Alex Cheong Pui Yin

15th April 2024 - 4 min read

SeaMoney, the financial services arm of Sea Limited, has partnered with Allianz General Insurance Malaysia to launch a new Travel Insurance, offering comprehensive protection for domestic and international travellers from an affordable price of RM3 and RM10 per day, respectively. It can be purchased conveniently on Shopee, the e-commerce platform owned by Sea Limited.

In a statement, SeaMoney said that policyholders will be able to get up to RM150,000 personal accident coverage, and up to RM165,000 medical coverage, including hospitalisation and Covid-19 protection. These are on top of compensations offered for travel inconveniences that travellers may face during their journeys, such as travel curtailment, travel and luggage delays, and trip cancellations.

Here’s a table to summarise the benefits that you can enjoy via the new Travel Insurance offered on Shopee:

| Categories | Benefits | Sum Insured | |

| Domestic (max coverage period: 30 consecutive days) | Asia & Worldwide (max coverage period: 200 consecutive days) | ||

| Personal accident | Accidental death | RM100,000 | RM150,000 |

| Permanent disabilities due to accident | Up to RM100,000 | Up to RM150,000 | |

| Medical | Medical expenses | Up to RM12,000 | Up to RM150,000 |

| Hospitalisation income | RM100/day (up to RM3,000) | RM350/day (up to RM15,000) | |

| Travel inconveniences | Deposit or trip cancellation | Up to RM1,000 | Up to RM5,000 |

| Travel curtailment | Up to RM1,000 | Up to RM5,000 | |

| Personal luggage or personal effects | Up to RM500 | Up to RM5,000 | |

| Luggage delay (min 6 hours) | RM100 | RM200/six hours (up to RM800) | |

| Travel delay | RM100/six hours (up to RM1,500) | RM300/six hours (up to RM2,000) | |

There are also additional policy riders that you can opt for if you lead a more active lifestyle, including for sports activities, sporting equipment, and high-altitude mountaineering activities.

You can purchase the Travel Insurance plan for up to 10 travellers at one go (as a group), but note that all your purchases must be made at least one day before starting your trip (both domestic and international). Additionally, the main traveller (the person who does the purchasing) must be aged between 18 to 65 years old, while other travellers in the group should be aged between 30 days to 65 years old.

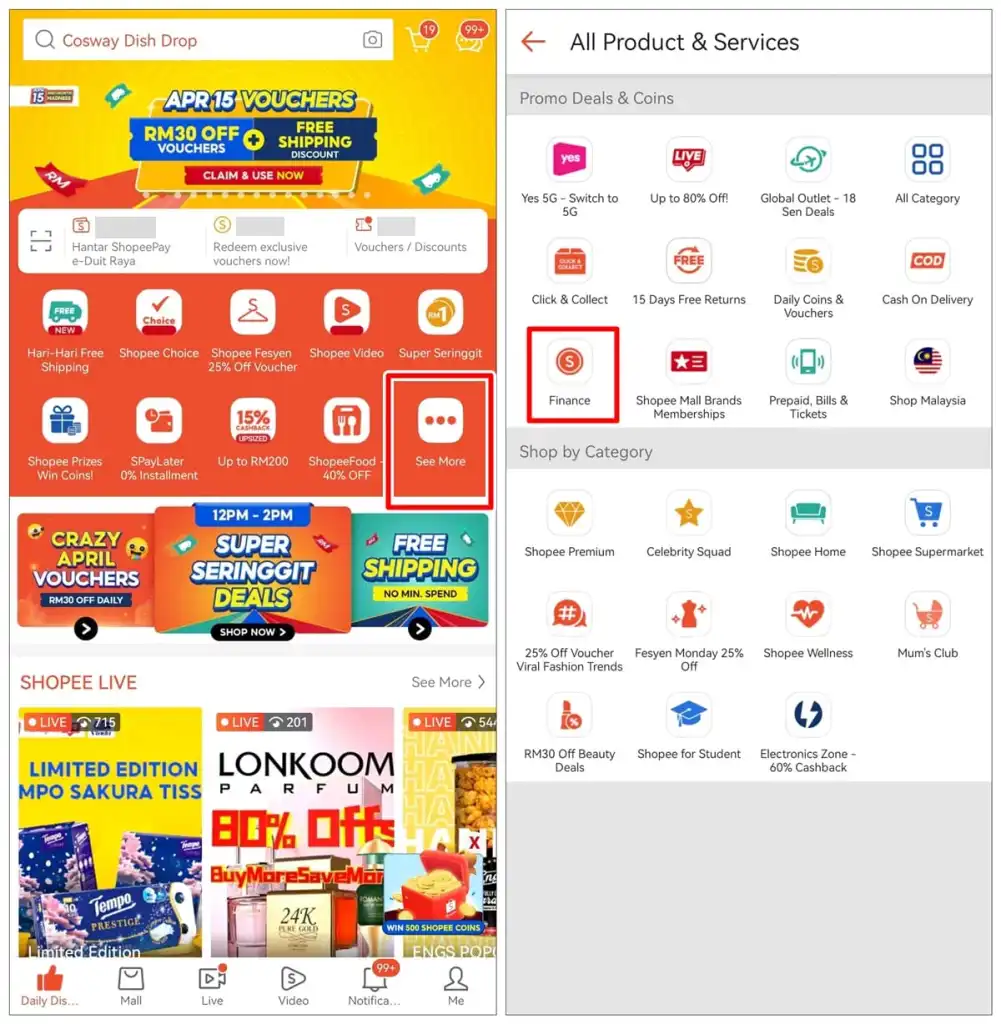

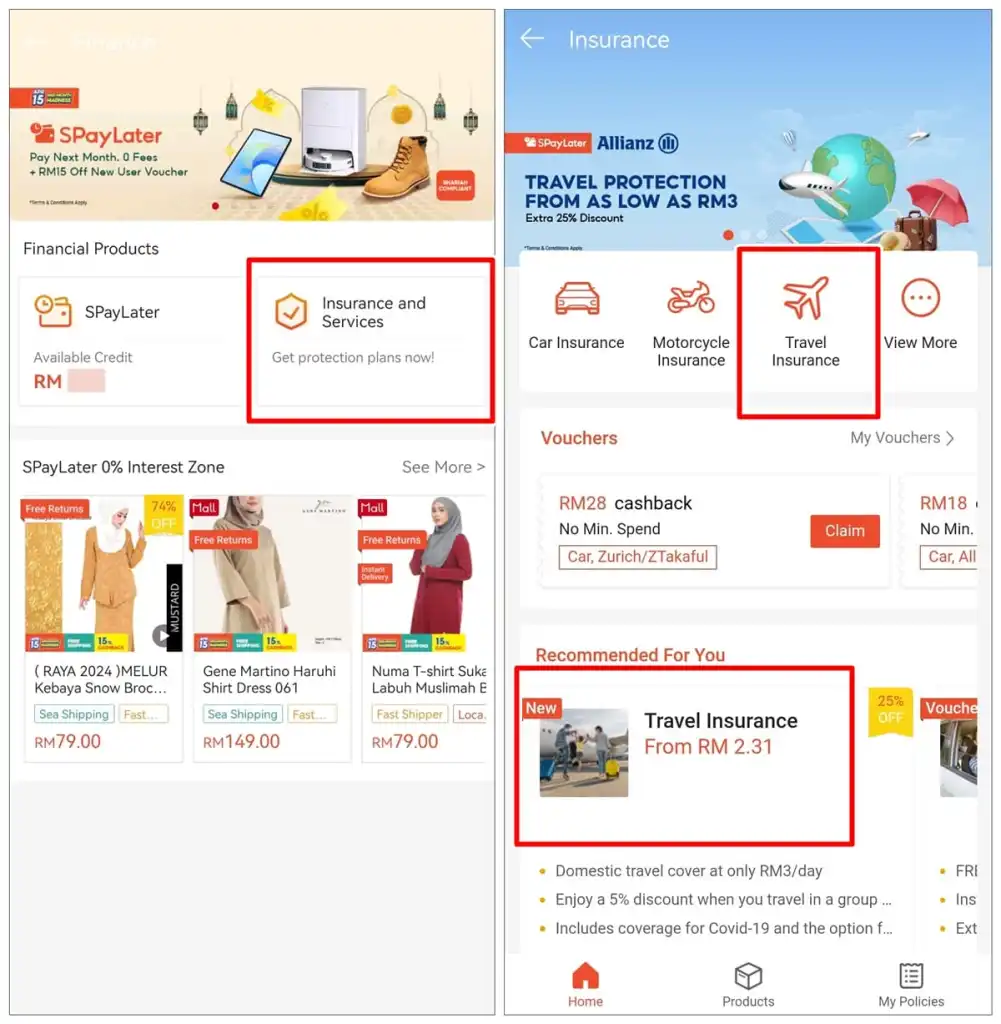

If you’d like to check out the new Travel Insurance on Shopee, simply fire up your app and tap on “See More” on your home screen, followed by “Finance” and “Insurance and Services”. You can then tap on “Travel Insurance” or any of the promo banners to find out more.

Meanwhile, here’s a quick guide on how you can purchase the Travel Insurance plan on Shopee:

If you’d like to view your certificate in your Shopee app, go ahead and tap on “Me” >> “Insurance” >> “Travel Insurance”.

Head of SeaMoney Malaysia, Alain Yee said that the launch of the Travel Insurance is intended to make insurance and protection more easily accessible to Malaysians everywhere. “Travelling has always been something many Malaysians look forward to, cherishing their free time or making the most of the festive seasons and school holidays. By partnering with Allianz, we aimed to make acquiring travel insurance a much simpler process for Malaysians, offering them peace of mind on their trips within just a few clicks,” he said.

Chief executive officer of Allianz General, Sean Wang also echoed a similar sentiment. “Travel insurance has always been an integral yet overlooked form of protection. There are many things that can otherwise spoil what is an enjoyable experience. Through this partnership, we are thrilled to involve more Malaysians in the insurance industry and keep them protected so they can travel worry-free and with full confidence,” he commented.

In conjunction with the launch of the Travel Insurance plan on Shopee, Malaysians can currently tap into a 25% discount on their premiums when they purchase the plan on Shopee. Group travellers who are travelling in groups of five or more can also enjoy a 5% discount per insured person.

Comments (0)