Pang Tun Yau

22nd February 2020 - 3 min read

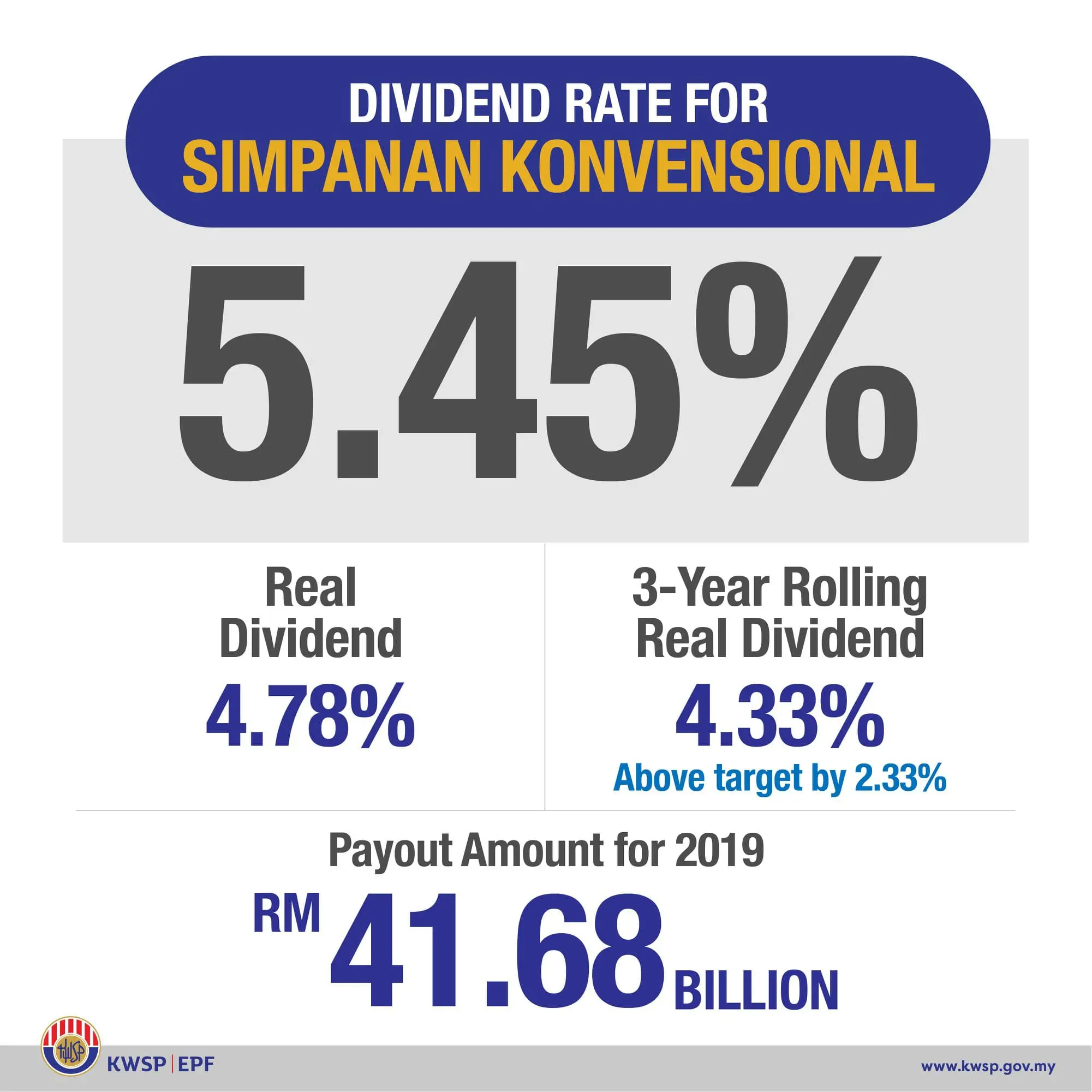

The Employees Provident Fund (EPF) has declared the dividend payouts for its members at 5.45% for conventional and 5% for its Simpanan Syariah fund. For the conventional fund, the rate is the lowest since 2008, where the dividend was just 4.5%.

Citing a “challenging 2019” which saw plenty of events that affected the global and domestic markets, the EPF maintained that the 5.45% rate is a “solid performance”, and reiterated that it is 2.95% above the mandate set in the EPF Act 1991, which requires it to declare at least 2.5% in dividends every year.

“As anticipated, we saw substantially more volatility in 2019 as compared to 2018. Certainly 2019 exemplified what it means to be living in a VUCA (Volatility, Uncertainty, Complexity, Ambiguity) world. Many issues in the global markets remained unresolved, but we also saw some new issues cropping up. There were three rate cuts made by the US Federal Reserve, the US-China trade spat escalated and continues to be unresolved, and there were uncertainties surrounding the Brexit negotiations. On top of this, we did not expect the Hong Kong protests to be prolonged and that certainly added pressure on an already fragile far-east market,” Chief EPF Officer Alizakri Alias said.

A stagnant domestic market was also a big factor. “In addition, the domestic markets did not support the income-generating capabilities of the EPF as 70% of the fund’s assets are in Malaysia, with a major part of our assets in domestic equities,” Alizakri added.

Overall, the EPF’s investment income from equities in 2019 dropped 24% from 2018, at RM21.49 billion from RM26.66 billion in 2018. Equities remained the biggest income contributor for the fund, at 47%, with fixed income instruments contributing a further 43%. Real Estate & Infrastructure (6%) and Money Market Instruments (4%) make up the rest of the income.

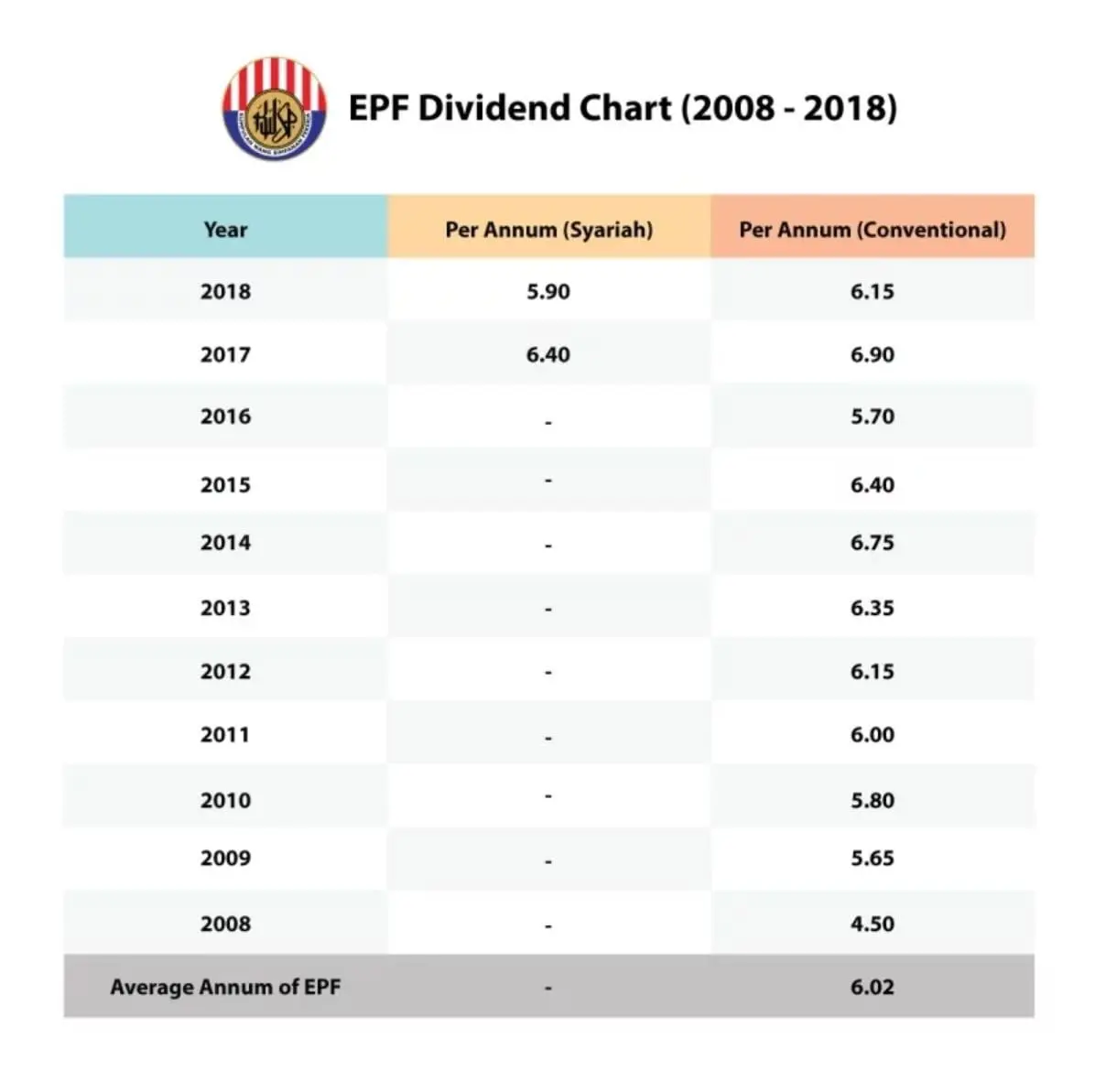

Many were expecting a lower EPF dividend payout for 2019, given the volatile global market conditions last year. This was intensified when PNB announced a 5.5% payout for its historically-resilient Amanah Saham Bumiputera (ASB) for 2019. Since 2008, there have only been four occasions when the EPF dividend has dropped below 6%: 2008 (4.5%), 2009 (5.65%), 2010 (5.8%), and 2016 (5.7%).

The EPF is already bracing for another difficult year ahead. “We expect that 2020 is going to be just as or even more challenging than 2019, with the full impact of the COVID-19 virus likely to drag down already soft global growth. The US-China trade war still sees no signs of ending, among other risks to economic recovery. We hope that the domestic markets will be resilient, especially in light of the soon-to-be-announced government stimulus package which should help support investor and consumer sentiment,” Alizakri said.

Comments (0)