers who are registered with the Companies Commission of Malaysia (CCM), the local authorities, and SOCSO before 1 January 2020. Companies with Malaysian employees earning RM4,000 and below for three months can benefit from the wage subsidy. Employers who choose to accept this wage subsidy are bound to keep their workers in employment for at least 6 months – that is, 3 months under the wage subsidy and 3 months after that.

New PRIHATIN Special Grant for eligible micro SMEs

The government will provide RM3,000 for each micro-enterprise under its new PRIHATIN Special Grant, with a total allocation of RM2.1 billion. The micro-enterprises must be registered with Lembaga Hasil Dalam Negeri (LHDN) to be eligible and the government will obtain the list of eligible micro-enterprises from the authorities.

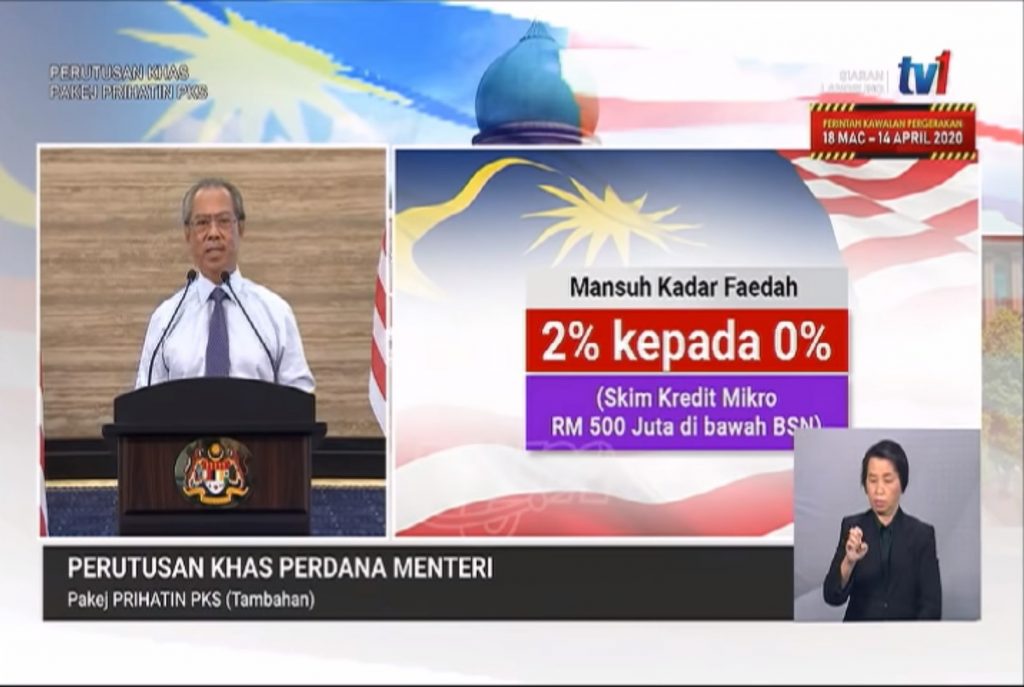

0% interest for micro-credit scheme

In the initial PRIHATIN Economic Stimulus Package announcement, the microcredit facility by Bank Simpanan Nasional (BSN) saw a fund injection of RM500 million, with the interest rate lowered from 4% to 2%. However, the government has announced that it will be abolishing the 2% interest rate for the Micro-Credit Scheme. The scheme is also extended to TEKUN Nasional with a maximum loan amount of RM10,000 per company at an interest rate of 0%.

Rent exemption or discount for SMEs

SME retail owners who are paying rent for premises owned by government-linked companies such as MARA, PETRONAS PNB, PLUS, and UDA will have their rent exempted or discounted.

The government is also encouraging the private sector to follow suit and offer rental discounts during the movement control order (MCO) period and the next three months after. Property owners who offer a rent discount or exemption to their SME tenants will be allowed tax deductions equal to the amount of the rent deduction for the months of April to June 2020. This tax break is dependent on the condition that the rent discount is at least 30% of the original rental amount.

Reduced foreign worker levy

The government is allowing a 25% decrease on the foreign worker levy to all companies whose employees’ permits are ending between 1 April and 31 December 2020. However, this levy decrease is not applicable to domestic helpers.

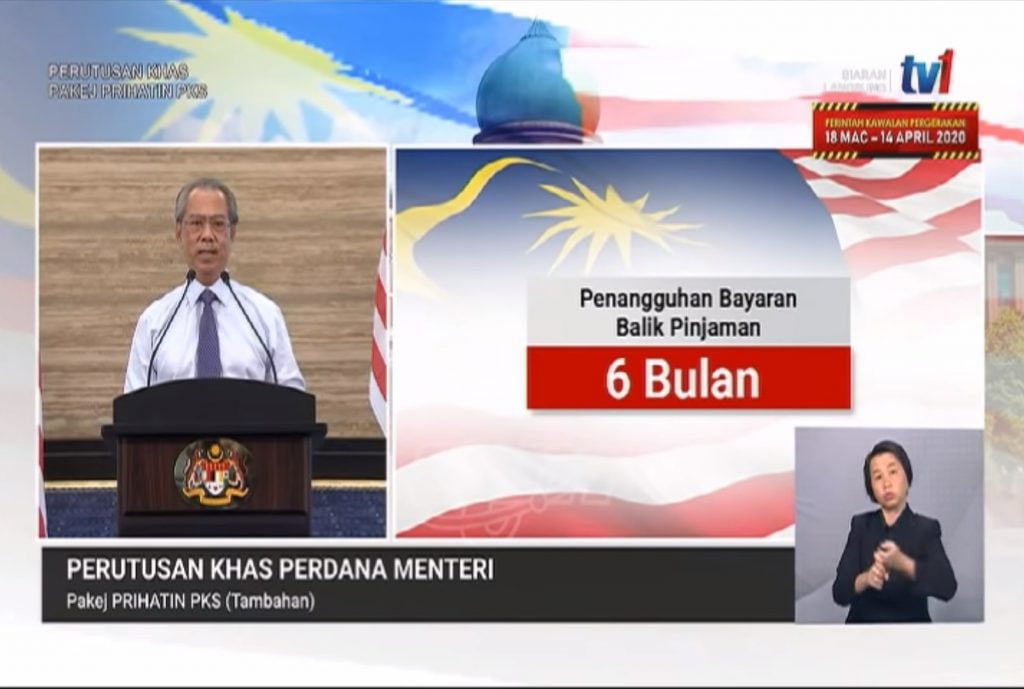

Call for licensed moneylenders to offer moratoriums

Licensed moneylenders are encouraged to offer a 6-month moratorium on the monthly credit repayments for SMEs, similar to what is currently being offered by the banks regulated under Bank Negara Malaysia.

Automatic moratorium for statutory documents to CCM

Companies who need to present their statutory documents to the CCM will be granted an automatic moratorium of 30 days from the last day of MCO, to help address the mobility difficulties in doing so.

The deadline for surrendering company financial statements is also extended to 3 months after the end of the MCO period.

***

According to the prime minister, the extended PRIHATIN package has been introduced in response to feedback from SME associations as well as those in micro-enterprises who have requested that government look over the benefits directed towards them.

“I acknowledge that SMEs are the root of the nation’s economy,” said Tan Sri Muhyiddin Yassin. “This sector contributes to more than two-thirds of the nation’s jobs and up to 40% of the economy. As such, it is important to ensure that the SME sector stays resilient against the pressures and economic challenges of these current times.”

Comments (1)

RM3,000 for each micro-enterprise under its new PRIHATIN Special Grant,

Is this automatic or need to apply?

If apply ,please tell us how