Samuel Chua

15th November 2024 - 2 min read

The Employees Provident Fund (EPF) dividend rate for 2024 may exceed 6%, following a strong third-quarter performance that has boosted optimism for higher payouts, according to financial experts.

Lee Heng Guie, executive director of the Socio-Economic Research Centre, projects a dividend rate of at least 6.25%, based on the fund’s robust investment income so far this year. “Going by the strong investment income in the first nine months, we expect the full year’s total investment income will exceed 2023’s RM67bil, given the still buoyant performance in both domestic and overseas equity markets,” Lee was quoted as saying.

Additionally, Dr Liew Chee Yoong, associate professor of finance at UCSI University Malaysia, expressed confidence that a 6% dividend or higher is achievable. He highlighted EPF’s diversified portfolio, which includes notable gains from equities (contributing RM18.32 billion in the third quarter) and consistent returns from fixed-income assets.

Geoffrey Williams, founder of Williams Business Consultancy Sdn Bhd, also said a 6% dividend rate would be plausible for EPF members this year. Noting EPF’s strong income performance together with a membership increase of 364,364 as well as higher voluntary contributions, he said this reflects a solid financial position.

As of the end of September, EPF’s total investment income reached RM57.57 billion, a 20% increase from RM47.86 billion in the same period in 2023.

However, Lee pointed out potential challenges for 2025. “The prospects of a stronger investment income next year might be slightly more challenging, given the near-term uncertainties arising from ‘Trumponomics 2.0’, which may cause volatility in the equity and foreign-exchange markets,” he said.

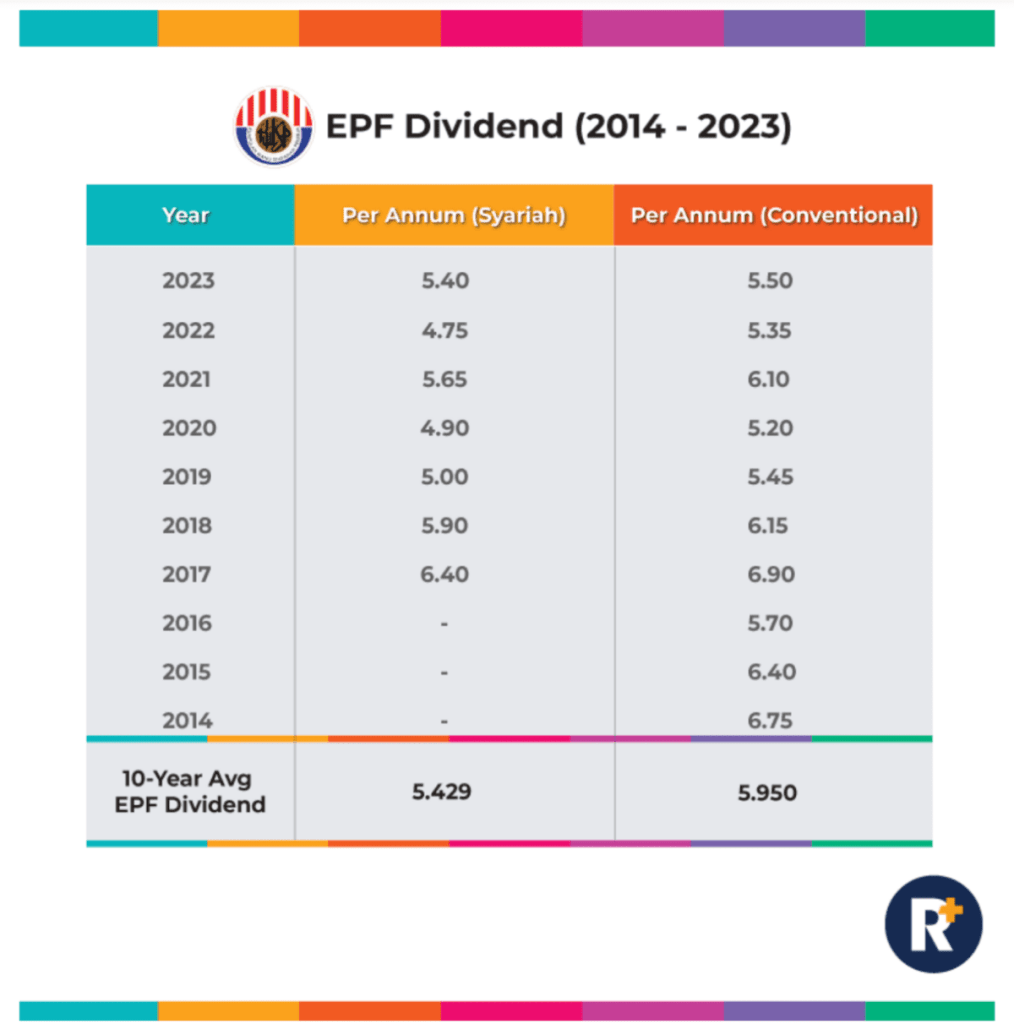

Over the past decade, EPF recorded an average dividend of 5.95% for its conventional scheme and 5.43% for the shariah scheme, which was introduced in 2017. The EPF’s highest dividend payout in the past decade was in 2017, with rates of 6.9% for the conventional scheme and 6.4% for the shariah scheme.

(Source: The Star)

Comments (0)