Alex Cheong Pui Yin

31st October 2022 - 6 min read

In my last column, I shared some thoughts on some key details about retirement planning, such as how much you actually need in order to retire, as well as what you can do to grow your retirement savings. This time round, I’d like to dedicate this column to discussing several common misconceptions that people have about retirement planning.

As we all know, the key objective of retirement planning is to ensure that you have financial security to be able to enjoy your golden years, instead of having to constantly worry about how to pay for your needs. This is especially important now that Malaysians have a longer life expectancy as compared to before; the Department of Statistics Malaysia (DOSM) noted that male and female youths (aged 15 in 2021) are expected to live until the age of 73.9 years and 79 years, respectively. This is an increase of one to one and a half years in life expectancy as compared to a decade ago.

Given the importance of retirement planning, let’s start by debunking some key misconceptions that Malaysians often have with regard to the matter.

I’m still young, I’ve got plenty of time!

People often think that they still have time before they get to the age where they need to worry about saving for a nest egg.

Well, I’m here to say that it’s always better to start young. When you’re young, you have a higher likelihood of generating additional return and making compounding interest work for you. For those who aren’t aware, compounding interest is basically the interest that you can earn on a deposit, accrued on both the initial principal and the accumulated interest from previous periods (aka interest on interest).

This means that you can actually earn quite a bit via compounding interest – if you start saving or investing early – and it is also why it is important for you to think about retirement planning now.

I’m too old, what’s the point?

On the other end of the continuum, there are also those who think that they’re too old to do any planning for retirement, having hit the age of 40s or 50s.

“I’m already reaching the age where I can withdraw my Employees Provident Fund (EPF) anyway – there’s nothing that I can do about retirement planning anymore.“

Quite untrue! In such a situation, the goal of retirement planning then is to ensure that you can generate consistent funds to last you through your golden years, or to stretch out the value of your savings. At the very least, it is important to know how much you need to live on once you’re in your retirement days, as we tend to overestimate and think that what we have is more than enough for our retirement.

I’ve parked all my retirement savings in fixed deposit (FD) accounts.

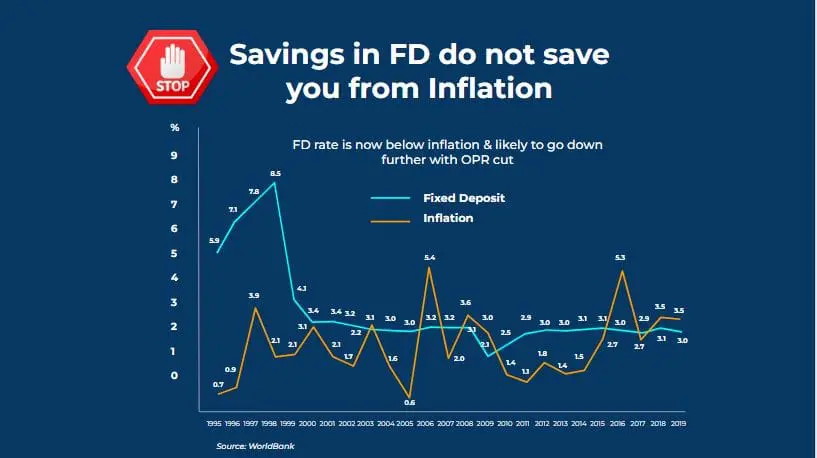

The third misconception revolves around the placement of your retirement funds, where most people think that it is sufficient to just park their savings in a savings account or FD account. Unfortunately, that’s not the case. The returns from your savings and FD accounts are lower than the inflation rate that we see today, as is clearly shown in the graph below:

As such, you’ll have to look at other asset classes beyond your savings and FD accounts to give you that return for your retirement. Some instruments that you could also consider in your retirement planning strategy include bonds, equities, money market funds, real estate investment trusts (REIT), and so on.

I’ve worked hard, I deserve to spend it now.

This is an issue of delayed versus instant gratification – you’ve worked hard to earn your money, so why should you not enjoy what you have reaped now?

My stance is that you can enjoy your hard-earned money now, but it’s also crucial for you to allocate a portion of it for retirement. Approximately 10% to 20% of your income today should go to your retirement funds, making for a good balance for your spending at present, as well as for your future. And note that this 10% to 20% for your retirement should not include the amount already credited to your EPF savings – precisely because of my very next point.

I’ve got my EPF savings for my retirement.

There’s no way around it: EPF savings is just not enough to take care of your retirement needs. As our RinggitPlus Malaysian Financial Literacy Survey 2021 has shown, more Malaysians are now aware this fact; in fact, only 15% of our respondents believe that their EPF savings is sufficient for their retirement. Therefore, you have to think of additional funds to supplement your EPF savings if you wish to enjoy a comfortable retirement.

I need to prioritise my child’s education fund.

Oftentimes, parents may prioritise their children’s education fund, hoping that their children will then be able to take care of them in their retirement days after landing a good job through quality education. However, this may not be the best way forward because there’s no promise over the outcome of your children’s education resulting in higher income.

In fact, if you look at the average starting salary for most graduates in Malaysia, it’s not very substantial. It may not be enough to support both your child’s needs as well as your retirement needs – which is why having your own retirement fund is crucial.

I must know EVERYTHING about investing and retirement planning.

Finally, I believe that while you should have an adequate grasp of investing or retirement planning before making any decisions, you do not need to know all the ins and outs of everything in order to start taking action. If you make it a necessity to know everything about investing before taking a step, you may never start investing at all. As such, do your best to arm yourself with as much knowledge as you can, and then start the ball rolling.

***

Of course, this list only highlights some of the main misconceptions that people can have about retirement planning; there are likely many more out there. But now that you’re better informed about how important it is to start early, I hope you’re ready to take the first step to grow your retirement savings – as I’ve advised in my previous column. More importantly, share your knowledge with your loved ones so that they, too, can secure their future!

As always, catch my full discussion on the topic of retirement planning here:

This article was contributed by Azril Ikram, a licensed financial planner. To get deeper insights on your personal financial goals, check out RinggitPlus Financial Planner, a 1-to-1 financial planning service. RinggitPlus Financial Planner covers everything from tax efficiency all the way down to wealth planning and retirement savings.

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (1)

thank you