Nur Adilah Ramli

6th May 2022 - 3 min read

Several economists have predicted that Bank Negara Malaysia (BNM) will soon raise the country’s overnight policy rate (OPR) in light of the improved economic conditions and inflationary pressures.

This came as the US Federal Reserve recently announced its biggest interest rate increase in over 20 years. The benchmark interest rate was increased by 0.5 percentage points to a target rate range of between 0.75% and 1%. The rate was previously increased by 0.25 percentage points in March, which marked the first increase since December 2018.

UOB Global Economics and Markets Research senior economist Julia Goh expects BNM to increase the OPR by 25 basis points to 2% on 11 May. She also predicted a further increase by another 25 basis points in the third quarter of 2022, bringing the OPR to 2.25% by the end of the year.

According to Julia, an increase in the OPR is imminent given the growth trajectory of the Malaysian economy and upward pressure on prices. “With real gross domestic product (GDP) growth outlook of 5.3% to 6.3% (versus potential output growth of 3% to 4% in 2022), the negative output gap is expected to narrow further. This serves as a signal for potential rate hikes,” she added.

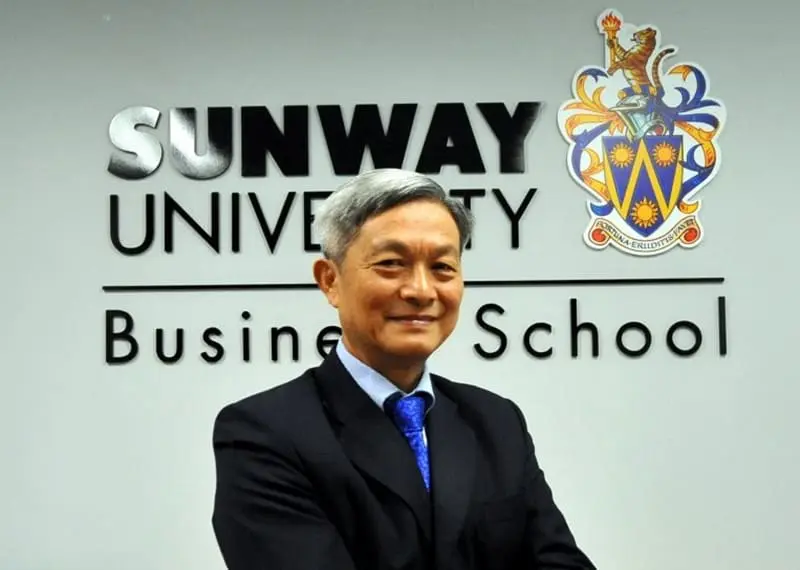

Meanwhile, Sunway University Business School economics professor Dr Yeah Kim Leng expects the central bank to increase the OPR in the early part of the second half of this year, following the improving economic growth and rising inflationary pressures. He further stated that the decision to increase the OPR will be driven by the need to balance growth and inflation, and minimise financial stability risks.

“It is well known that high household indebtedness may be destabilising to the economy in the event of an interest rate shock. However, a well-telegraphed and gradual rise will not be too disruptive but conversely, it would be beneficial in reducing any build-up of inflation and debt risks,” Dr Yeah further commented.

Similarly, OCBC economist Wellian Wiranto expects BNM to increase the OPR by 25 basis points as early as July. He also commented that in spite of the rising Fed funds rates, the direct effect on Malaysia is relatively mild. This, he said, is due to Malaysia’s current account surplus status, which makes it less susceptible to the changing global yields and investor sentiment.

Additionally, Wellian also said that Malaysia’s inflation has remained broadly under control. He noted that while prices for some items are on the rise, the continued subsidies on fuel will contain the increase in prices. “The effects of ringgit depreciation on imported inflation will be there too, but BNM is unlikely to react with rate hikes purely on this basis alone,” he added.

Moody’s Analytics assistant director Denise Cheok also predicts an increase in the OPR by 25 basis points in the third quarter of 2022. “Inflation in Malaysia remains relatively moderate compared to the rest of the region, and the central bank will likely prioritise the economy’s return to pre-pandemic levels over capital outflows and currency depreciation,” she said.

She also highlighted that Malaysia has recorded one of the highest household debt-to-Gross Domestic Product (GDP) ratios in the region even before the Covid-19 pandemic. She said that a low interest rate will keep debt service from becoming a systemic issue that eats up consumer spending.

The current OPR of 1.75% is the lowest on record following four consecutive cuts in 2020.

(Source: The Edge Markets)

Comments (0)