Iman Aminuddin

27th May 2015 - 3 min read

If you have a vehicle you don’t use as much, whether it’s for occasional errands or short commutes, Toyota’s “Drive Less, Pay Less” (DLPL) programme rewards low-mileage drivers with cashback of up to 30% on the annual vehicle insurance/takaful premium coverage. This helps reduce your vehicle’s protection costs while encouraging more sustainable driving habits, all in line with Toyota’s commitment to Environmental, Social, and Governance (ESG) goals.

Unlocking Savings With Smart Car Protection

As one of the key benefits of the detariffication of motor insurance/takaful in Malaysia back in 2017, general insurance and takaful companies have leveraged on smart technology to create innovative policies that add value to the vehicle owner. Toyota’s DLPL is one such product, developed in collaboration with Etiqa.

Vehicles protected by DLPL will have both the Vehicle Telematics System (VTS) and Global Data Communication Module (GDCM) installed, allowing Toyota to accurately track the distance driven in the car—and reward vehicle owners when the vehicle is driven for less than 15,000km in a year.

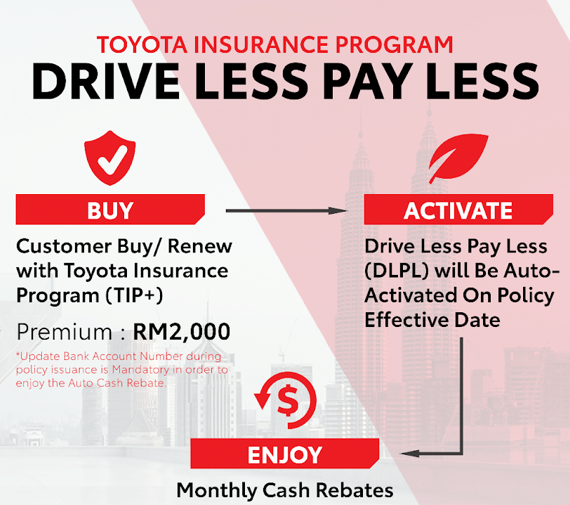

Moreover, Toyota owners can seamlessly enjoy the benefits of the DLPL programme by simply purchasing or renewing their insurance/takaful under the Toyota Insurance Program (TIP+). This means that drivers are automatically enrolled in the programme without the hassle of having to opt in to the programme or applying through a third-party insurance or takaful operator.

Monthly Cashback Breakdown

The DLPL initiative offers a structured cashback system that rewards drivers based on their monthly mileage.

For example, if the premium/contribution is RM2,000, the monthly cashback is broken down as follows:

- RM16 cashback for driving less than 1,302 KM/month

- RM33 cashback for driving less than 868 KM/month

- RM50 cashback for driving less than 434 KM/month

These cashback amounts are automatically calculated at the end of each month and credited to the vehicle owner’s bank account within 10 working days. However, it’s important to note that if the vehicle’s annual mileage exceeds 15,000 KM, the driver will not be eligible for any cashback under the DLPL programme.

Annual Savings Potential

Over the span of a year, vehicle owners can save a substantial amount with Toyota DLPL, making this plan highly appealing for low-mileage vehicles:

These savings can accumulate significantly throughout the lifetime of the vehicle, allowing owners to save on the vehicle’s insurance/takaful costs.

***

As technology advances, insurance/takaful operators are leveraging telematics and other innovative solutions to tailor premiums/contributions based on individual driving behaviour. This shift not only promotes safer driving but also empowers consumers to choose lower-priced options that were previously unavailable.

For drivers who use their vehicles sparingly—whether as a second car or for work commutes—the DLPL programme provides an easy way to save on insurance/takaful costs. With automatic cashback and seamless enrolment, it’s a simple and efficient solution for low-mileage drivers looking to reduce their vehicle insurance/takaful expenses.

To learn more about how you can benefit from the Drive Less, Pay Less initiative, visit your nearest Toyota showroom, speak with a Sales Advisor, or contact the Toyota Call Centre at 1-800-8-869682! Click here to find a Toyota dealer near you.

Comments (0)