Pang Tun Yau

9th July 2021 - 17 min read

Under the PEMULIH stimulus package, Malaysia will once again see a 6-month moratorium for all loans, applicable to all Malaysians starting July 2021 until the end of the year – the second time the government has done so since the Covid-19 pandemic hit us in early 2020.

The 2021 loan moratorium is largely similar to what we saw in the middle of last year, and does not have the same eligibility requirements as the Targeted Repayment Assistance that was available from October 2020. Under the new loan moratorium, any Malaysian individual and micro-SME can apply for a loan moratorium for all existing credit facilities, including mortgages and home loans, hire purchase agreements or car loans, personal loans/financing, and includes other loans such as ASB financing.

But given that this is third such financial assistance of its kind to be offered to Malaysians, there is a huge amount of confusion and uncertainty regarding what the actual terms are for this 2021 loan moratorium. We have addressed this in our previous article, and for this article, we’ll be taking a deep dive on the pros and cons of taking this loan moratorium.

Hire Purchase/Car Loans

A majority of hire purchase agreements in Malaysia are fixed-rate loans, which means that the interest rate is agreed upfront and is charged on a fixed amount (the value of the loan) throughout the tenure of the loan.

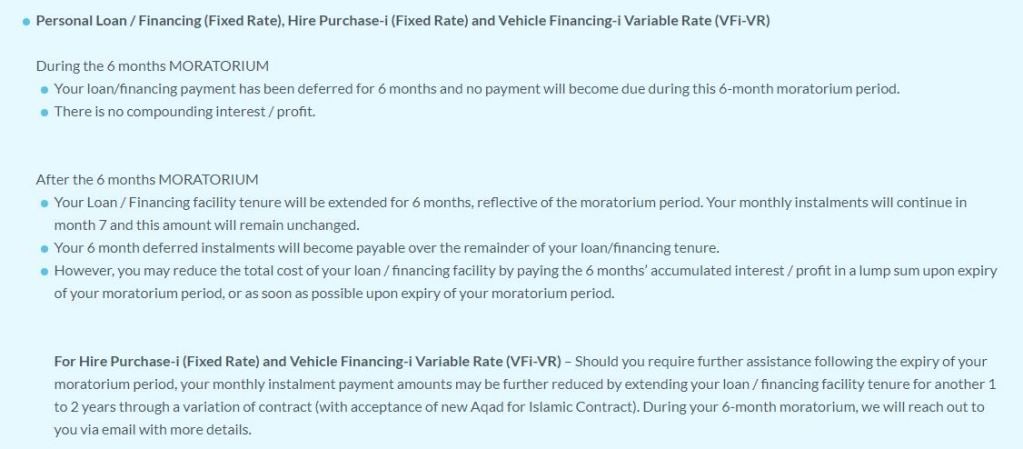

For this year’s loan moratorium, there is no “blanket” rule on how this moratorium will impact existing hire purchase agreements. As mentioned previously, the banks are allowed to set their own terms and conditions for this loan moratorium, and it is evident in how they treat hire purchase agreements.

Thus, for fixed-rate hire purchase agreements, one bank may impose interest accrual during the deferment period while another may not (and thus offer a true “payment holiday” from July to December 2021). Based on the banks’ FAQs released on 7 July, we can confirm that hire purchase loans from Maybank, Hong Leong Bank, CIMB Bank – among others – will accrue interest during the deferment period. This accumulated interest is then to be paid off in one lump sum alongside the final instalment.

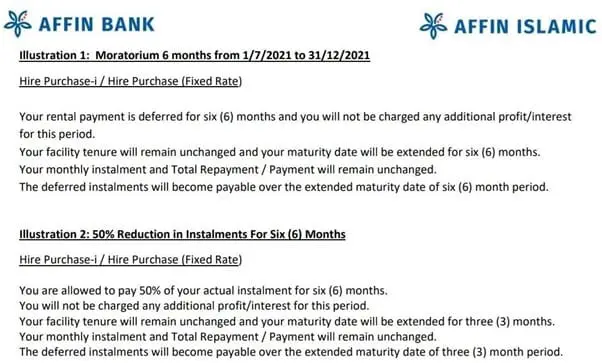

Interestingly, Affin Bank’s original FAQ stated that there will be no interest accrued (i.e. accumulated) during the deferment period – before that document was deleted and reuploaded with one that omits that crucial bit of information.

As such, we encourage borrowers to check with their banks on the specific terms they are offering for fixed-rate hire purchase agreements. The bank will also share other information to you, such as the additional interest accrued and tenure extension (if any).

Meanwhile, variable-rate hire purchase agreements will be similar to home loans, which we will cover below.

Personal Loans/Financing

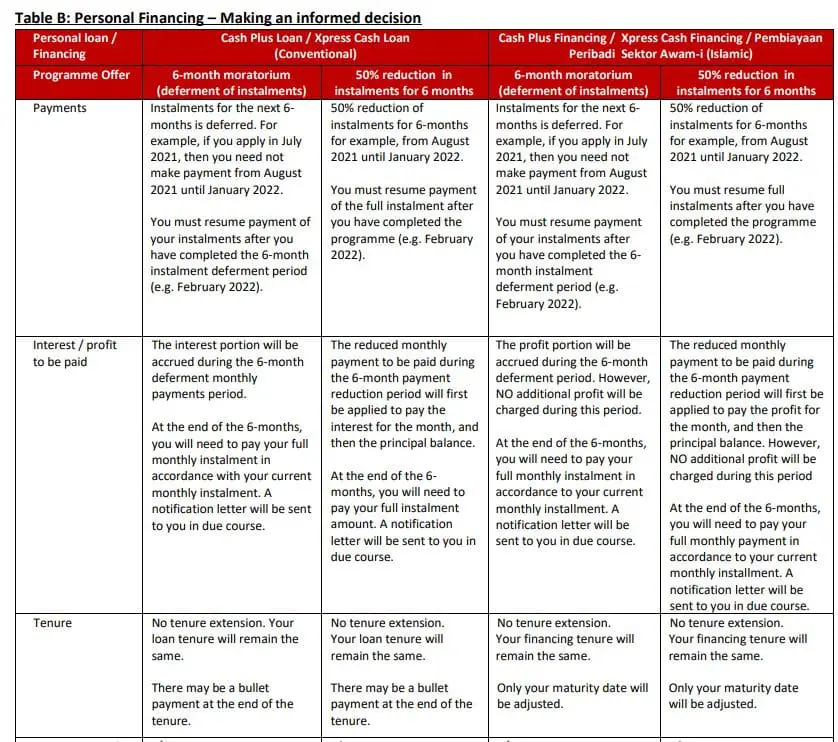

Just like hire purchase agreements, personal loans/financing follow a flat-rate basis for interest/profit rates – it is agreed upfront and is charged on a fixed amount/value (i.e. the value of the loan).

For this year’s loan moratorium, however, conventional personal loans will see interest accrued during the deferment period and may result in an extension of the loan tenure. As for the treatment of interest, once again it is a case of different banks with different terms. For example, CIMB’s FAQ states that loan tenure will be unchanged, and the accrued interest is to be paid alongside the final instalment. Meanwhile, RHB’s FAQ states that this accrued interest can be paid off in one lump sum upon expiry of the deferment period.

Perhaps most interesting is the fact that Maybank – based on its current FAQ – mentions that it is offering a “true” moratorium for its personal loan and personal financing facilities, with zero additional interest/profit accrued during the deferment period. There are no changes to the monthly instalments, and the loan tenure is extended by 6 months.

Mortgages/Home Loans

Mortgages or home loans charge interest on a reducing balance basis, where interest is charged each month based on the outstanding balance from the previous month. With the six-month loan moratorium, all monthly repayments are paused, but interest will still accrue – it is the same as last year’s moratorium as well.

As mentioned by Finance Minister Tengku Zafrul Abdul Aziz, interest will accrue but not compound during the deferment period – and all the banks’ FAQs also mentions this point. However, once repayment is resumed, the accrued interest is capitalised – this means that it is added to the principal balance and is then treated as the total outstanding balance…and thus, will compound over time.

Note that the above applies only for conventional home loans – for Islamic home financing, the accrued interest is always treated separately. In many cases, resumed repayments will go towards paying off this portion first before the principal – which still means the overall cost of borrowing increases (because you’re paying the principal slower than before the moratorium).

Nonetheless, it should be noted that the effect of non-compounding interest during the deferment period is generally negligible for the individual borrower. As we highlighted last year, the value is very small since the duration is too short to be significant – the effects of compounding interest gets stronger the longer it goes on, and six months does not even make up 1.5% of a 35-year loan. To illustrate, here’s our example from last year:

Scenario: outstanding balance RM500,000, with a 4% p.a. mortgage and monthly repayment is RM2,390.52.

| Month | Interest charge (non-compounding) | Interest charge (compounding) |

| July 2021 | RM1,666.67 | RM1,666.67 |

| August 2021 | RM1,666.67 | RM1,672.22 |

| September 2021 | RM1,666.67 | RM1,677.80 |

| October 2021 | RM1,666.67 | RM1,683.39 |

| November 2021 | RM1,666.67 | RM1,689.00 |

| December 2021 | RM1,666.67 | RM1,694.63 |

| Total | RM10,000.02 | RM10,083.71 |

| Difference | RM83.69 | |

Disclaimer: The example above is for illustration purposes only. Please refer to your banks on the actual computation of interests for your loan/financing.

As you can see, the compounded value is not substantial whatsoever from an individual borrower’s perspective. But as we also highlighted last year, this value quickly turns into a considerably big amount for the banks. Data from the National Property Information Centre shows that between 2009 until 2018, there were over 2.3 million residential properties sold. Assuming all of these properties were sold via home loans, the value of the 6-month non-compounding interest could actually come up to hundreds of millions of Ringgit in potential revenue for the banks in Malaysia.

The figure that borrowers must be aware of the most is that this moratorium will result in an additional borrowing cost of a minimum six months’ worth of interest into your home loan, and this amount will compound over the tenure of the loan. And this time around, the banks are not offering options for paying off this accrued interest (at least not in their FAQs). Most banks will maintain the borrower’s previous monthly instalment when the deferment period ends, and the loan tenure will be extended accordingly.

Coincidentally, this is also the option that will incur the highest borrowing cost based on our analysis last year (where three repayment options were given). We’ve reproducing it here for easy reference:

Scenario: outstanding balance RM500,000, with a 4% p.a. mortgage and monthly repayment is RM2,390.52.

| Option 1: Lump sum payment in Month 7 | Option 2(A): Same monthly repayment, extend tenure | Option 2(B): Higher monthly repayment, +6 months tenure | Option 3: Higher monthly repayment, no tenure extension | |

| Monthly repayment | RM2,390.52 | RM2,390.52 | RM2,438.33 | RM2,459.88 |

| Repayment difference | 0 | 0 | + RM47.81 | + RM69.36 |

| Loan tenure | + 6 months | + 21 months | + 6 months | Unchanged |

| Total interest charged from deferment | RM10,000.02 | RM33,866.34 | RM17163.94 | RM10139.68 |

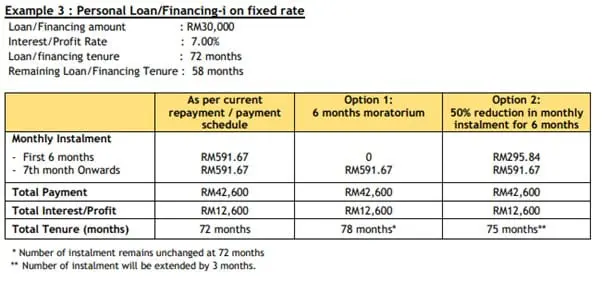

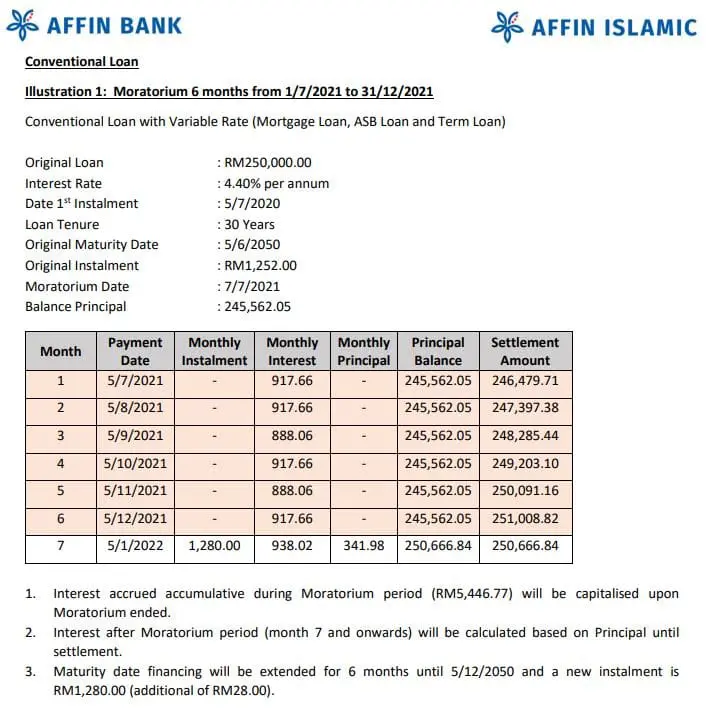

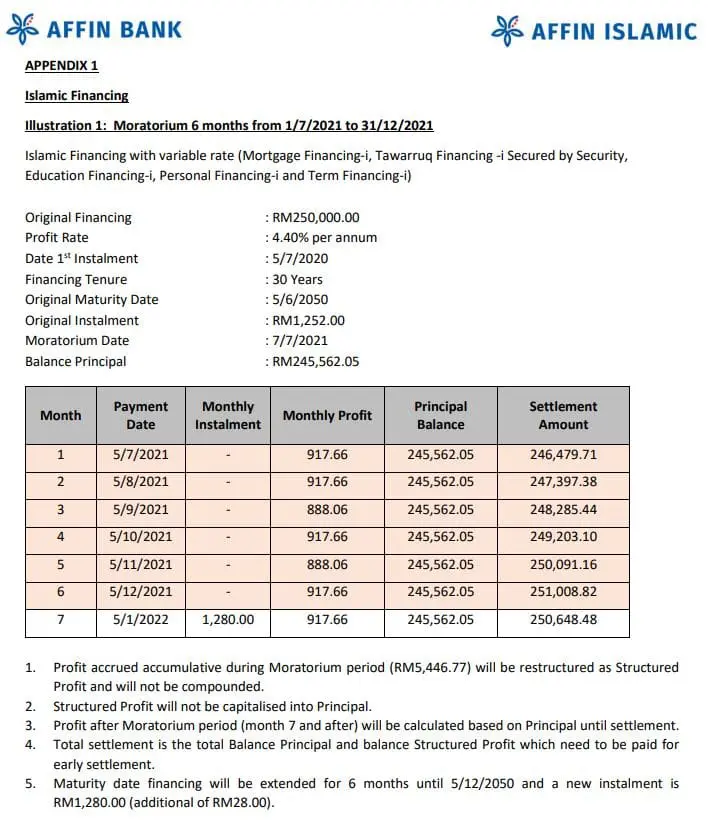

From our checks of the banks’ FAQs, CIMB is an exception, where there is no extension of loan tenure and borrowers may be required to pay a lump sum payment of the outstanding balance at the contracted loan maturity date. Affin is also another exception, where it is the only bank to offer increased instalment payments to reflect the additional outstanding balance and extend the loan tenure only by six months. This increase will be marginal, probably only in the two-digit range. Here’s Affin’s example in its FAQ:

While there are no multiple repayment options on the table as with last year’s moratorium, the banks are encouraging borrowers to resume normal repayments as soon as possible to. All banks are offering the flexibility of resuming usual repayments to borrowers who take up the loan moratorium and effectively terminate the deferment early (and therefore reduce the borrowing cost). According to Bank Negara Malaysia, banks are also able to adjust your instalments when your income improves – this is something to keep in mind that you can commit to in the future.

What about Islamic home financing?

Since Shariah-based financing forbids compounding profit (i.e. no profit from accrued profit), you will only need to repay the accrued profit from the six-month deferment which will be kept separate from the principal balance. That said, borrowing costs will still increase since post-moratorium instalments will be used to pay off the principal and this accrued interest – since the principal repayment is now made at a slower rate, the loan tenure will be extended and effectively increase the borrowing cost.

Thus, we recommend checking with your respective banks on how repayment will be implemented at the end of the moratorium period.

What should you ask your banks?

Considering the fact that this loan moratorium is being handled differently by different banks, we strongly encourage borrowers to ask the banks directly regarding your loan/financing. They will be able to provide the most accurate information, so you can make the best decision for yourself.

Some of the questions you should ask are:

- How much is the new monthly instalment amount after the moratorium?

- How much is the additional interest accrued after the end of the moratorium?

- What are my options to repay the accrued interest after the moratorium ends?

- Will my tenure change?

- Are there any additional fees involved?

- What can I do if my income has not recovered after the six-month deferment?

Note also that if you currently have an existing Repayment Assistance for your loan, you need to check how this new loan moratorium will affect your existing and future repayment arrangements. If you are one of these borrowers, you need to ask your bank about this, because there may be multiple capitalisations of interest involved that can significantly increase the cost of borrowing.

Impact Of the Loan Moratorium: Cash Flow Relief To Those Who Need It Most

The most important thing to remember about the loan moratorium is the immediate relief it brings to the borrower’s cash flow. For those who have lost their jobs or are facing salary cuts, this is a huge chunk of monthly commitment that can be paused without consequence (other than increased borrowing cost, of course).

Using the same RM500,000 home loan example earlier in this article, the monthly repayment of RM2,390.52 is a substantial amount that can be channeled towards groceries, children’s education needs (especially now with remote learning and online classes), and of course, alleviating immense financial stress. In exchange, the borrower pays RM47.81 or RM69.36 (or whichever increase proposed by the bank) more to their home loan repayments each month for the next 30 years.

For those who don’t have a choice, this trade-off is worth every Ringgit.

For Those Who Can Afford, Should You Take The Loan Moratorium And Invest?

One interesting piece of data from last year’s loan moratorium showed how many Malaysians took their loan moratorium funds and invested them, driving retail participation in Bursa Malaysia in 2020 to a record level. In 2021, is this still a viable option?

With the glove stocks bull run already over, heightened local political instability, and global concerns over new mutations of the virus that will affect economic recovery, the level of investment risk today is arguably higher than in 2020 – there is a strong possibility of losing money if you are planning to just cash in and out within a few months. Of course, if your investment horizon is long (>10 years), this may be an opportunity to invest in high-quality blue chips, unit trust funds, or other investment vehicles.

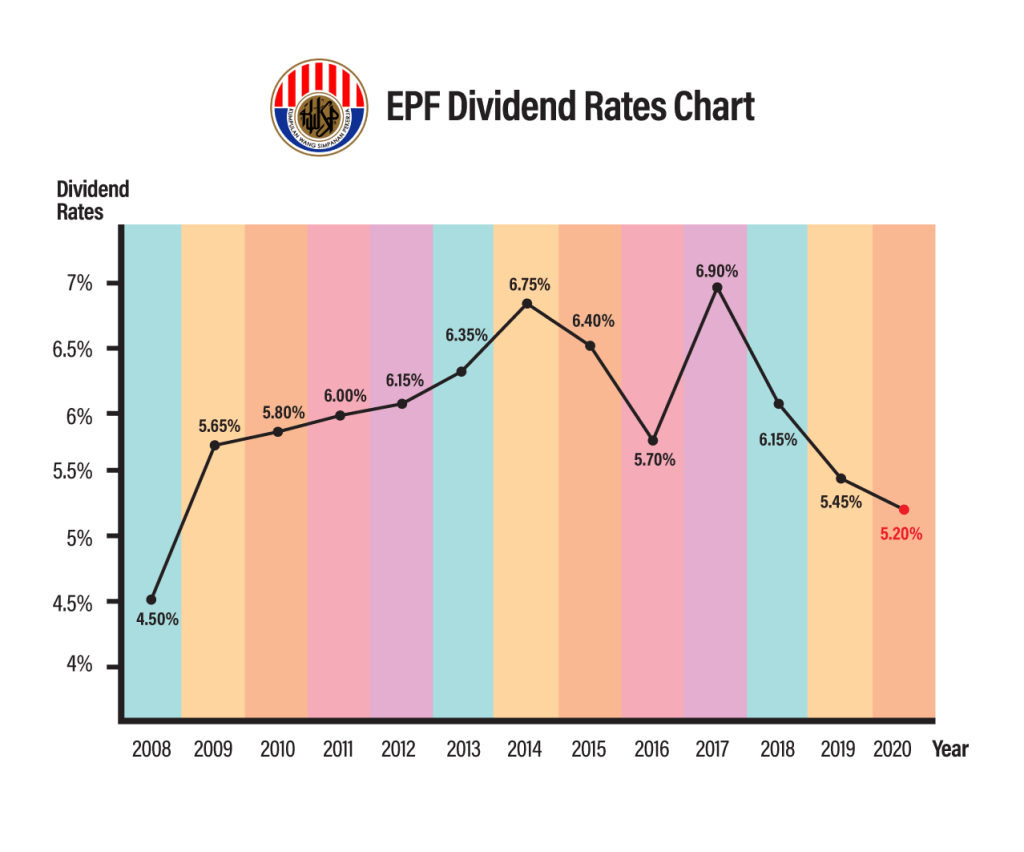

Alternatively, RinggitPlus co-founder and Licensed Financial Planner, Hann Liew, has another option: put these funds into investment assets even if lower on the risk scale such as EPF or balanced PRS funds. “The goal here is to get consistent returns at above home loan rates; currently they are in the 3% p.a. range, but in better economic climates they hovered in the 4.5% p.a. range. I’d target long-term returns of 5-6% p.a. at the minimum to be safe,” he said.

So what investment assets fit this bill? Hann added, “The EPF has consistently declared annual dividends above 5% p.a. for over 20 years. Its 10-year historical dividend rate of 6.11% is around 2x current home loan rates, and since 1999 (the furthest publically-available annual records of its dividends), there have only been four years where its dividends dropped below 5%. EPF members can self-contribute up to RM60,000 per year, so this is a relatively safe option that offers decent returns.”

Meanwhile, unit trust funds offered in the Private Retirement Scheme (PRS) cover a broad scope of risk to suit various investors – historically, the funds record returns from 3% p.a. to more than 10% p.a. depending on risk level (conservative, balanced, growth) and asset management house. There is also the RM3,000 tax relief for PRS investments to consider, too. If you are considering this route, here’s a guide on how to select a unit trust fund.

More importantly, both EPF and PRS “locks” your investments until you are 55 years of age and thus eliminate the risk of you withdrawing the funds earlier or misusing them in other ways (because the breakeven point can be decades down the line). In the long run, these investments could yield a net positive return throughout the investment period and offset the accrued and compounding mortgage/home loan interest.

To illustrate, let’s use the same home lone scenario: RM500,000 outstanding balance, interest rate at 4% p.a., monthly instalment RM2390.52, and a remaining tenure of 420 months (35 years). After the deferment period, the accumulated interest is RM10,000.02 – this figure will then compound monthly until the end of the loan to a final amount of RM39.657.98 (assuming a fixed home loan rate of 4% p.a.). We compare two options: investing just this interest portion (RM10,000.02) and the full six months instalments (RM14,343.12) into EPF (assuming a 6.11% dividend). The table below displays the hypothetical dividends earned after 35 years and the breakeven points for both options:

| Dividends earned at Year 35 | Net profit at Year 35 | Breakeven point | |

| Invest interest portion only | RM69,702.47 | RM30,044.49 | Year 24 |

| Invest full instalment | RM99,974.89 | RM60,316.19 | Year 18 |

But of course, it must be reiterated that before making any investment decisions, borrowers must consider the risks involved – in this case, using borrowed funds to invest in an uncertain market. The above does not constitute as financial advice.

Should You Take The 2021 Loan Moratorium? Our Recommendations

So, with all that said and done, should you take the six-month loan moratorium in 2021? Surprisingly, our recommendations have not changed much compared to last year. We recommend you to take the loan moratorium if…

1. You face some serious cash flow issues during this period and have no/exhausted emergency funds. This moratorium is aimed at addressing this exact concern. If your employer has imposed a salary cut or worse, a round of layoffs that affects you, this deferment will ease the financial stress. Meanwhile, don’t forget to also check what financial aids you are eligible for – there are quite a few announced in the latest PEMULIH package. This is a very difficult period that’s worse than 2020 both economically and pandemic-ally, but we can pull through.

2. You foresee a potential cash flow issue. With businesses crippled and whole industries unable to operate during this extended lockdown, you’ll never know what might happen. This moratorium can be opt in at any time from now until 31 December, and will apply for six months after, so you don’t have to make a decision now.

Alternatively, there is also the 50% reduction option that is available for all loans and financing. This reduces the cost of borrowing (compared to the full loan moratorium) but is still a considerable amount so you will need to decide if that amount is worth the extra peace of mind. Bank Negara Malaysia also confirmed that you can switch to the full loan moratorium at any time during the deferment period should your financial situation worsen.

Another option is to consult with a Licensed Financial Planner who may be able to provide better advice and strategies to help you better prepare for cash flow issues.

3. Your bank offers a “true” moratorium for your loan/financing. From the banks’ FAQs, there are some facilities that enjoy a “true payment holiday” (at the time of writing, of course – the T&Cs may change in future). With zero additional borrowing cost, you can use this amount to rebuild your emergency fund or probably get some decent short-term returns by placing them in fixed deposits or other low-risk facilities such as money market funds. Do consider that in this low-interest environment, the net returns may not amount to much. Lastly, be responsible with this fund since it is meant for loan repayment and the loan/financing tenure is short – no hodl mentality here.

4. Your risk appetite is high enough, or if your investment horizon is long. If you can afford your monthly instalments, have a comfortably-sized emergency fund, and job security isn’t an issue, you can potentially make use of the deferred monthly repayments to make more money as explained in the previous section. That said, borrowers must understand that every investment has its risks, and using borrowed funds to invest increases the quantum of profits and losses. Do your own research or consult with a Licensed Financial Planner if you are considering this option.

*****

In conclusion, the 2021 bank loan moratorium will benefit all Malaysians servicing any form of loan/financing facility and is a much needed one in such a difficult period. We recommend those eligible to take the loan moratorium, as those who will need it will have a brief respite, while those who can afford to service their loans can earn some money by saving or investing the deferred instalments.

Disclaimer: The information shared in this article is accurate at the time of writing, but may change should there be new developments to the 2021 bank loan moratorium. The recommendations mentioned here do not constitute as financial advice, and borrowers should speak to their banks or consult with a Licensed Financial Planner before making a decision.

Comments (2)

Good read, thanks for writing this much-needed article for the average laymen who are keen on personal finance. The concept is well explained. the potential pitfalls or ‘catch’ are all highlighted, and the potential opportunities to gain from the moratorium based on certain circumstances are all well explained. Well done!

Hi, thank you for the article. I have a crazy idea. What is the benefit/impact of taking up the 6-month moratorium and dumping the full monthly instalment amounts into the same flexi housing loan? Can you help to check on this and give some clear examples on how this should or should not be considered?