Pang Tun Yau

6th April 2023 - 3 min read

As part of its second public consultation paper (CP2) released today, the Consumer Credit Oversight Board (CCOB) Task Force has also proposed several enhancements to the Hire Purchase Act 1967. Among others, the enhancements are focused on computation of interest – which will greatly benefit consumers who pay off their loans early.

Currently, hire purchase agreements for vehicles employ a flat interest rate and a lesser-known computation known as the “Rule of 78”. Also known as the Sum of Digits Rule, this method of computation frontloads the interest payment in the earlier part of the loan tenure. This means that a higher portion of the borrower’s monthly loan repayment goes towards paying interest rather than the principal balance. As a result, borrowers who seek to settle their loans early will not save as much interest as they would expect.

Meanwhile, flat rate computation of interest bases the charges on the full principal amount instead of the outstanding amount they still owe (which is a separate method known as “reducing balance”). As a result, borrowers pay much more interest compared to the reducing balance method.

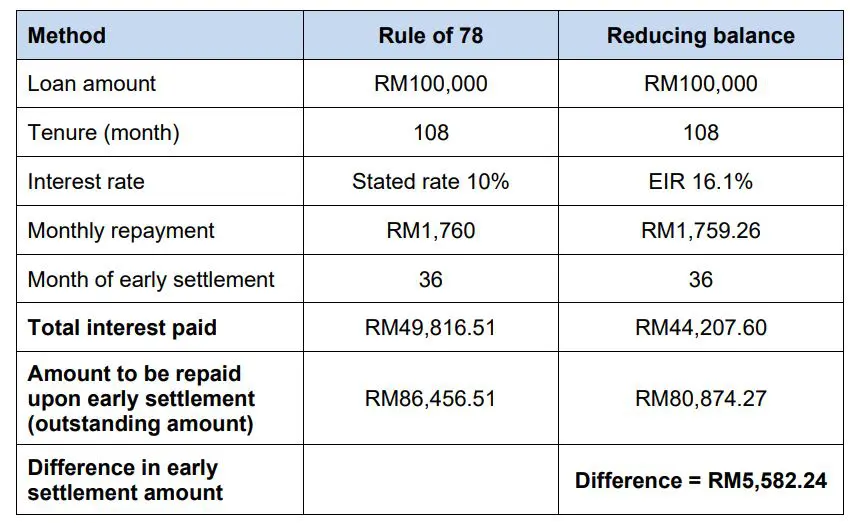

Here’s an example of how the Rule of 78 works in comparison to the reducing balance method, as provided in the CP2 report:

While it is still standard practice in many parts of the world, the both Rule of 78 and flat rate computation methods are recognised as unfair to borrowers and is prohibited in various countries. In the United Kingdom and United States, flat rate loans are only permitted if the total interest charged is equal to or lower than the total interest charged under the reducing balance method.

As such, the CCOB Task Force is proposing to amend the hire Purchase Act 1967 to prohibit both the Rule of 78 and flat rate methods in computation of interest, and employ the reducing balance method instead. If enacted, this will result in lower total interest charges for the same loan amount. The reducing balance method is also familiar to Malaysian borrowers as it is used in mortgages/home loans.

In addition, the reducing balance method also incentivises borrowers to settle their loans early. Since the interest charged is based on the outstanding balance, borrowers pay less interest if they repay ahead of schedule or settle the full amount before the end of the tenure.

If the amendments are approved, it will only apply to new hire purchase agreements from the date of the enactment. Existing motor vehicle loans will not be converted to the reducing balance method, mainly because they are contractually bound.

In addition, the CCOB Task Force also proposed a few other enhancements to the Hire Purchase Act, including the display of the effective interest rate (EIR) to provide a better reflection of the cost of the loan, as well as the acceptance of digital and electronic signatures in line with recent advancements in technology to provide a more convenient solution alongside physical signatures.

The proposed amendments are just some of the main enhancements shared in the second consultation paper that is made available to the public. The CCOB Task Force is inviting feedback from the public and industry players from now until 15 May 2023, which can be emailed to [email protected]. For more information about CP2 and the Consumer Credit Act, visit www.ccob.my.

Comments (0)