Alex Cheong Pui Yin

2nd September 2022 - 12 min read

This article is an advertisement by Eastspring Investments.

For a country that has only opened its doors to foreign businesses and investments for slightly more than 40 years, China has made impressive progress on the global stage. It’s near impossible to ignore this global force that has emerged to become one of the largest economies in the world, second only to the United States (US).

China’s rapid progress has captured the attention and interest of many investors globally over the past decades. There is also general consensus that China continues to possess long-term growth potential, making it more attractive to foreign investors in the future.

If you’ve always heard about China’s growth potential but never really understood why, this article will explain three factors said to be key propellers to China’s future prospects.

Technology

China’s tech sector has long stopped being a follower but has instead transformed into an industry leader with technological innovations in various areas. These include telecommunications, Big Data and supercomputers, artificial intelligence, robotics, as well as e-commerce and fintech – just to name a few. This is demonstrated by the fact that Chinese technology brands like Alibaba, Huawei, and Tiktok have now become household names.

A lot of this can be attributed to how much China spends on research and development (R&D); the country reportedly has a ratio of R&D spending to GDP of approximately 2.5% – which far exceeds the average for upper-middle-income countries. To further put things into perspective, China’s annual R&D spending grew 169 times from 14.3 billion yuan (approximately US$2.12 billion) at the beginning of the 1990s to 2.44 trillion yuan (approximately US$0.36 trillion) in 2020. And this trend is likely to continue for the foreseeable future, given the government’s determination in prioritising the development of innovative capabilities.

The key areas within China’s tech sector that have been identified as potential growth engines moving forward include semiconductor, software, and automation. For instance, China is projected to contribute 24% of the world’s global semiconductor capacity by 2030. Software companies, too, will likely benefit from the government’s recent promise to draft out policies that will support the country’s Big Tech platforms in their journey of innovation and globalisation.

Consumer Goods & Consumption

With a population of approximately 1.4 billion people, China’s consumer market has immense potential and opportunities to offer. The National Bureau of Statistics of China reported that China’s total retail sales of social consumer goods hit 44.1 trillion yuan (approximately US$6.5 trillion) in 2021. This figure is expected to grow in the long-term as China’s middle-income class continues to expand, and a significant segment of the group gradually succumbs to “premiumisation”.

Simply put, premiumisation is built upon consumers’ preference for the premium lifestyle, where they are willing to pay extra for luxury or branded items – whether as a boost to their social status or an actual appreciation for better quality. In China, this phenomenon was noted to prevail in all aspects of life, including daily necessities – and many companies see this as a great opportunity to drive growth.

Some consumption trends that tap onto this vast consumer market – which is estimated to hit US$13.9 trillion by 2030 – are online entertainment and healthcare. CNBC, for instance, reported that China is still the world’s largest e-sports market despite recent regulatory restrictions, with industry revenue growing 14% year-on-year in 2021, while one of China’s largest tech and video game companies, Tencent, recently declared that it “sees growth for online games in China and beyond”. Similarly, demand for better healthcare is also projected to expand at about 11% by 2031, led by sectors such as pharmaceutical and biotechnology.

Renewable Energy and Clean Tech

2020 saw renewable energy investments and sustainable finance taking the spotlight, with many global economies gradually latching on to the trend. China is already a notable world leader in the area of renewable energy and clean tech, and already produces most of the technology used to build new green economies.

The country seems to be winning the clean energy race and is leading the world in renewable energy production figures; it is already the world’s largest producer of wind and solar energy, as well as the largest domestic and outbound investor in renewable energy. Nevertheless, it appears China will continue to make even more such investments moving forward. In 2022 alone, China aims to install a record 156 gigawatts of wind turbines and solar panels – a 25% jump from the previous record set in 2021.

The Chinese government has also long held ambitions for the country’s electric vehicle (EV) adoption, with various policies already in place to nurture the EV industry and to encourage the adoption of EVs. With the implementation of these policies, it hopes that at least 40% of the vehicles sold within the country will be EVs by 2030. Not only that, the government also aims to have installed a charging infrastructure network to meet the needs of more than 20 million EVs by 2050.

Ultimately, these green ambitions may propel many Chinese renewable players ahead of others in the global decarbonisation trend.

***

As these trends emerge, investors may want to consider the opportunity to invest in China today in hopes of reaping potential returns, especially with the market being more subdued at present, combined with attractive valuations.

If you’re convinced of the investment opportunities that China has to offer, there are numerous funds in the Malaysian market with exposure to China. Two specific ones that you may want to consider are the Eastspring Investments Dinasti Equity Fund and the Eastspring Investments Islamic China A-Shares Fund.

Investing In China With Eastspring

Eastspring Investments Berhad currently manages a total of RM1.35 billion (as of 31 August 2022) in Chinese equities, complemented by a network of investment experts across Asia.

Meanwhile, the Eastspring Investments Dinasti Equity Fund and the Eastspring Investments Islamic China A-Shares Fund are both growth equity funds and are shariah-compliant. More importantly, a big portion of their portfolios are invested in the three emerging trends discussed above.

1) Eastspring Investments Dinasti Equity Fund

A significant portion of the Eastspring Investments Dinasti Equity Fund portfolio, for instance, is dedicated to technology (42.85%), with the next biggest fund allocation being industrials (16.46%). This is followed by consumer goods (14.90%) and consumer services (11.52%). Here’s the full asset allocation for the Eastspring Investments Dinasti Equity Fund:

As you can see, the Eastspring Investments Dinasti Equity Fund is already primed to tap into the key investment trends that make China an attractive investment destination. Top holdings in the fund, meanwhile, include Alibaba, Taiwan Semiconductor Manufacturing Co. Ltd, and Tencent Holdings Limited.*

Cost-wise, there is a sales charge of up to 5.50% of the net asset value (NAV) per unit. There is also an annual management fee of up to 1.80% p.a., as well an annual trustee fee of up to 0.08% p.a. (subject to a minimum of RM18,000 per annum, excluding foreign custodian fees and charges).

*as of 30 June 2022

2) Eastspring Investments Islamic China A-Shares Fund

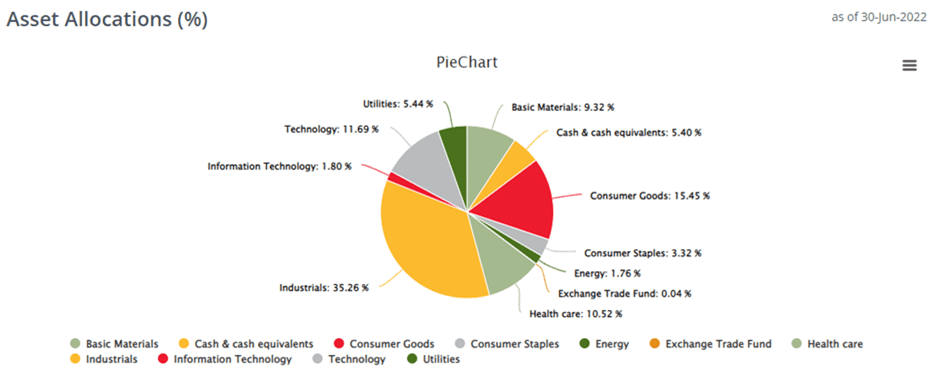

Meanwhile, the Eastspring Investments Islamic China A-Shares Fund has a higher allocation for industrials (35.26%) in its portfolio, followed by a fairly equal distribution to consumer goods (15.45%), technology (11.69%), and healthcare (10.52%) – as you can see here:

Some notable companies that have the greatest weightage in this fund include Contemporary Amperex Technology Co. Ltd, BYD Company Limited, Longi Green Energy Technology Co. Ltd, China Yangtze Power Co. Ltd, and Shenzhen Mindray Bio-Medical Electronics Co. Ltd.**

Similar to the Eastspring Investments Dinasti Equity Fund, the sales charge is up to 5.50% of the net asset value (NAV) per unit and an annual management fee of up to 1.80% p.a.. Meanwhile, the annual trustee fee can go up to 0.065% p.a. (subject to a minimum of RM15,000 per annum, excluding foreign custodian fees and charges).

**as of 30 June 2022

Investing With Prudence

As a savvy investor, though, we’re sure you know that it’s crucial to carry out your own due diligence before going ahead with any investments. While China investments certainly sounds like an exciting prospect, it also comes with its set of risk and volatility – especially for long-term growth investments.

Some recent developments that have affected China’s markets recently include regulatory crackdowns on some of the country’s prominent tech companies, China’s persisting zero-Covid policy, as well as the continuous strain in US-China relations. The property crisis in 2021 – which saw the fall of real estate giant, Evergrande – has also spooked foreign investors as real estate accounts for approximately 15% to 20% of China’s gross domestic product (GDP).

From a long-run perspective, these incidents are expected to be temporary hurdles in China’s growth trajectory. Investing in China is undoubtedly a long-term play, and early investors with a suitable risk appetite who have a head start – especially when they buy in at low valuations – may be a prudent decision.

If you’re ready to take your first step in investing in China, you can find out more about the Eastspring Investments Dinasti Equity Fund or the Eastspring Investments Islamic China A-Shares Fund here.

***

Disclaimer: The contents of this advertorial are intended for general information only. Investors should carefully consider their investment objectives as well as the risks and costs associated with fund investing prior to making any investment decisions.

Based on Eastspring Investments Dinasti Equity Fund’s (“Fund”) portfolio returns as at 30 June 2022, the Volatility Factor (VF) for this Fund is 17.3 and is classified as “High” (Source: Lipper). “High” generally includes funds with VF that are higher than 14.21 but not more than 17.635. The VF means that there is a possibility for the Fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision. The VF for the Fund may be higher or lower than the VC, depending on the market conditions. The Fund’s portfolio may have changed since this date and there is no guarantee that the Fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC.

Investors are advised to read and understand the contents of the Eastspring Investments Master Prospectus dated 15 July 2017, the Eastspring Investments First Supplementary Master Prospectus dated 2 February 2018, the Eastspring Investments Second Supplementary Master Prospectus dated 31 October 2018, the Eastspring Investments Third Supplementary Master Prospectus dated 2 January 2019, the Eastspring Investments Fourth Supplementary Prospectus dated 1 August 2019, the Eastspring Investments Fifth Supplementary Master Prospectus dated 1 October 2020, the Eastspring Investments Sixth Supplementary Master Prospectus dated 15 December 2021, the Eastspring Investments Islamic China A-Shares Fund Prospectus dated 13 September 2021, the Eastspring Investments Islamic China A-Shares Fund First Supplementary Prospectus dated 1 August 2022 (collectively, the “Prospectuses”), as well as the fund’s Product Highlights Sheet (“PHS”) before investing. The Prospectuses and PHS are available at offices of Eastspring Investments Berhad or its authorised distributors and investors have the right to request for a copy of the Prospectuses and PHS.

This advertisement has not been reviewed by the Securities Commission Malaysia (“SC”). The Prospectuses have been registered with the SC who takes no responsibility for its contents. The registration of Prospectuses with the SC does not amount to nor indicate that the SC has recommended or endorsed the product. Units will only be issued upon receipt of the application form accompanying the Prospectuses. Past performance of the Manager/fund is not an indication of the Manager’s/fund’s future performance. Unit prices and distributions payable, if any, may go down as well as up. Where a unit split/distribution is declared, investors are advised that following the issue of additional units/distribution, the Net Asset Value (“NAV”) per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV. Where a unit split is declared, investors are advised that the value of their investment in Malaysian Ringgit will remain unchanged after the issue of the additional units.

Investments in the fund are exposed to the risks as tabulated below. Investors are advised to consider these risks and other general risks as elaborated in the Prospectuses, as well as the fees, charges and expenses involved before investing. Investors may also wish to seek advice from a professional adviser before making a commitment to invest in units of any of our funds.

| Fund Name | Principal Risks |

| Eastspring Investments Dinasti Equity Fund | Security risk, credit or default risk, interest rate risk, countries or foreign securities risk, currency risk, counterparty risk, license risk, Shariah-compliant derivative risk, prepayment and commitment risk and reclassification of Shariah status risk. |

| Eastspring Investments Islamic China A-Shares Fund | Islamic collective investment scheme risk, equity risk, single country risk, currency risk, counterparty risk and Shariah status reclassification risk. |

Eastspring Investments is an ultimately wholly owned subsidiary of Prudential plc. Prudential plc, is incorporated and registered in England and Wales. Registered office: 1 Angel Court, London EC2R 7AG. Registered number 1397169. Prudential plc is a holding company, some of whose subsidiaries are authorized and regulated, as applicable, by the Hong Kong Insurance Authority and other regulatory authorities. Prudential plc is not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc. A company incorporated in the United Kingdom.

Comments (0)