Christina Chandra

25th August 2025 - 2 min read

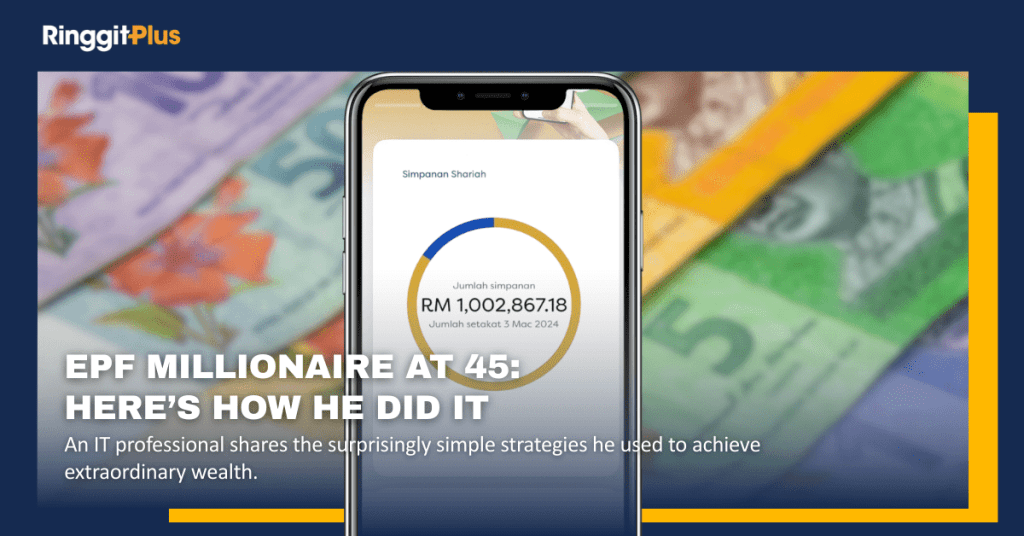

A Malaysian IT professional working in Kuala Lumpur managed to build up over RM1 million in his EPF account by the age of 45. His friend, Nur Fadhli Bassar, highlighted this achievement in a social media post, sharing that this financial goal is possible for the average Malaysian. The individual, who started his career at 23, made one necessary withdrawal from his EPF Account 2 to buy a house, but has otherwise kept his contributions steady.

Smart Financial Habits For a Strong Retirement Fund

The IT Pro credits his financial success to several careful and planned habits. First, a steady job with a good salary was the foundation of his savings journey. He also actively increased his monthly EPF contributions from the required 11% to a higher 13%. This simple but effective step helped him save money much faster.

He also showed good money management by not taking out any money from his EPF account unnecessarily, since he had already built up a separate, adequate emergency fund. The individual also made a clear choice to increase his salary by changing jobs eight times throughout his career. Each move was a planned step to get a higher income, which in turn boosted his EPF savings.

A Mindset of Consistency and Giving

Beyond his career and saving plans, the man’s approach is also built on a consistent way of growing his finances and giving back. He believes that paying zakat, a compulsory donation for Muslims, helps to bring blessings and a more successful financial life.

The man’s 2023 EPF dividend alone, which was at 5.4%, would generate approximately RM4,512 per month in passive income, allowing him to live comfortably without touching his main savings.

The Path to Financial Independence

If he continues his job until the age of 60, his EPF savings could potentially grow to over RM2 million, providing a monthly pension of around RM10,000 in retirement. This confirms the recommended savings goal of RM1 million by age 55 for a comfortable retirement in Malaysia.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Christina writes about personal finance with an eye for making the complicated feel straightforward. She is drawn to the everyday money decisions people face and genuinely enjoys finding the clearest way to explain them. Between articles, she is probably napping, on a hiking trail, or terrorising her sister’s cats.

Comments (0)