Jasen Lee

29th July 2024 - 9 min read

Artificial Intelligence (“AI”) is arguably one of the most important technological advancements in our generation. Thanks to accelerated developments in hardware that enable more complex AI processing, we now have Machine Learning, Neural Networks, and Large Language Models (“LLM”) that are not only capable of processing vast amounts of data, but also able to adapt and improve over time.

For instance, the public release of ChatGPT by OpenAI showcased to the world for the first time just how transformative AI can be, thanks to its ability to utilise “transformer-based machine learning” to analyse vast datasets and understand complex human language patterns, contexts, and nuances. Further, with the recent announcement of its latest flagship model, “GPT-4o”, ChatGPT’s recognition and cognitive capabilities will be elevated to even greater heights with its upgraded function that even allows users to interact with the AI-powered language model through video in real-time.

With AI technologies continuing to rapidly advance, it is becoming clear that we are now at the inflexion point where AI is revolutionising industries of all kinds around the globe.

As investors, the rapid progression of AI will not have gone unnoticed – but not many may understand how far-reaching the “AI investment theme” may be. There are various layers when it comes to the global AI market, and this article will attempt to share a glimpse of how different companies and industries may benefit from their exposure to AI.

Unveiling The Investment Potential In AI

The expansive AI value chain presents compelling opportunities for growth and innovation. This diverse ecosystem, spanning from software development to hardware manufacturing to cybersecurity and even utilities, offers substantial opportunities for investors looking to capitalise on the transformative impacts of AI into their investment portfolio.

Let’s take some easy examples of how AI is already positively impacting our daily lives. Video streaming platforms like YouTube and Netflix use AI algorithms to offer personalised recommendations for TV shows, movies, and videos based on a user’s viewing history. Apps like TikTok, Facebook, and Instagram work the same way, too. You would also have seen the recent launch of Tesla Electric Vehicles (“EV”) in Malaysia, which is much vaunted for its Autopilot system that includes a Full Self Drive (“FSD”) function that, again, is built on algorithms developed using thousands of hours of traffic data and enhanced with machine learning.

Beyond that, AI is also playing its role in creating a better world. In healthcare, AI-driven algorithms analyse extensive amounts of data to predict patient outcomes, help with treatment plans, and support medical research, thanks to the ability to conduct accelerated data analysis. Factories around the world are also leveraging AI to enhance manufacturing efficiency, while in agriculture, AI has been used in practices such as crop health monitoring and pest detection.

Despite all of these advancements, the mind-blowing fact is that AI capabilities will only continue to improve with greater adoption due to its inherent machine learning feature and capacity to leverage on big data. As such, one can expect AI to further improve industries, driving greater innovation, efficiency, and new business models. This also means we may only be seeing the start of the AI revolution for investors, making it a compelling long-term investment opportunity for the next decade and beyond.

However, this then leads to an important question: with so many companies and industries across the AI value chain, how exactly should we invest to capitalise on the AI trend? That’s where investing in a unit trust fund with a focus on AI, such as the RHB Global Artificial Intelligence Fund, comes into play.

Invest In AI Through RHB Global Artificial Intelligence Fund

The RHB Global Artificial Intelligence Fund is a unit trust fund managed by RHB Asset Management Sdn Bhd (“RHBAM”), strategically designed to help investors achieve long-term capital growth by investing in a target fund that builds a portfolio comprised of AI-advancing companies with exposure to various industries.

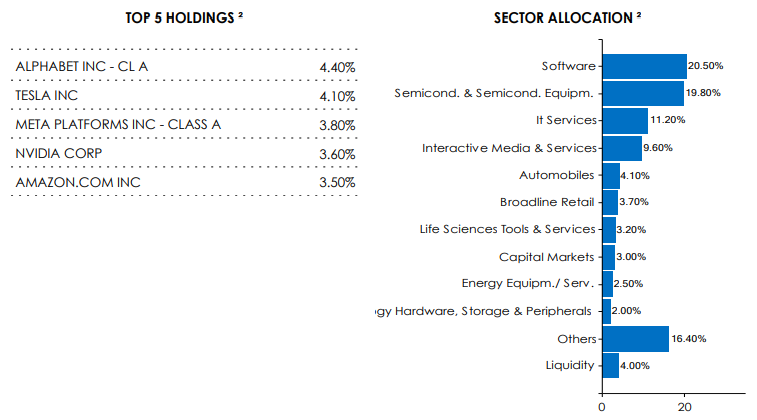

Source: RHB Global Artificial Intelligence Fund Fact Sheet (May 2024), RHB Asset Management Sdn Bhd.

As shown in the diagram above, the RHB Global Artificial Intelligence Fund maintains a sector allocation that spans multiple industries critical to AI development, including semiconductors and semiconductor equipment, software, IT services, and more. The fund’s top holdings, which include leading global companies such as NVIDIA Corp, Tesla Inc, Alphabet Inc, Meta Platforms Inc, and Amazon.com Inc, exemplify its strategic investments in major firms that are at the forefront of AI innovation and application across different fields. With this strategy, the fund manages short-term risk and volatility while maintaining diversified exposure across the AI value chain.

These allocations reflect the fund’s comprehensive and long-term approach to investing in AI technologies across a broad spectrum of industries, ensuring exposure to all areas where AI is expected to make a significant impact. Hence, through a single investment alone in RHB Global Artificial Intelligence Fund, investors have the opportunity to gain comprehensive exposure to the entire AI value chain and benefit from active management by an experienced investment team.

You can invest in the RHB Global Artificial Intelligence Fund and many other funds from RHB Asset Management via the RHBAM MyInvest Online Platform. It is a one-stop platform that is easy and convenient to use, allowing you to manage your investments anytime, anywhere, coupled with powerful tools and market insights that empower your investment journey.

***

Investing in the AI industry represents a unique opportunity for investors looking for long-term wealth creation, given its transformative impact across various sectors across the globe. The RHB Global Artificial Intelligence Fund offers a strategic avenue where investors can tap into the comprehensive AI value chain and capitalise on its growth.

Ready to embark on this innovative journey? From 15 July 2024 to 30 September 2024, pay 0% sales charge when you invest in the RHB Global Artificial Intelligence Fund through the RHBAM MyInvest Online Platform and stand a chance to win the latest Apple iPhone Pro Max. Terms & Conditions apply.

Click here and visit the RHBAM MyInvest Online Platform to find out more.

This article is brought to you by RHB Asset Management Sdn Bhd.

Disclaimer:

This is an advertisement.

The information provided herein is not intended for general circulation but for discussion purposes only. It does not take into account the specific investment objectives, financial situations or particular needs of any particular person. This does not constitute an offer, solicitation or recommendation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy. Information contained herein should not be relied upon when making investment decisions. You should seek independent legal or tax advice before making any investment decisions. Investments are subject to investment risks, including the possible loss of the principal amount invested. Value of the investments and the income, if any, may fall or rise.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by RHB Asset Management Sdn Bhd (“RHBAM”) and it should not be relied upon as such. RHBAM does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. RHBAM shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. The information provided herein is based on certain assumptions, information and conditions available as at the date of this advertisement and may be subject to change at any time without notice.

Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. RHBAM does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. The contents hereof may not be reproduced or disseminated in whole or in part without RHBAM’s written consent.

The distribution of this advertisement may be restricted in certain other jurisdictions. The above information is for general guidance only and it is the responsibility of any persons in possession of this advertisement to observe all applicable laws and regulations of any relevant jurisdictions.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Global Artificial Intelligence Fund (“Fund”) is available and investors have the right to request for a PHS. Investors are able to download it from RHB Asset Management Sdn Bhd (“RHBAM”)’s website. Investors are advised to obtain, read and understand the contents of the PHS and Prospectus dated 01 July 2024 and its supplementary(ies) (if any) (“collectively known as the Prospectus”) before investing.

The Prospectus has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval or authorization, or the registration of the Prospectus should not be taken to indicate that the SC has recommended or endorsed the fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. You should understand the risks involved, compare and consider the fees, charges, and costs, make your own risk assessment and seek professional advice where necessary. Any issue of units to which the Prospectus relates will only be made on receipt of a form of application referred to in the Prospectus. Further, there can be no guarantee that any investment objectives will be achieved. This is not an offer or solicitation, nor is it a tax or legal advice. Investors should not make an investment decision based solely on this advertisement.

The Manager wishes to highlight there are specific risks and other general risks of the Fund. These risks are elaborated in the Prospectus.

This advertisement has not been reviewed by the Securities Commission Malaysia.

For more information, please visit https://rhbgroup.com/myinvest or obtain any fund’s documents from any of our branches or authorized distributors.

Comments (0)