Alex Cheong Pui Yin

17th August 2023 - 3 min read

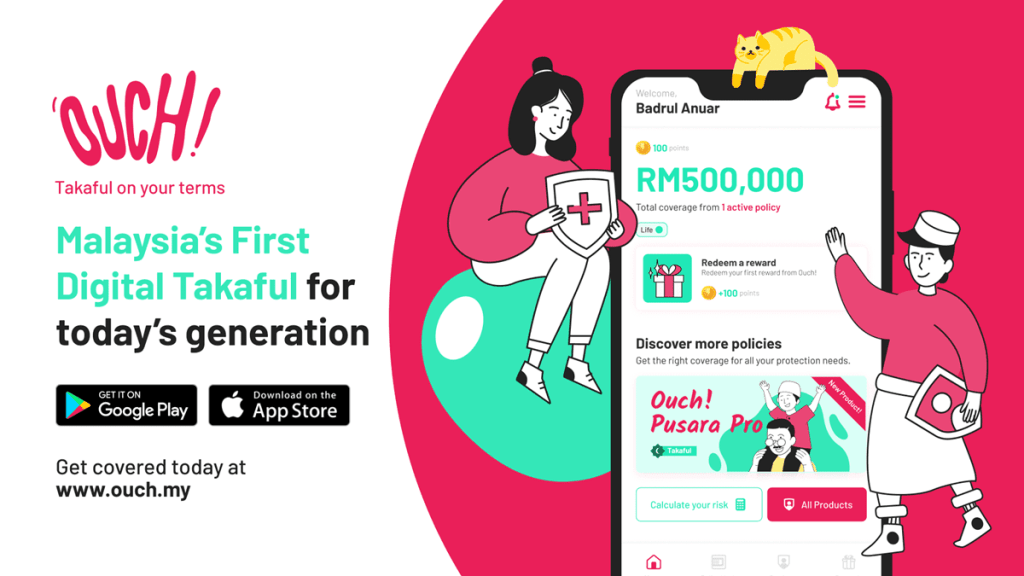

Homegrown insurtech platform Ouch! has launched its first digital takaful offering called Pusara Pro, a term life product that provides policyholders with a death benefit of up to RM500,000, and an additional 10% compassionate benefit of the total sum assured in the event of death. With this, Ouch! also formally debuts as the first digital takaful operator in Bank Negara Malaysia’s (BNM) Regulatory Sandbox programme.

Specifically, individuals who are insured under Pusara Pro will be entitled to the following benefits:

| Benefits | Details | Amount |

| Death benefit | – 100% of sum assured (paid within 7 days once documents are verified) | – Minimum RM50,000 – Maximum RM500,000 |

| Compassionate benefit | – Additional 10% of sum assured (paid within 24 hours once documents are verified) | – Minimum RM5,000 – Maximum RM50,000 |

In particular, Ouch! stressed that its 24-hour compassionate benefit claims payout is a unique offering and a record first in Malaysia across both conventional insurance and takaful markets. This is as most insurers will take longer to disburse such payments.

“As an insurtech platform looking to shake up the insurance or takaful space, we are determined to eliminate one of the industry’s greatest hurdles: the claims experience and processing time. The swift 24-hour turnaround for compassionate claims is our commitment to our participants so that we can help provide crucial financial support for families during the incredibly challenging, immediate aftermath of losing a loved one,” said the chief executive officer of Ouch!, Shazy Noorazman.

Meanwhile, the contribution that has to be paid will vary for each policyholder, depending on their sum assured, gender, and age – and the amount may start from as low as RM4.13 per month. 20% of your contribution will be deducted upfront for management expenses (wakalah fee), while the remaining 80% will be parked into the community pool as tabarru’.

Ouch! further noted that it is able to maintain an estimated 20% lower contribution rate than the market average by leveraging on technology and eliminating middleman costs. As such, this makes Pusara Pro a suitable and cost-effective option for young Malaysians, many of whom are uninsured or underinsured.

Furthermore, Ouch! endeavoured to make its product more approachable by eliminating jargons and simplifying the overall application process; individuals are only required to answer four health underwriting questions to purchase Pusara Pro. In fact, Ouch! said that interested individuals can complete the process and get their protection in less than 10 minutes. Note that you can only own one Pusara Pro takaful certificate at one time.

To find out more about or purchase Pusara Pro, go ahead and download the Ouch! mobile app from Google Play or the App Store. The app also makes it convenient to submit your claims in the event of any unfortunate events. Aside from policy management, Ouch! hopes to eventually include more functions in its app, including educational tools, lifestyle rewards features, a coverage calculator, as well as a referral programme.

(Source: Ouch!)

Comments (0)