Samuel Chua

22nd September 2025 - 2 min read

The Sales and Service Tax (SST) remains a key concern for property developers, with more than 70% indicating they are likely to raise property prices by between 3% and 5% due to higher costs.

This is based on a survey conducted by the Real Estate and Housing Developers’ Association (Rehda) Malaysia involving 187 developers. The findings show that 62% expect the SST to significantly increase project costs and affect their operations. About 70% believe construction costs will rise by at least 3%, leading 73% of respondents to consider price adjustments for future projects.

Why This Matters For Buyers

Residential properties are technically exempt from SST, but higher construction and compliance costs may still influence property prices. Developers often pass on part of these expenses to consumers, meaning new projects could become more expensive or come with fewer rebates and discounts.

For future homeowners, this makes affordability a growing concern. It also highlights why policy measures, such as tax incentives or homebuyer campaigns, remain important in keeping housing accessible.

Rehda Engages Government On SST Rules

To address industry concerns, Rehda is working with the government to improve the application of SST in the property and construction sectors.

President Datuk Ho Hon Sang said developers are seeking clearer guidelines to avoid double taxation, as well as incentives such as tax breaks for essential materials and eco-friendly products. He also highlighted the need for input tax credits or faster refunds to improve cash flow, simplified SST structures including tiered rates, and better digital systems for engaging with Customs and other authorities.

Challenges With Current Tax Structure

While residential properties are exempt from SST, commercial properties are not, and mixed developments present unique difficulties.da

To simplify the process, Rehda has proposed a flat 3% SST rate for the sector. According to Ho, construction costs are typically split between labour and building materials, making a simplified approach more practical for developers.

Call For Revival Of Home Ownership Campaign

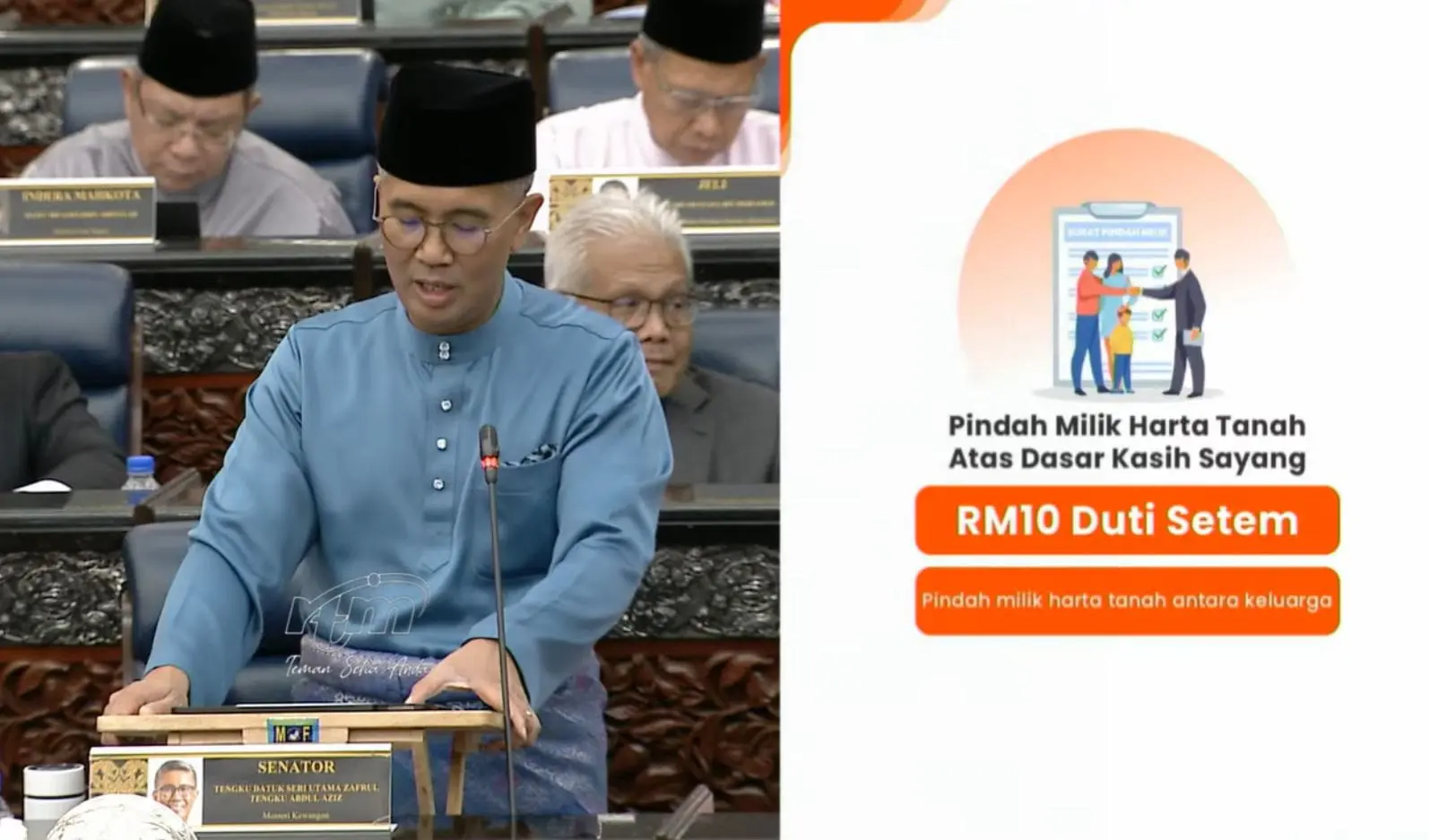

Beyond tax reforms, Rehda is also advocating for the return of the Home Ownership Campaign (HOC), which previously offered stamp duty exemptions for instruments of transfer.

The earlier editions of the HOC were well received, with strong take-up rates from homebuyers. Ho said reintroducing the initiative could help stimulate the property market and boost buyer confidence at a time when developers are facing additional pressures from tax and rising costs.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)