Eloise Lau

16th January 2026 - 5 min read

Chinese New Year is traditionally a time to clear out the old and make space for the new physically, mentally, and financially. We clean our homes, organise our cupboards, and get rid of things we no longer need, all in the hope of starting the year on a better footing.

Yet one area often escapes scrutiny: recurring digital subscriptions quietly charging our cards and e-wallets every month.

From apps used once and forgotten to services bundled into old promotions, unused subscriptions can easily cost Malaysians RM1,000 to RM2,000 a year without delivering any real value. In most cases, a focused 30-minute audit is enough to uncover and cancel the majority of these charges.

Before we gallop into the year of the Horse, take 30 minutes to uncover forgotten subscriptions and reclaim money from your account.

Step 1: Review App Store and E-Wallet Subscriptions

Small recurring charges are easy to overlook. RM5.90 or RM12.90 a month does not feel significant until you add them up over a year.

Start with your app stores:

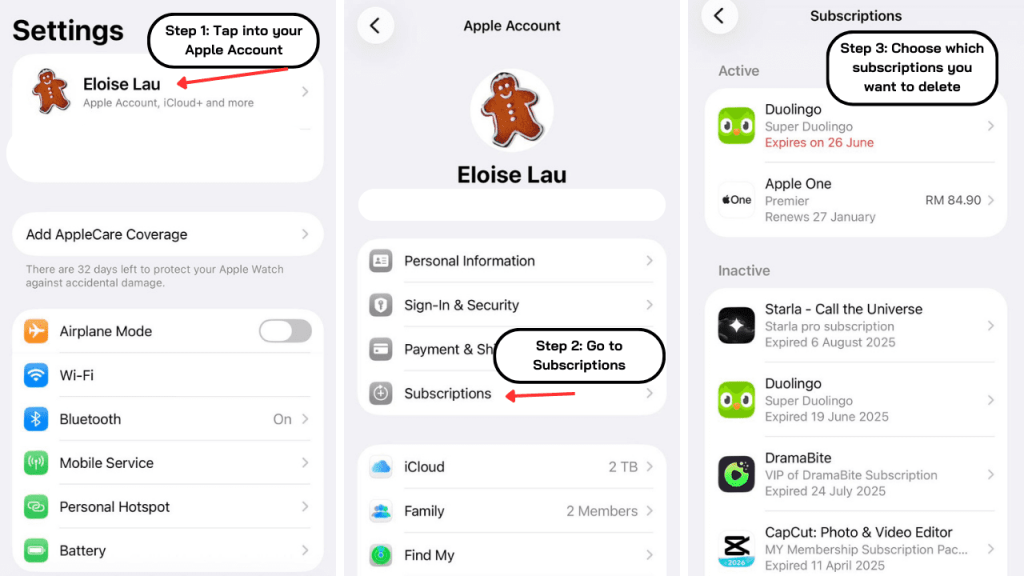

iPhone users: Settings > Apple ID > Subscriptions

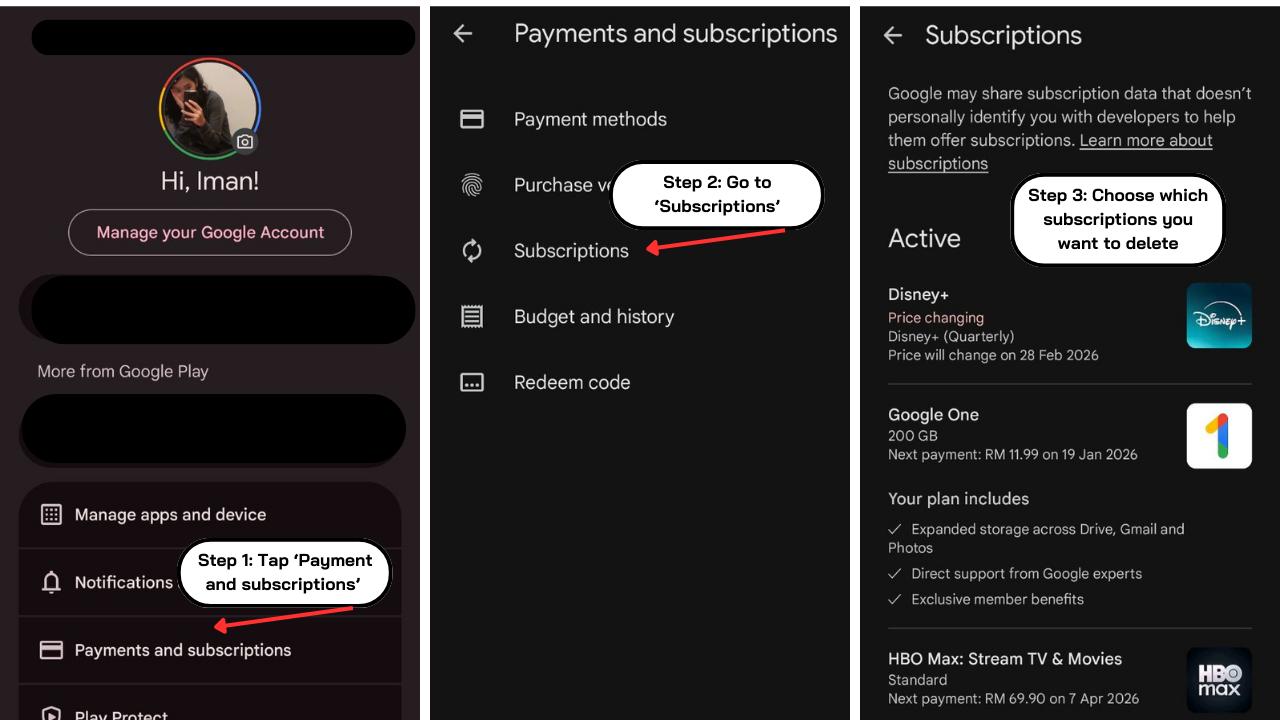

Android users: Google Play > Payments & Subscriptions > Subscriptions

Look for subscriptions you no longer recognise or actively use. These often include cloud storage upgrades purchased to back up old photos, productivity or photo-editing apps subscribed to for one-off projects, and fitness or tracking apps linked to devices you no longer own.

Next, check your e-wallets:

Touch ’n Go eWallet: Settings > Auto Debit

GrabPay: Finance > Gear Icon > All Payment Methods > Linked Accounts

Here, you may find recurring donations set up during past campaigns, or auto-reload features for games and services you no longer use. Because these charges are often small, they may never trigger alerts or stand out in transaction histories. Cancel anything you are confident you will not use in the coming month.

Step 2: Check Bank and Card Recurring Payments

Log in to your primary banking app and look for recurring payment or card authorisation settings:

- Maybank MAE: Card > Manage Recurring Payments

- CIMB OCTO: Cards > Recurring Payments

Other banks offer similar features under card or payment settings

This section shows merchants authorised to charge your card automatically. Many will be legitimate, such as insurance premiums or gym memberships. Others may be less obvious.

Pay close attention to lifestyle or digital add-ons attached to your card years ago, premium SMS or content services subscribed to unintentionally, and extended warranties or memberships that renew automatically without obvious reminders.

Review at least the past three months of your credit card statements as well. Subscription services often appear under unfamiliar billing names, making them easy to miss. A RM29.90 monthly charge may not raise alarms, but over a year, that is RM358.80 spent on something you may not even remember signing up for.

Step 3: Decide What to Keep, Cancel, or Rotate

Once you have removed subscriptions you clearly do not use, assess the ones that remain.

Ask a simple question: Does this service provide clear, regular value?

Instead of keeping every service year-round, consider rotating your subscriptions based on what you actually watch. Many households subscribe to multiple streaming platforms such as Netflix, Disney Hotstar, and Amazon Prime Video, but actively use only one or two at a time. Keep the service you are currently using, cancel the others, and resubscribe only when there is a show or movie you want to watch. This approach allows you to enjoy all the content you want without paying for multiple services simultaneously, and ensures your subscription spending delivers real value.

Before cancelling anything, check whether the subscription is already bundled with an existing service. Some streaming or digital subscriptions are included with Unifi Home plans, CelcomDigi or Maxis postpaid packages, or promotional banking and credit card offers. You may be paying for a service that is already available to you at no extra cost.

How Much Could You Save?

A realistic subscription cleanup might look like this:

| Subscription | Monthly Cost | Annual Cost |

| iCloud storage upgrade (Apple) | RM12.90 | RM154.80 |

| Mobile game auto top-up (e.g., Mobile Legends, Free Fire) | RM19.90 | RM238.80 |

| Digital magazine subscription (e.g., The Edge, Tatler Malaysia) | RM29.90 | RM358.80 |

| Second streaming service (e.g., Disney+ Hotstar or Amazon Prime Video) | RM44.90 | RM538.80 |

| Unused gym membership (e.g., Fitness First, Celebrity Fitness) | RM89.00 | RM1,068.00 |

Total | RM196.60 | RM2,359.20 |

That is over RM2,300 freed up for money that could go towards festive expenses, travel, or building an emergency fund. In many cases, these savings exceed what most people manage through weeks of cutting daily expenses.

Before You Close Your Banking App

Once your audit is complete, set a calendar reminder to repeat the process every six months. Where possible, turn off auto-renewal for new subscriptions so you receive a prompt before trials end, and lower your SMS or app notification threshold to flag even small recurring charges as they happen.

Think of the money you’ve reclaimed as a big ang pow to yourself! The savings you free up can go toward festive treats, family gatherings, or starting the year on a stronger financial footing. Thirty minutes of effort now can put RM2,000 or more back in your pocket over the year, making this a simple yet meaningful way to prepare for the Year of the Horse.

Keep an eye out for more festive content in the coming weeks. We’ll be sharing Chinese zodiac wealth predictions, Ang Pow reviews and digital Angpow options to Raya buffet promotions. Stay tuned!

Don’t Miss Out! Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)