Lisa Ameera Azman

24th August 2022 - 3 min read

Having a cash injection may be helpful when there are certain goals you’d like to achieve that require an initial investment. While there are many financial institutions that offer personal financing in large amounts, perhaps what you’re looking for is a smaller fund, or in other words, microfinancing.

While there are a number of financing choices available in the market, Emicro is an option that those interested can consider applying for.

What is Emicro?

Emicro i-Financing is certified by a Shariah advisory registered and licensed by the Securities Commission of Malaysia, to provide services in Shariah advisory and consultancy works.

The financing solution provided by Emicro is designed to be quick, accessible, and simple. It is Shariah-compliant and based on the concept of Tawarruq. Let’s dive deeper into what Emicro personal financing really looks like.

Shariah Compliant Micro-Financing Facility To Help You Get Started

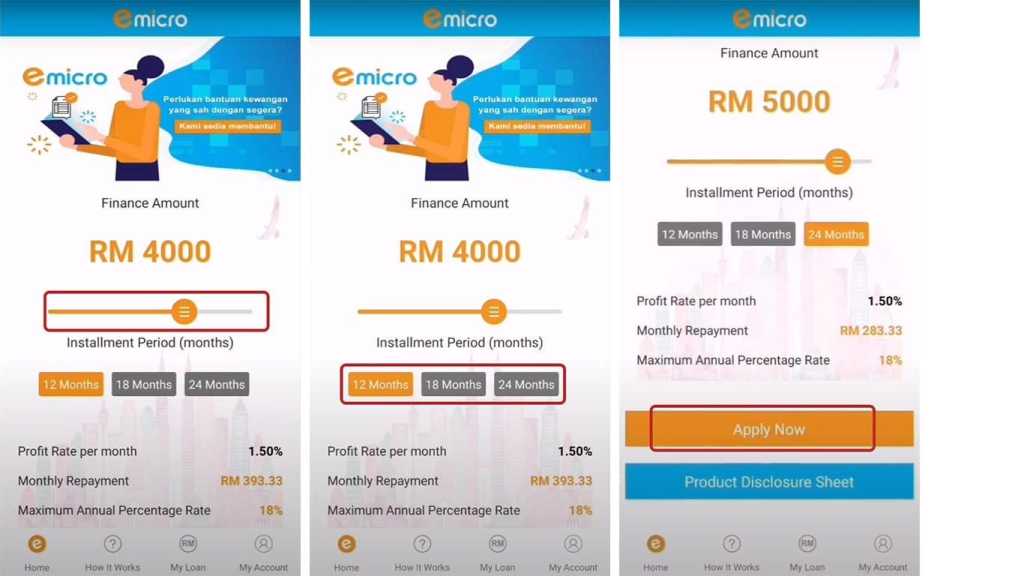

Whether you decide to pursue your education or kickstart your business, Emicro offers a financing amount of up to RM10,000. Depending on how much you apply, the payment tenure could last anywhere from 3 months to a maximum of 24 months.

If all you need is an initial RM5,000 to start that online business you’ve been thinking about, you can apply for just that. Plus, the fast disbursement means you can get the ball rolling in a shorter amount of time. This is especially helpful if the amount you’re looking for is lower than the minimum financing amount of other products in the market.

On top of that, the financing has a fixed profit rate of as low as 1.5% a month. Since the profit rate is predetermined, applicants will not have to worry about any unexpected or potential increases throughout their tenure.

Simple Online Application Process

One of the big advantages of applying for Emicro’s Shariah-compliant micro-financing facility is its easy application process. As the product is web and mobile-based, there is absolutely no need for face-to-face interaction. That means you won’t have to drive around the block multiple times to search for parking, navigate your way through an unfamiliar neighbourhood, or worry about making an appointment.

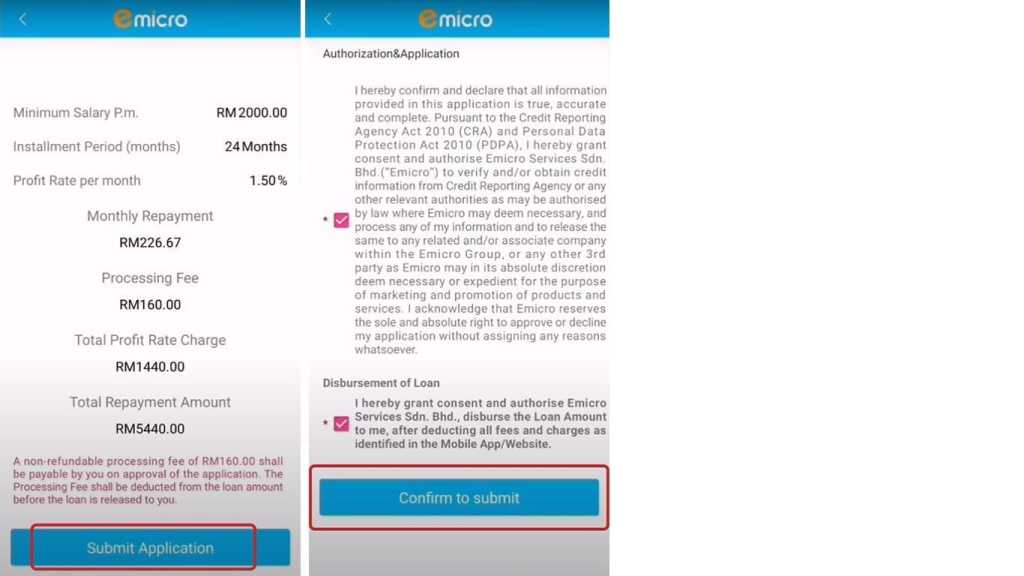

With a few documents and a digital signature, applicants can apply for and receive Emicro i-Financing from the comfort of their homes.

Conveniently Quick

While the fully-online application process certainly makes it convenient, Emicro i-Financing is also speedy. If an applicant submits their application during business hours, they may even receive their financing within the same day. This is because Emicro has a fast approval process where disbursements may be ready in as quick as 6 hours.

***

For those who may be wary, as mentioned above, Emicro is licensed by the ministry. Regardless of the amount of financing you apply for, rest assured that this product is legal and the provider is registered via SSM.

If you’re interested in applying for a Shariah compliant micro-financing facility, consider Emicro. The application process is fully online and promises fast approval in as quick as 6 hours. The documents required are standard, such as MyKad, the latest utility bill, and salary slip. All you need to do is download the user-friendly app or visit the website, and apply online with your details.

Download the Emicro Loan app today or visit the website to learn more.

The contents of this article do not constitute financial advice. Readers should conduct their own research before making a financial decision.

Comments (0)