Alex Cheong Pui Yin

14th October 2022 - 3 min read

Securities Commission Malaysia (SC) has specifically cautioned the public to be wary of self-proclaimed investment gurus, who typically take to social media to offer questionable advice and spread false or misleading information. This is especially amidst a rising number of investment scams that is happening within the country.

According to the chairman of the SC, Datuk Seri Dr Awang Adek Hussin, there has also been a growing number of “celebrities or influencers” who were invited to endorse selected retail investment offerings on social media. In addition to sharing testimonies of supposed successful investments, these figures will also provide investment advice to investors.

Datuk Seri Dr Awang Adek noted this situation to be problematic as the public can be easily persuaded by such figures. He also reiterated that the internet and social media have now become fertile ground for fraudsters and entities that are either illegal or do not comply with local securities laws. They would find increasingly sophisticated ways to prey on investors who invest with the desire to gain huge earnings irrespective of the risks involved.

“Most scams are spread through messaging apps and platforms like WhatsApp and Facebook. And we have recently noticed that they started using Telegram as well. Many of these scams also claim to be shariah-compliant,” added Datuk Seri Dr Awang Adek.

The SC had previously reported that more than 1,800 complaints and enquiries related to investment scams and unlicensed activities alone have been lodged with the commission as of September 2022. Meanwhile, the Commercial Crime Investigation Department (CCID) of the Royal Malaysia Police (PDRM) recorded a total of 71,833 fraud cases, with losses amounting to more than RM5.2 billion, between 2020 to May 2022.

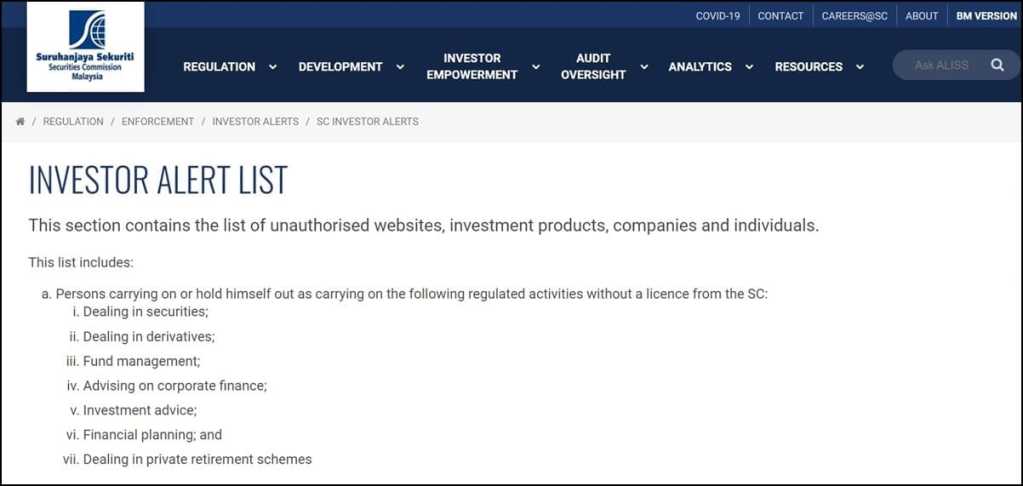

To address the problem, Datuk Seri Dr Awang Adek said that the SC has increased its collaboration with various stakeholders. “Our multi-pronged approach includes alerting the public via our Investor Alert List, blocking websites, and geo-blocking offending social media pages. We also take enforcement actions as needed,” he said.

Notably, the SC has added 275 names to its Invest Alert List in just last year. It also blocked 143 websites and geo-restricted 35 social media pages. “This year, we have added 194 names to our Alert List, and 143 websites and 26 Facebook pages were blocked as of August,” said Datuk Seri Dr Awang Adek.

Furthermore, Datuk Seri Dr Awang Adek reminded the public that all entities that wish to provide capital market products and services to Malaysian investors must first be licensed or registered with the SC, including those who are or claim to be licensed overseas. This is because they must fulfil stringent regulatory requirements that are designed to protect Malaysian investors, specifically.

“Investors who choose to trade on unlicensed platforms risk not being protected in the event of any dispute arising. In short, we cannot protect you if choose to invest with unlicensed people,” the SC chairman said.

Finally, Datuk Seri Dr Awang Adek shared that the SC will be introducing a range of new policy initiatives to further develop the country’s capital market, including digital-centric initiatives. While he did not reveal much details, he noted that there will be a formal announcement of the initiatives by the end of October.

(Source: The Edge Markets)

Comments (0)