Ahmad Mudhakkir

4th April 2016 - 1 min read

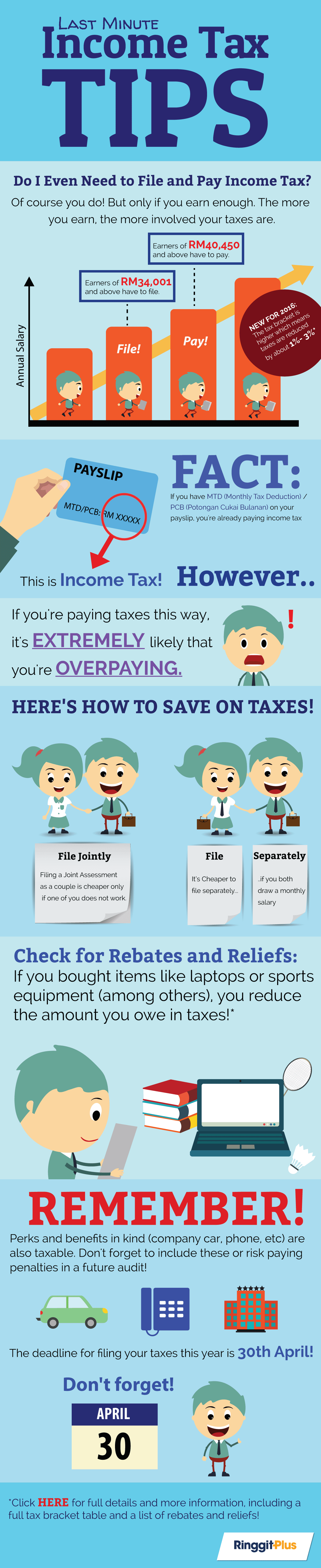

Have you done your income taxes for this year yet? They’re due pretty soon and there’s quite a bit to figure out. But fret not, we’ve compiled an easy-to-read, super-digestible graphical guide to filing your income tax for 2016, including tips and tricks we’ve found that can save your some tax expenses. Read on!

Now you have pretty much everything you need to start filing your income tax like a boss. As we’ve stated in the graphic, you can check out more detailed information on tax brackets, rebates, reliefs, and much more in our in-depth article on how to file your income tax for the year of 2016. File responsibly!

Comments (0)