Alex Cheong Pui Yin

20th November 2023 - 3 min read

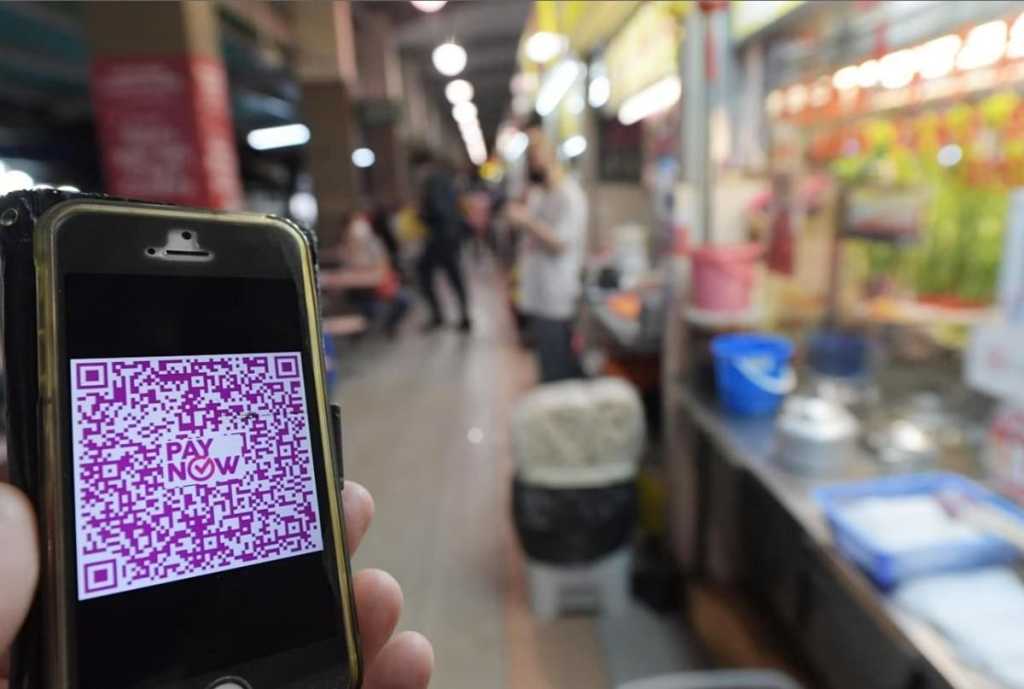

Malaysians can now make instant cross-border person-to-person (P2P) money transfers to individuals in Singapore using the recipient’s mobile number or Virtual Payment Address (VPA), as well as receive funds through a similar manner too. This came following the successful launch of a new real-time payment systems linkage between Malaysia’s DuitNow and Singapore’s PayNow, done by Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS).

In a statement, both central banks said that the DuitNow-PayNow linkage will offer instant, secure, and cost-effective P2P fund transfers and remittances between the two countries. It is also the first linkage to include the participation of non-bank financial institutions from both countries; here’s the full list of financial institutions that will offer improved features via this new linkage:

| Banks & financial institutions from Malaysia | Banks & institutions from Singapore |

| CIMB Bank Maybank TNG Digital (TNG eWallet) Coming soon Hong Leong Bank | Maybank Singapore OCBC Bank UOB Bank Liquid Group (LiquidPay) Coming soon DBS Bank |

For TNG eWallet, specifically, this money transfer service will be offered first for outbound transfers (Malaysia to Singapore) – available immediately – before being followed by inbound transfers (Singapore to Malaysia) next month. Similarly, the service will also be made available to Singaporeans in phases, with participating banks rolling it out to selected customer groups from today until end-January 2024.

It was also noted that Malaysians will be allowed a daily transfer limit of RM3,000 via this service (while Singaporeans are capped at a cumulative maximum transfer of SG$1,000 per day).

“Cross-border payments that are fast, secure, and cost-efficient can provide immense benefits, especially for individuals and small businesses in countries with very close economic ties, such as Malaysia and Singapore. The DuitNow-PayNow linkage enables us to reap these benefits towards our shared growth and prosperity, while laying the foundations for scalable cross-border payment networks across and beyond ASEAN,” said the governor of BNM, Datuk Abdul Rasheed Ghaffour.

The managing director of MAS, Ravi Menon also echoed similar sentiments, adding that the linkage represents another step towards ASEAN’s vision for regional payments interconnectivity. “The PayNow-DuitNow linkage is the culmination of a shared aspiration by Singapore and Malaysia to facilitate cross-border payments between our two countries,” he said.

For further context, P2P and remittance transactions between Malaysia and Singapore came up to a total of RM7.8 billion in 2022.

Meanwhile, BNM and MAS had also enabled a cross-border QR code payment linkage between both countries earlier in March this year. This allowed Malaysians who travel to Singapore to make QR code payments via selected home e-wallets when making purchases from Singaporean merchants, and vice versa.

(Source: BNM)

Comments (0)