RinggitPlus

9th April 2025 - 3 min read

Property prices in Putra Heights could drop by 5% to 20% following the recent gas pipeline explosion, according to experts. Homes in the affected area, mainly double-storey terraces worth between RM650,000 and RM850,000, could lose up to RM170,000 in value.

Ishak Ismail, president of the Malaysian Institute of Property and Facility Managers (MIPFM), compared the situation to Shah Alam’s 2021 floods, where quick government action helped restore confidence. He also shared that accurate property valuations will only be possible after six months, once transaction data becomes available.

“As in that case, public perception could drive a drop in property values in Putra Heights, but the actual impact will only become clear once property transaction records for the next six months are available.”

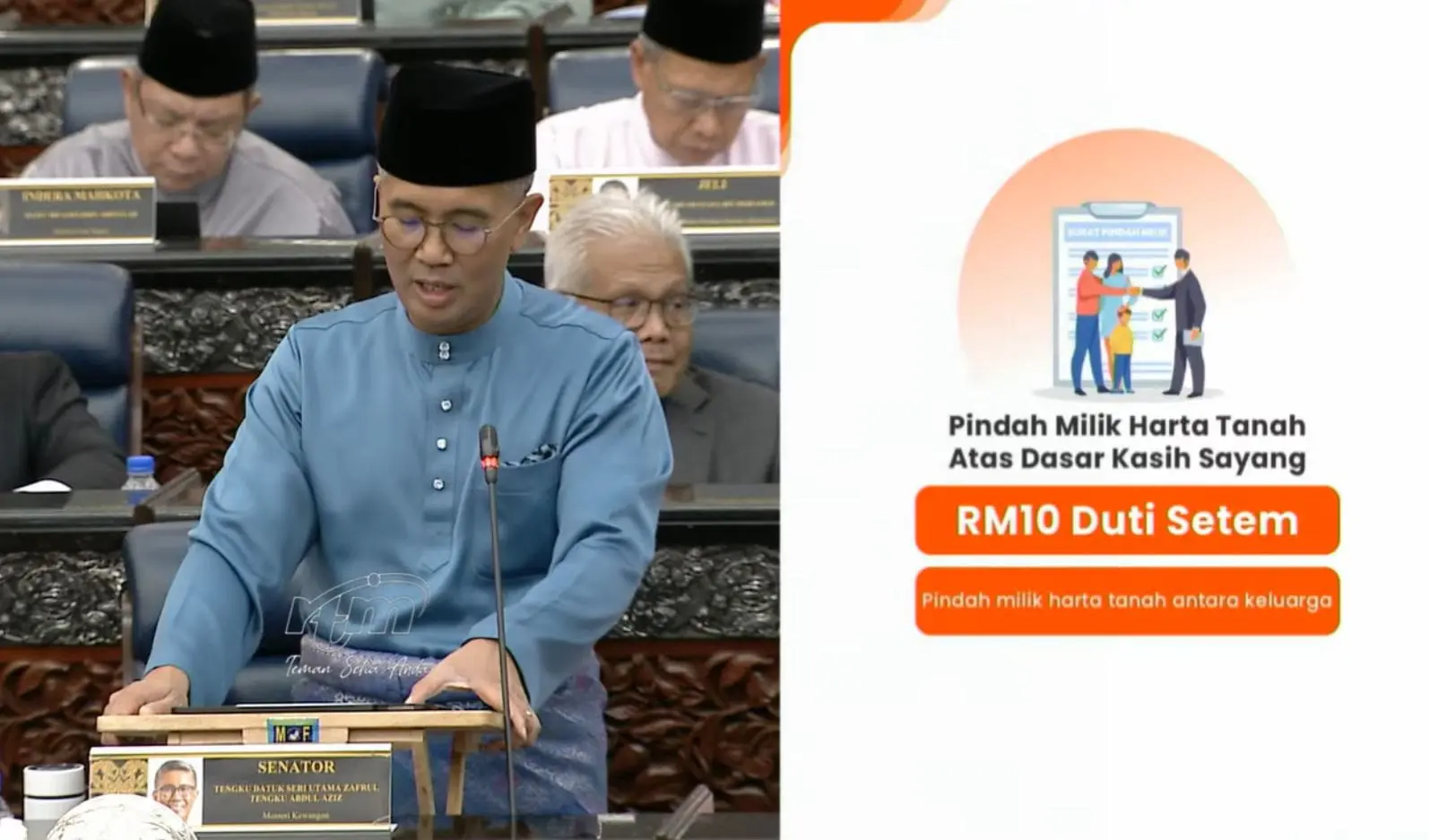

“Property transaction records, based on banking, transfer of ownership and stamp duty valuation data, typically take up to four months to materialise before they are reflected in market statistics.”

“This drop in value is largely driven by public concern over safety, liveability, and health risks following an incident that was previously unimaginable in a mature residential neighbourhood.”

“As such, the authorities must act promptly to repair damaged infrastructure and bolster public confidence, while also tightening standard operating procedures (SOPs) to prevent future incidents,” he said.

Selangor police chief Datuk Hussein Omar Khan stated that the April 1 explosion, caused by a leaking gas pipeline, damaged 437 homes and affected 364 people from 74 families. Total property losses are estimated at RM64.5 million.

Universiti Kebangsaan Malaysia’s (UKM) Centre for Global Business and Digital Economy senior lecturer, Dr Sharizal Hashim said prices could drop by as much as 30% in worst-case scenarios, especially near the blast site, unless strong and transparent actions are taken. He also called for a review of existing safety procedures, as the incident appears to be due to technical or procedural failures, not a natural disaster.

“For example, double-storey houses in the explosion zone valued between RM700,000 and RM1.3 million could see a drop of RM210,000 to RM390,000 if the decline reaches 30%.”

“Recovery efforts should not rest solely on the government. Construction companies, insurance providers, and Petronas must work together on a comprehensive action plan,” he said.

Universiti Teknologi Mara (UiTM) Shah Alam, Master’s in Construction Engineering programme senior lecturer and postgraduate coordinator, Dr Mazlina Zaira Mohammad added that while short-term price drops are likely, long-term effects will depend on how well the situation is handled. She believes prices could recover within 6 to 24 months if investigations are transparent and new safety measures are introduced.

“Buyers and investors may now lack confidence in the safety and utility infrastructure in the area, which will likely suppress property demand for the time being.”

“As a result, homeowners may be forced to lower their asking prices to attract increasingly cautious buyers”, she said.

Despite the incident, she said Putra Heights remains attractive due to its good location, nearby amenities, and strong infrastructure.

(Source: NST)

Comments (0)