Alex Cheong Pui Yin

21st June 2023 - 3 min read

A survey from Principal Financial Group has revealed that 41% of its Malaysian respondents are not confident that they can manage their finances without additional financial assistance in the post-pandemic era. This is made worse by the rising inflation that is currently sweeping across the world.

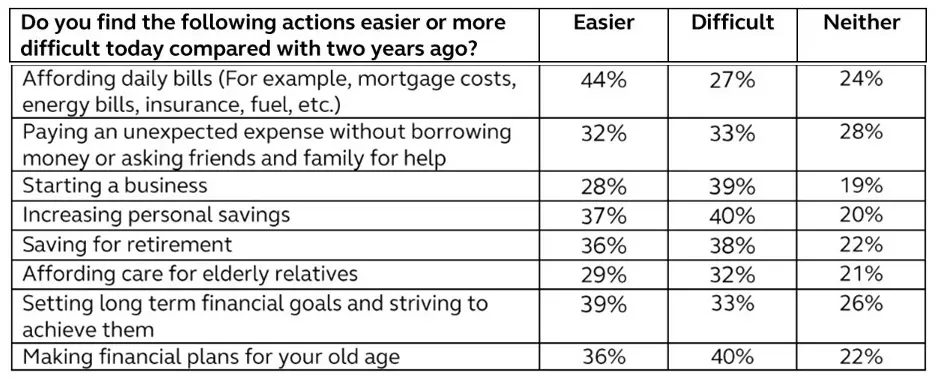

Principal’s survey also indicated that 55% of its Malaysian respondents have seen their savings decrease over the last two years, while 49% said that their debt levels have increased. Another 27% shared that it is harder today to afford daily bills – such as mortgage cost, energy bills, insurance, and fuel expenses – than it was two years ago. 33% also commented that they find it difficult to cope with an unexpected expense without external help.

Aside from that, 38% of Malaysian survey participants noted that saving for retirement is now more challenging, whereas 33% and 40% said that they are struggling to set long-term financial goals and plan for old age, respectively. More alarmingly, 47% of them also feel that family members are now more dependent on them financially – as compared to two years ago.

Overall, 39% of Malaysian respondents said that they are not happy with their current financial conditions, with many believing that they are doing worse than pre-pandemic times.

While immediate resolution of the situation is not possible, 34% of Malaysian respondents said that they will feel more financially supported if pandemic-related financial aids provided by the government can be extended or made permanent. Meanwhile, 27% felt that financial services companies should also extend or make permanent their pandemic-related aids. Additionally, 26% indicated that they would welcome increased financial assistance to support the cost of caring for elder relatives.

In its statement, Principal also clarified that its survey – which has a total of 1,500 respondents – has actually been conducted across three countries: Malaysia, Singapore, and Hong Kong (500 respondents from each country). Despite the difference in region, many have expressed similar concerns regarding their financial situation.

“Across Hong Kong, Malaysia, and Singapore, people are increasingly challenged to balance today’s needs against planning for the future. Between high inflation and rising interest rates, macroeconomic and socioeconomic factors are having a greater impact on individuals’ sense of financial stability than they did before the pandemic,” said the president of Asia for Principal, Thomas Cheong.

“Looking to the future, we hope understanding the economic struggles and financial situations of those in Hong Kong, Malaysia, and Singapore will help governments, financial institutions, and employers ascertain how they can work together to drive positive change through effective policies and programmes,” Cheong further said, adding that employers can also help alleviate the situation via efforts like increasing their pension fund contribution for employees or allowing permanent flexibility in work locations and working hours.

Comments (0)