Eloise Lau

13th November 2025 - 6 min read

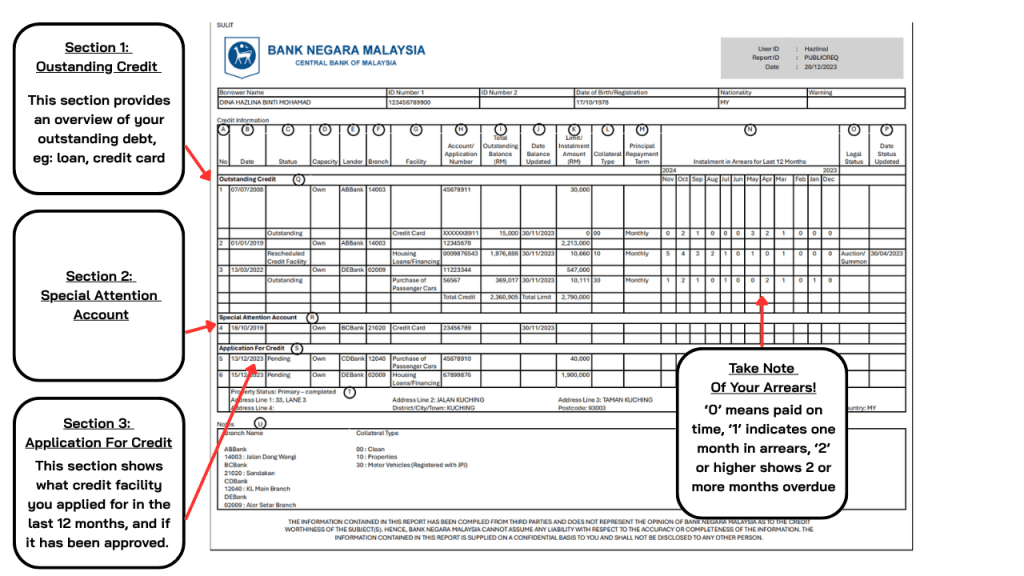

Before applying for a housing loan, car loan, or credit card, you need to know what banks will see when they check your credit history. In Malaysia, lenders rely heavily on the CCRIS (Central Credit Reference Information System) report managed by Bank Negara Malaysia.

Checking your own CCRIS report helps you spot reporting errors before they lead to a loan rejection. The process is now free and can be done entirely online.

What Is The Difference Between CCRIS And A Credit Score?

The CCRIS report and credit scores serve different purposes.

CCRIS Report: A factual data report managed by Bank Negara Malaysia with no “score” attached. It displays your loan and repayment history from banks over the past 12 months, covering outstanding loans, credit limits, payment behaviour, and new credit applications.

Credit Score: A 3-digit number (300-850) generated by private Credit Reporting Agencies like CTOS and Experian. These agencies calculate this score by analysing your CCRIS data alongside other information from legal records and utility bill payments.

The CCRIS report is raw data from financial institutions. A credit score is a grade assigned by a private company based on that data. Most lenders will check both your CCRIS report and your credit score when assessing your application.

How To Check Your CCRIS Report Online For Free

Bank Negara Malaysia provides a secure online portal called eCCRIS for Malaysians to access their own credit reports.

To register for the first time, visit eccris.bnm.gov.my and click “Register Now”. You’ll need to fill in your personal information, including your full name, MyKad number, date of birth, mobile number, and email address. The system requires digital authentication, which means performing a one-off RM1.00 transfer from your internet banking account to a designated Bank Negara Malaysia account. This is a security measure, and the RM1 will be refunded to you within two working days.

After your identity is authenticated, you’ll receive a 6-digit One-Time Password (OTP) on your registered mobile number. Return to the eCCRIS homepage and select “First Time Login”, then enter your MyKad number and the OTP. The system will prompt you to create a permanent User ID, password, and set up your personal security questions. Once this is done, you can access your report anytime by logging into the eCCRIS portal.

After the initial setup, you can view, download, or print your latest CCRIS report whenever you need it.

What CCRIS Records Can Prevent Loan Approval?

Banks review your CCRIS report for evidence of past repayment behaviour. The report shows your payment history for each loan using a numbered system covering the last 12 months. A ‘0’ means payment was made on time, ‘1’ means one month in arrears (one payment missed), ‘2’ means two months in arrears, and so on. A perfect record shows ‘0’ for all months across all your accounts.

Banks look for red flags that suggest you might struggle with repayments. Late payment history raises concerns, even if relatively minor. One or two months showing ‘1’s or ‘2’s will make lenders cautious about approving new credit. Any record showing ‘3’ or higher indicates you’ve missed multiple payments and signals serious repayment problems.

A Special Attention Account classification means the loan is non-performing (NPL), usually because you’ve defaulted on payments for 90 days or more. Accounts under a debt restructuring programme like AKPK (Agensi Kaunseling dan Pengurusan Kredit) also receive this classification, though banks often view restructured debt more positively than an outright default since it shows you’re taking active steps to resolve the situation.

Multiple recent credit applications can also work against you. The report lists every credit application you’ve made in the last 12 months. When banks like Maybank, CIMB, or Public Bank see numerous applications in a short period, they may interpret this as desperate or credit-hungry behaviour, suggesting you’re struggling financially or overextending yourself.

How Do I Dispute Incorrect Information On My CCRIS Report?

If you find an error on your report, like a settled loan still showing an outstanding balance, you need to get it corrected. Bank Negara Malaysia only collects and displays the data it receives; it cannot alter information submitted by banks.

To dispute credit information, such as an incorrect balance or wrong payment status, contact the financial institution that reported the information directly. You’ll need to work with their customer service or complaints unit and provide supporting proof, like a settlement letter or payment receipts. The bank will need to verify your claim and then submit corrected data to Bank Negara Malaysia.

For personal information errors, like a wrong address, you can submit a “Data Verification Request” directly through the eCCRIS portal. Once the financial institution verifies and corrects the error, they’ll send the updated data to BNM in the next reporting cycle.

How Long Does It Take For Cleared Debts To Show As Settled On CCRIS?

The CCRIS system isn’t updated in real-time. Financial institutions submit their data to Bank Negara Malaysia in batches, and all institutions must provide their updated data by the 10th of the following month.

For example, if you fully pay off your car loan on 15 May, the bank has until 10 June to report this “settled” status to CCRIS. Any CCRIS report you pull after mid-June should accurately reflect that the loan is closed. This lag time is worth remembering if you’re planning to apply for new credit shortly after settling an existing loan — you may need to provide additional proof of settlement to the new lender if the CCRIS report hasn’t caught up yet.

Can I Access Someone Else’s CCRIS Report With Their Permission?

No. Your CCRIS report contains highly sensitive personal financial data. Under Malaysian law, the CCRIS report can only be furnished to the owner of the information.

You cannot authorise a third party, whether a family member, friend, or professional advisor, to obtain your report from Bank Negara Malaysia on your behalf. This strict privacy measure protects your financial identity. If someone needs to review your credit history (for example, when helping you with financial planning), you’ll need to download your own report and share it with them directly.

Check Your Report Before Applying For Credit

Regularly checking your CCRIS report through the free eCCRIS portal helps you understand exactly what lenders will see when assessing your applications. Spotting errors early means you can get them corrected before they derail a loan application for your home, car, or business.

Beyond just checking for errors, reviewing your CCRIS report shows you where you stand. If you see late payment markers, you’ll know you need to focus on rebuilding your payment history before applying for major credit. If your report is clean but you’re still getting rejections, the issue might lie with your credit score or other factors like your debt-service ratio.

After reviewing your CCRIS data, consider checking your full credit score with CTOS or Experian to get the complete picture of your credit health. You can also use RinggitPlus comparison tools to compare rates and features before submitting your credit card or financing application.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)