Alex Cheong Pui Yin

24th August 2023 - 3 min read

Executive chairman of the Securities Commission Malaysia (SC), Datuk Seri Dr Awang Adek Hussin has highlighted the considerable growth of the financial planning industry in Malaysia over the past few years, noting that it now plays an increasingly pivotal role in the financial wellbeing of many individuals. As such, it is now more crucial than ever for the industry to be attentive to investor demands and market conditions, and adapt to keep up with them.

To underscore his point, Datuk Seri Dr Awang shared that the number of financial planning firms has increased by 42% between 2015 and 2022, from 31 to 44 firms as of end-2022. The number of licensed representatives, meanwhile, ballooned by 145% to 1,455 individuals during the same period.

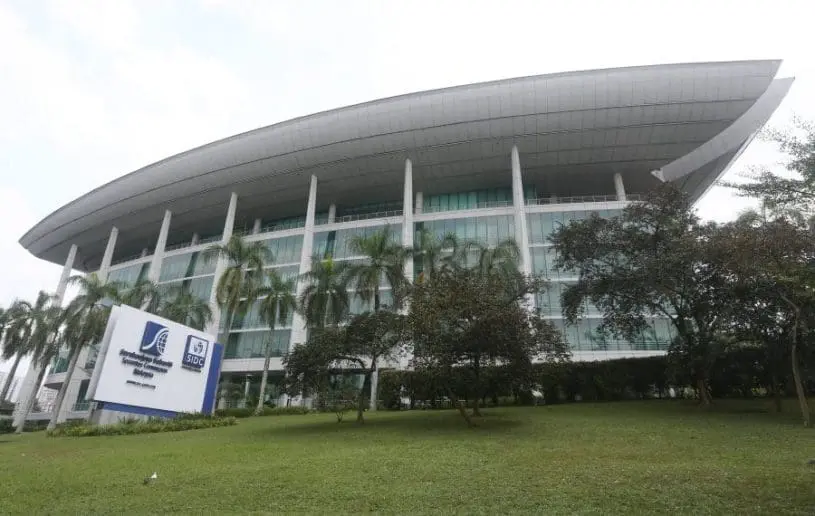

Given this development, the financial planning industry must be better equipped so that they can serve their customers more efficiently. “The financial planning industry must broaden its offerings to meet investors’ preference for socially responsible investment (SRI), invest in technology for more personalised services, and build a skilled talent pipeline for the future,” stressed Datuk Seri Dr Awang at the Financial Planning Association of Malaysia (FPAM) Annual Signature Financial Planning Symposium 2023.

The SC chairman also noted that current investors are more interested in seeking advice on holistic investment strategies that take their entire portfolio into consideration, as opposed to focusing only on individual products. Accordingly, this also ramps up the demand for personalised services from financial planners.

“The evolving service model and access demanded by clients is led by increased demand for personalised advice with deeper investor engagement over the long term. Towards this end, the SC seeks to facilitate and empower firms and consultants to move towards more comprehensive wealth management offering across the capital market and financial sectors in a bid to meet Malaysians’ evolving needs,” said Datuk Seri Dr Awang.

In addition to this, Datuk Seri Dr Awang commented that the recent launch of the government’s Ekonomi Madani framework will boost the industry with new opportunities for financial planners as well. “Initiatives under the Madani Economy framework are expected to improve investor confidence in the Malaysian economy and attract greater inflows and foreign investors into the domestic capital market. This in turn will provide better opportunities for financial planners to expand their client base as well as enable existing clients to grow their wealth,” he said.

Among other things, the SC – along with the government – is looking at policies to attract and facilitate the establishment of family offices in Malaysia, which could, in turn, attract more investments to support financing for the country’s recovering economy and SMEs. Briefly, family offices are dedicated private wealth management advisory firms that manage the financial and investment needs of affluent individuals or families.

Finally, the financial planning industry is also encouraged to build its talent pipeline by collaborating with universities and other professional associations. This way, they can develop relevant courses to mould and cultivate a future generation of first-class financial planners, thereby ensuring the endurance and progression of Malaysia’s financial planning industry.

(Sources: Business Today, The Edge Malaysia)

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)