Gavin Pereira

29th April 2016 - 3 min read

Easy Payment Plans are useful to help us save money, especially when you are trying to purchase one of those big ticket items that could cost you a little more than a month or two’s worth of salary.

Sometimes you may already have such a feature on your credit card but not realise it as it goes by a different product name. Why do banks do this? Possibly to differentiate themselves from the competition and portray a unique sense of identity.

Let’s explore EPP in a little more detail before we shed some light on what other banks offer them as well.

What is an Easy Payment Plan (EPP)?

Ultimately, an Easy Payment Plan (EPP) is a credit card feature that allows you to break down your transacted purchases into smaller and more manageable payments over a specific term. The term could range from a minimum of 6 months, all the way up to 36 months which could vary depending on the bank.

If you were a home owner and would like to furnish your house for the upcoming festive season, wouldn’t it be great if you could purchase these items and paid for them over a term? If you had swiped your card for a RM14,000 couch without taking an EPP plan and were unable to pay for it all at once, the gradual build up of interest could substantiate into a huge debt. So why not take advantage of this credit card feature and split the payments so you can entertain guests in comfort and with pride.

You are probably wondering if you owe the bank, there should be some fees or interest involved. Some banks offer this feature with a 0% interest fee which at times could incur a one-time upfront handling fee instead. All of these terms and conditions vary from bank to bank and it is best you do a little bit of research and understand before committing to such a plan.

Does Your Card have an EPP?

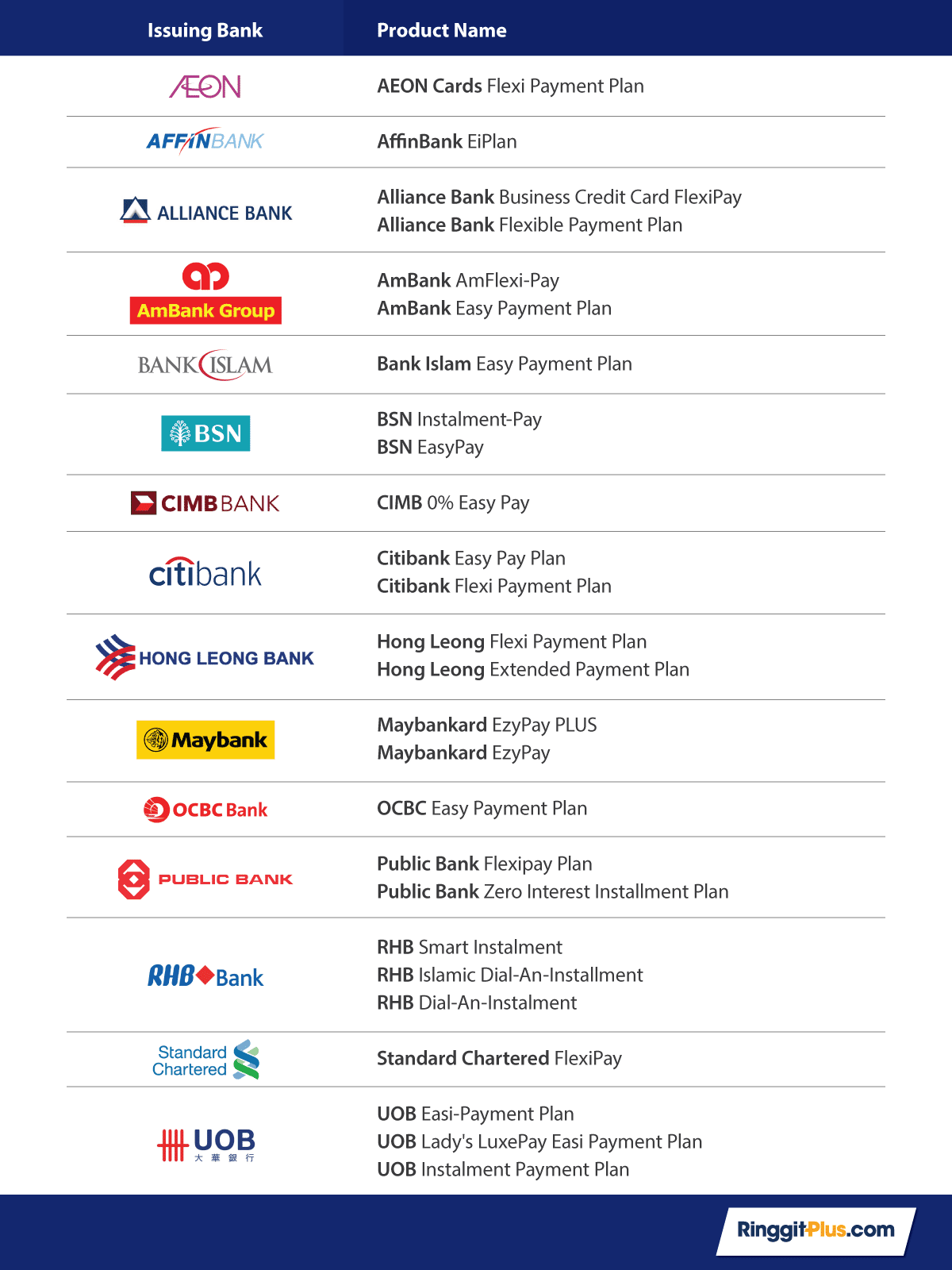

As we mentioned previously, there is a chance your credit card already has this amazing feature but has marketed it in a different name.

The table below has the issuing banks and their many names which are actually Easy Payment Plans.

If by some obscure chance your credit card doesn’t offer you such a service and you would love to add this to your arsenal of financial tools, take a look at the list below and apply for one on Ringgitplus.com

If you have any questions or comments feel free to do so in the section below.

Comments (0)