Hann Liew

31st March 2016 - 17 min read

[UPDATE] We have a newer version of this article, complete with all the new changes for 2017 *right here*!

Whenever the tax season rolls around (that’s 1st March to 30th April), there is inevitably a sense of worry amongst the public because there are many financial, technical and even legal considerations to be taken into account when filing in at Lembaga Hasil Dalam Negeri (LHDN or Hasil) or online.

This guide was written for the January – December 2015 tax year, but we will be sure to update this whenever the Government decides to make any changes throughout 2016. Remember that you file in March/April 2016 for the 2015 calendar year of income and expenses. And without further ado, we present the Income Tax Guide 2016 (for assessment year 2015)!

Malaysia Personal Income Tax Rates

Two key things to remember:

- Tax rates are Progressive, so you only pay the higher rate on the amount above the rate (i.e. you will never have less “net income after tax” by earning more!).

- Tax rates are on Chargeable Income, not salary or total income. Chargeable income is calculated after tax exemptions and tax reliefs (more below).

First off, we start with the table for personal income tax rates in Malaysia for the Assessment Year 2015, so everyone would be able to cross-check the tax bracket and the amount of tax needed to pay.

How Much Do I Have To Earn Before Filing

For most residents of Malaysia, the key figure to take note of is about “RM34,001 per year (after EPF deductions)” which is inclusive of all benefits, allowances, bonuses, overtime and commissions.

If you’re earning anywhere below that figure, then there’s no need for you to open up a file for tax to be deducted from your income (while the con is that you’re probably not earning as much as you’d like, the pro is that there’s less hassle from a tax perspective!).

However, if you do earn above that, you need to have a tax file opened with your income tax automatically deducted from your income (welcome to the world of big money!).

Some extra notes about income tax that you may find interesting:

1) For non-residents of Malaysia (people who have been living in the country for less than 182 days per year), the tax rate has been set at 25% on all the income that has been earned in Malaysia regardless of your citizenship or nationality. However, there are some exceptions to the matter. Certain professions such as public entertainers (15%) as well as those who receive payments for services in connection with the use of property or installation, payments for technical advice and rent (10%) are taxed differently.

2) You may still be overpaying or underpaying on your tax, even if you are a salaried worker or civil servant under a Potongan Cukai Bulanan (PCB), a Monthly/Schedular Tax Deduction (MTD) system or if you are self-employed/own your own business.

What is Chargeable Income in Malaysia?

As mentioned before, the tax rates above are effected on a person’s Chargeable Income (rather than salary or total income, in fact, the amount of the chargeable income is usually much lower). Now I’m sure many of you first-timers may be wondering what your “Chargeable Income” is.

You take the following equation and apply where necessary:

Chargeable Income = Taxable income – Tax exemptions – Tax Reliefs

Check out the example below for a general idea:

You are earning a RM40,000 salary, you have a RM2,000 local bank interest income as well as RM13,000 from property rental income a year. That should bring your chargeable income to RM55,000 correct? Nope, that’s not the way to go about it. Even without taking into account the many tax reliefs available, every taxpayer gets the standard RM9,000 individual tax relief as well as a maximum relief of RM6,000 for EPF contributions. The government has also given an additional special relief of RM2,000 for tax payers earning an aggregate income of up to RM96,000 annually for the 2015 assessment year only.

That means your EPF contribution is calculated at 11% of RM40,000, i.e. RM4,400. Also, while “interest” is taxable income (more on this below), all local bank interest income is tax exempted (lucky us!).

Therefore, your Chargeable Income (by applying the aforementioned formula) will actually be:

RM55,000 – RM2,000 – (RM 9,000 + RM4,400) = RM39,600.

There you have it! A much lower figure than you initially thought it would be!

Taxable Income in Malaysia

Taxable income actually refers to the “base upon which an income tax system imposes tax”. In general, the Lembaga Hasil Dalam Negeri (LHDN) organisation includes all kinds of earnings which the Malaysian taxpayers have to pay for, but which is reduced by expenses and other deductions. Some of them include the following:

1. General Taxable Income

a) Business or Profession

b) Employment

c) Dividends

d) Interest (except bank deposit interest)

e) Discounts

f) Rent

g) Royalties

h) Premiums

i) Pensions

j) Annuities

k) Others

2. Perquisites

Perquisites are taxable benefits that can be converted to cash and are given to an employee from his/her employer.

Examples of which include:

1) Bill Claims

If your employer pays your utility, mobile phone, income tax, road tax or car insurance tax bills for you, then the amounts paid are considered to be perquisites and are taxable.

Example: John’s company pays his RM100 mobile phone bill. Then the amount of RM100 is a perquisite and is taxable

2) Company Credit Card

If your employer provides you with a credit card to make purchases on behalf of the company, but you use that card instead for personal use, then any retail purchases you make including the annual fee of the credit card are considered to be perquisites and are taxable.

Example: Tom uses the company credit card which has an annual fee of RM200, to purchase a flat screen TV worth RM5000 for his home. Then the amount of RM5200 is a perquisite and is taxable.

3) Loan from Company

If your employer provides you with a interest free loan and the source of funds for the loan is derived from extra company funds, then the loan is considered to be a perquisite and is taxable.

Example: Leonard’s boss grants him an interest free loan of RM6000 using extra company funds. Then the amount of RM6000 is a perquisite and is taxable.

Or if your employer provides you with a loan with funds taken from a third party source such as a bank etc. Then the difference in interest paid by the employee and the employer is considered to be a perquisite and is taxable.

Example: Keith’s boss gives him a loan with 4% interest using company funds taken from a local bank. The bank in turn, charged the company 8% interest for the initial loan. If the company paid a total of RM900 of interest payments to the bank while Keith paid a total of RM460 in interest payments to the company. Then the amount of RM900 – RM460 = RM440 is considered to be a perquisite and is taxable.

Or if your employer agrees to waive a loan in exchange for services performed, then the loan amount is a perquisite and is taxable.

Example: Eddie’s boss gives him a study loan of RM30,000 and agrees to waive the loan if he stays and works with the company for a minimum of 36 months. If Eddie successfully completes this agreement and the loan is waived, then the amount of RM30,000 is considered a perquisite and is taxable.

4) Sponsored Club Membership

If your employer provides you with an individual club membership (not corporate), then the cost of the membership is considered to be a perquisite and is taxable.

Example: Bruce is provided with an individual country club membership by his company. The annual fees of the membership are RM400. Then the amount of RM400 is a perquisite and is taxable.

5) Sponsored Child Tuition Fees

If your employer pays for your child’s tuition fees, then the amount paid is considered to be a perquisite and is taxable.

Example: Shawn’s company pays for the school fees of his son, Ross. The annual school fees amount to a total of RM10,000. Then the amount of RM10,000 is a perquisite and is taxable.

6) Company Insurance Premiums

If your employer pays for an insurance premium that covers yourself and your immediate family. Then the annual amount of premium paid is considered to be a perquisite and is taxable.

Example: Richard’s company pays for an insurance package that covers himself and his wife and five children. The annual amount of premium paid is RM900. Then the amount of RM900 is a perquisite and is taxable.

7) Personal Driver, Guard or Maid

If your employer allows reimbursements on the salary of personal drivers, guards or maids, then the amount that is reimbursed is considered to be a perquisite and is taxable.

Example: Colin’s company allows him to reimburse 40% of the cost to hire his personal driver, Carlo. Carlo’s annual salary is RM25,000. Then the amount of RM10,000 is a perquisite and is taxable.

8) Special Staff Discounts

If your employer grants special staff discounts for certain products with monetary value such as cars, furniture, electronics etc. Then the amount of discount given is considered to be a perquisite and is taxable.

Example: Nathan’s company, BMW, grants him a special employee discount of 15% if he chooses to buy a BMW. If Nathan buys a BMW worth RM250,000 but only pays RM212,500 due to the 15% discount. Then the discount amount of RM37,500 is considered to be a perquisite and is taxable.

9) Gift Vouchers

If your employer gives you gift vouchers with monetary value during festive seasons such as Chinese New Year or Hari Raya. Then the monetary value of such gift vouchers is considered to be a perquisite and is taxable.

Example: Donald’s company awarded him a RM100 Tesco voucher during Chinese New Year. He subsequently used that voucher to pick up groceries for his family. The amount of RM100 is considered to be a perquisite and is taxable.

3. Benefits in Kind (BIK)

Benefits in Kind (BIK) are taxable benefits that cannot be converted to cash and are given to an employee from his/her employer. Since Benefits in Kind do not have a direct monetary value, there are two ways to determine the value of a BIK, the formula method or the prescribed value method. Examples of Benefits in Kind include company provided automobiles, lodging and household furnishing & electronics.

Formula Method:

Value of asset/Life span of asset = Annual Value of Benefit

Prescribed Value Method:

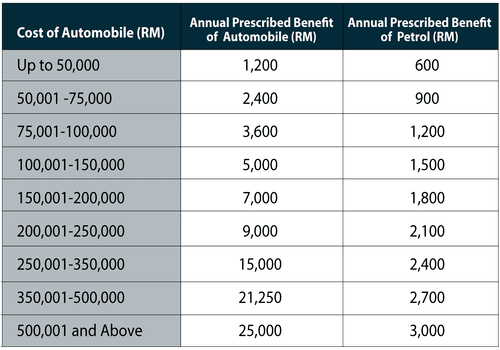

Assigns a predetermined value from a list sorted by classification of asset.

Example: Company Automobile

If your employer provides you with an automobile to use on the job and privately, then the asset is considered to a benefit in kind and is taxable by the formula method. Any petrol costs and toll bridge costs which are subsidized by the employer are included in the total taxable amount as well.

Example: Christopher’s company provides him with a car worth RM81,000 to use to get to work and travel around in his spare time. He passes by 1 toll bridge on his way to work which charges RM1.50. Any toll payments he makes are subsidised by his employer. In addition, his petrol costs are subsidized by his employer as well. In 2015, he made a total of RM1,800 in toll payments and RM3,000 in petrol payments. For cars, the prescribed average lifespan is set at a fixed 8 years.

Formula Method:

81,000/8 X 80% (20% abatement represents the value of the car when returned to the employer)

= RM8,100 + RM1,800 (toll payments) +RM3,000 (petrol payments) = RM12,900

Prescribed Value Method:

Under the prescibed value method, since the value of the car falls between RM75,001 and RM100,000, then the amount taxable is RM3,600. In addition, his petrol costs are also set at a predetermined RM1,200.

Total Cost:

RM3,600 + RM1,200 + RM1,800 (toll payments) = RM6,600

Tax Exemptions on Income in Malaysia

Tax exemptions in Malaysia come in many forms, and can be defined as “a personal allowance or specific monetary exemption which may be claimed by an individual to reduce taxable income”.

Generally speaking, it means they are income items which can be from (we refrain from using the word deductions here, because tax reliefs are also ‘deducted’ from your taxable income) the individual’s paycheck. Below you will find a full list of those items for you to get a general idea:

1) Leave Passage

2) Medical and dental benefit

3) Retirement gratuity

4) Gratuity paid out of public funds

5) Gratuity paid to a contract officer

6) Compensation for loss of employment

7) Pensions

8) Death gratuities

9) Scholarships

10) Cultural performances

11) Interest

12) Dividend

13) Royalty

14) Income Remitted from Outside Malaysia

15) Fees or Honorarium for Expert Services

16) Income Derived from Research Findings

17) Company Special Service Awards

18) Travelling Allowances

19) Benefits in Kind Exemptions

What Are Tax Reliefs?

What about a tax relief? It is defined as “an amount that can be deducted from a person’s annual income to reduce the amount on which tax is paid”.

To describe it in a more clear and concise manner, it is actually a way for you to lessen your chargeable income.

Let’s say you took home a gross monthly paycheck of RM3,000 from your company in 2015 and if there were no tax exemptions or reliefs, your chargeable income will remain the same at RM36,000. Given the annual income of RM36,000 your tax for the year would have been up to the 10% bracket.

Now say the Government decides that all Residents of Malaysia should get a personal tax relief of up to RM9,000 per year and the additional RM2,000 for assesment year 2015 as previously mentioned. Your chargeable income will now be RM25,000 (RM36,000-RM9,000 – RM2,000) which means that your tax would be up to the 5% bracket.

These are the following reliefs available for Malaysian Residents:

Tax Deductions vs Tax Reliefs

Most of the time people get confused between Tax Deductions and Tax Reliefs, and its easy to see why. They are for the most part the same thing, as they both allow you to reduce your Chargeable Income (that is, before you even start looking at tax rate tables). In fact most people worldwide use both terms interchangeably, and LHDN goes one step further and classifies Tax Deductions as a reduction in your Chargeable Income as a result of Gifts or Donations.

As a rule of thumb, you can deduct up to 7% of your aggregate income for gifts to charities and institutions which are approved by the government (not all charities are approved, so be sure to find out before you donate away!), unless you are giving to a few selected government-related bodies, where there is less restrictions on the amount deductible from your income.

For example, if you earned RM60,000 this year, and donated RM5,000 to an approved charity, you may deduct RM4,200 (ie. max 7% of RM60,000) off your chargeable income, in addition to all those reliefs above.

What are the Tax Rebates in Malaysia for 2015?

Some people will be having the question of how is a tax rebate different from a tax relief? A tax relief is a reduction in your chargeable income (ie. before you calculate tax) whereas a tax rebate is a reduction in your tax expense after you have calculated your tax for the year.

Tax rebates (or also known as “tax refunds” but done automatically rather than actually refunded to you). Simply put, there are income tax rebates for Malaysian taxpaying citizens who are having a chargeable income of less than RM35,000 which is RM400. There is also an additional RM400 rebate for married couples who have a chargeable income of less than RM35,000 per year and are eligible for the RM3,000 wife / husband / alimony relief.

To give a quick calculation example for tax rebates:

Taxable Income: Salary of RM45,000 a year

Chargeable Income: RM45,000 – (RM9,000 +RM2,000) – RM4,950 EPF relief =** RM29,050**

Tax calculated using Income Tax Tables (without including any further rebates): RM602.50

Tax Payable: RM602.50 – RM400 rebate = RM202.50

In the above example, you were eligible for the RM400 tax rebate because your Chargeable Income was less than RM35,000 (it was RM29,050 in that example).

Another type of tax rebate, but which is only applicable for Muslim citizens, is the zakat / fitrah. Zakat is a compulsory payment for charity and considered to be compulsory as it is one of the five pillars in Islam. It can be calculated via the Muslim taxpayer’s acquired wealth or income.

Zakat Fitrah, on the other hand, can be considered to be a small, compulsory levy that is imposed upon Muslim taxpayers only. It used to be calculated in the olden days using a pack of rice grains (one pack is equivalent to approximately 2.7 kg) but in the modern days, it is calculated based on the equivalent price of this pack rice grains.

You can read all about Zakat and the various types that exists in our guide Zakat in Islam.

So… What is the Cut-off Point to Pay Tax in 2016 (for Year 2015)?

Although the minimum threshold for filing tax is as per above; just because you have to file; doesn’t mean you will have to pay any tax. The minimum threshold for which you will need to pay tax has increased in 2015 to RM40,449.44 . How did we get to that figure?

Chargeable Income

Your Chargeable Income = Your taxable income – (Standard RM9,000 individual tax relief – Additional RM2,000 tax relief for aggregate income below RM96,000+ 11% EPF Contribution of your salary)

which means

Your Chargeable Income = RM40,449.44 – (RM9,000+ RM2,000 + RM4,494.44) = RM25,000

Based on the tax rate table above, RM25,000 would be taxed RM150 on the first RM20,000 and RM250 on the remaining RM5,000 which brings it up to about RM400 in tax.

RM400 Rebate

After taking into account the RM400 rebate for those with a chargeable income of RM35,000 or less, you’ll be paying

RM400 – RM400 = RM0 (no tax, yay!)

PCB / MTD System: Has Your Employer Paid Too Much Tax for You?

First off, “PCB / MTD” are actually acronyms for “Potongan Cukai Bulanan / Monthly Tax Deductions”.

How this works is that your employer will automatically deduct a certain amount from your salary every month to pay for tax on your behalf, going towards paying your tax for the year. This type of deduction is different from the basic Employees Provident Fund (EPF) and Social Security Organisation (SOCSO) monthly deductions.

Therefore, one can sum up that the MTD is calculated from one’s gross salary minus the EPF deductions of up to RM6,000 per year. If you were to take a closer look at the sum of the total MTD for the year, you will realise that the figure will be very close to your actual tax expense for the year, but given that your company has no idea of your additional reliefs other than being married or having children (such as Books, Sporting equipment etc.), they are very likely to have been overpaying for you.

Unless you believe you have no additional reliefs such as those listed; you might want to calculate to see if you are overpaying.

Final Reminder

The 2015 tax assessment year follows the calendar year, so it is effective from 1st January 2015 to 31st December 2015.

Taxpayers can start submitting their income tax return forms for the year of assessment 2015 through e-filing as well. The due date for the submission of return forms are as follows:

1) Employers (Form E) is 31 March 16

2) Residents and non-residents with non-business income (Form BE and M) is 30 April 16

3) Residents and non-residents with business income (Form B and M) is 30 June 16

4) Partnerships (Form P) is 30 June 16

Finally, do take note that you must keep records for 7 years from the date of filing so don’t throw away any receipts or evidence of tax reliefs, keep them in a file sorted by tax year.

Questions?

Got a tax question? Ask us in the comments section below – we’d be more than happy to assist you where we can!

Image Source: Image 3 from Personal Finance

Comments (0)