Arnie Ruxana

12th September 2019 - 33 min read

Editor’s Note: This guide is for assessment year 2017. Please visit our updated income tax guide for assessment year 2019.

As the clock ticks for personal income tax deadline in Malaysia 2018 – like gainfully employed Malaysians – you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure. After all, there’s no harm in early tax filing as you will be getting first dibs on the tax refunds (know which deductible expenses you qualify for to get a head-start on your claims!), or avoiding the tax penalty for exceeding the e-filing due date 2018.

No matter what your reason may be, we have you covered starting from the creation your tax file (for first-time personal income tax filing individuals!) to understanding what are the newest tax incentives and reliefs announced from the Malaysian Budget 2018 (for seasoned taxpayers).

Here’s a guide that you can refer to for filing personal income tax claims for the Year of Assessment 2017. But before you proceed with doing so, you want to know…

Do I Need to Pay Income Tax?

If you are a resident of Malaysia earning :

- Above RM34,000 per year (after EPF deductions) or RM2,833. 33 per month (after EPF deductions)

- Above RM38,202.25 per year (before EPF deductions) or RM3,183.52 per month (before EPF deductions)

While taking all benefits, allowances, bonuses, overtime and commissions into consideration, then the answer is yes. Apart from that, here are the other things that you need to observe:

- You have been in Malaysia for at least 182 days in a calendar year

- You have been in Malaysia for a period of less than 182 days during the year but that period is linked to a period of physical presence of 182 or more consecutive days in the following or preceding year.

In the situation that you have been temporarily absent from Malaysia due to the following reasons, it will be counted as part of the consecutive days. The reasons are as listed below:

a. Business trips

b. Health treatment for illness

c. Social visits not exceeding 14 days

Answering yes to reasons listed above means that it is compulsory for you to file your income tax in Malaysia. If it’s anywhere below RM34,0000/ RM2,833. 33 per month (after EPF deduction) or RM38,202.25 per year / RM3,183.52 per month (before EPF deductions), then you will have the option to do away with tax filing.

However, you may be missing out on all the extras that you stand to gain from filing your returns once you have made sense of all that tedious paperwork. In short, it’s up to you to decide what’s best for your personal income tax filing needs. So if you have already made your decision, the next question on your mind is…

How Do I File My Income Tax?

Once you have ascertained your income bracket, it’s time for find out which Malaysia income tax rate does your income fall under.

Not sure how tax rates work? Just remember that before you start your filing, you need to know your tax rates. It’s always a percentage of your chargeable income. The more you earn, the higher the percentage of tax you need to pay.

However, that higher percentage is only applied to the amount that’s higher. So you never end up with less net income after tax even if you earn more.

The next thing you would need to note is taxable income consists of the sum of the income you earn that is taxable. Taxes are levied only on your chargeable income, the portion of your taxable income after taking into account tax exemptions and tax reliefs. To find out if your tax has been deducted properly, our handy income tax calculator Malaysia 2018 can help you to do just that.

Here are the Malaysian income tax rates 2018 for the Year of Assessment 2017 that you use as a reference to find out the amount your tax that you will need to pay according to your chargeable income.

| Chargeable Income (RM) | Calculation (RM) | Rate (%) | Tax (RM) |

|---|---|---|---|

| 0 – 2,500 | On the first 2,500 | 0 | 0 |

| 2,501 – 5,000 | On the next 2,500 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000 | – | 0 |

| – | On the next 15,000 | 1 | 150 |

| 20,001 – 35,000 | On the first 20,000 | – | 150 |

| – | On the next 15,000 | 5 | 750 |

| 35,001 – 50,000 | On the first 35,000 | – | 900 |

| – | On the next 15,000 | 10 | 1,500 |

| 50,001 – 70,000 | On the first 50,000 | – | 2,400 |

| – | On the next 20,000 | 16 | 3,200 |

| 70,001 – 100,000 | On the first 70,000 | – | 5,600 |

| – | On the next 30,000 | 21 | 6,300 |

| 100,001 – 250,000 | On the first 100,000 | – | 11,900 |

| – | On the next 150,000 | 24 | 36,000 |

| 250,001 – 400,000 | On the first 250,000 | – | 47,900 |

| – | On the next 150,000 | 24.5 | 36,750 |

| 400,001 – 600,000 | On the first 400,000 | – | 84,650 |

| – | On the next 200,000 | 25 | 50,000 |

| 600,001 – 1,000,000 | On the first 600,000 | – | 134,650 |

| – | On the next 400,000 | 26 | 104,000 |

How Does Year of Assessment 2017 compare to Year of Assessment 2018?

As announced by the Prime Minister at Budget 2018, the M40 incentive consists of a 2-point tax rate reduction which is aimed to help approximately 2.3 million Malaysians earning between RM20,001 and RM70,000.

For Year of Assessment 2018, the rates for lower brackets earners have been decreased from 5% to 3%, 10% to 8%, and 16% to 14% for the year of assessment 2018. These new rates will apply for those who have accumulated their income from January 2018 to December 2018 and are filing their taxes from March – April 2019.

Those in the brackets above have their tax rates unchanged so now, the next thing you will need to do is to calculate your chargeable income. But before you can proceed further, you will need to ensure that you have registered for ez-HASiL e-Filing to complete your Income Tax Return Form (ITRF).

2018 Individual Income Tax Rates

| Chargeable Income (RM) | Calculation (RM) | Rate (%) | Tax (RM) |

|---|---|---|---|

| 0 – 2,500 | On the first 2,500 | 0 | 0 |

| 2,501 – 5,000 | On the next 2,500 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000 | – | 0 |

| – | On the next 15,000 | 1 | 150 |

| 20,001 – 35,000 | On the first 20,000 | – | 150 |

| – | On the next 15,000 | 3 | 450 |

| 35,001 – 50,000 | On the first 35,000 | – | 900 |

| – | On the next 15,000 | 8 | 1,200 |

| 50,001 – 70,000 | On the first 50,000 | – | 2,400 |

| – | On the next 20,000 | 14 | 2,800 |

| 70,001 – 100,000 | On the first 70,000 | – | 5,600 |

| – | On the next 30,000 | 21 | 6,300 |

| 100,001 – 250,000 | On the first 100,000 | – | 11,900 |

| – | On the next 150,000 | 24 | 36,000 |

| 250,001 – 400,000 | On the first 250,000 | – | 47,900 |

| – | On the next 150,000 | 24.5 | 36,750 |

| 400,001 – 600,000 | On the first 400,000 | – | 84,650 |

| – | On the next 200,000 | 25 | 50,000 |

| 600,001 – 1,000,000 | On the first 600,000 | – | 134,650 |

| – | On the next 400,000 | 26 | 104,000 |

The reduction would be effective as from year of assessment (YA) 2018.

Malaysia E-Filing for First-Timers

If this is your first time filing your income taxes, you will first need to register yourself as a taxpayer. Much like how the government uses your MyKad number to know who you are, so do they need an income tax number to know how much you’ve been earning. Get your income tax number by dropping by your nearest LHDN branch. Don’t forget to bring along a copy of your MyKad and recent payslip.

Apart from that, you can also do this via e-Daftar by filling in an online form and emailing them a scanned copy of the same documents.

Upon successful registration, you will receive your income tax number in the mail within 7-14 working days.

Another way for you to check on your application is that you can give them a call and ask them if your number is ready by using your application number (given when you apply) for reference. Here’s an illustration to help you get started on getting your Malaysian income tax pin for E-Filing.

E-Filing 2018 – Filing Taxes For The First Time

I Received My Income Tax Number. What Do I Do Next?

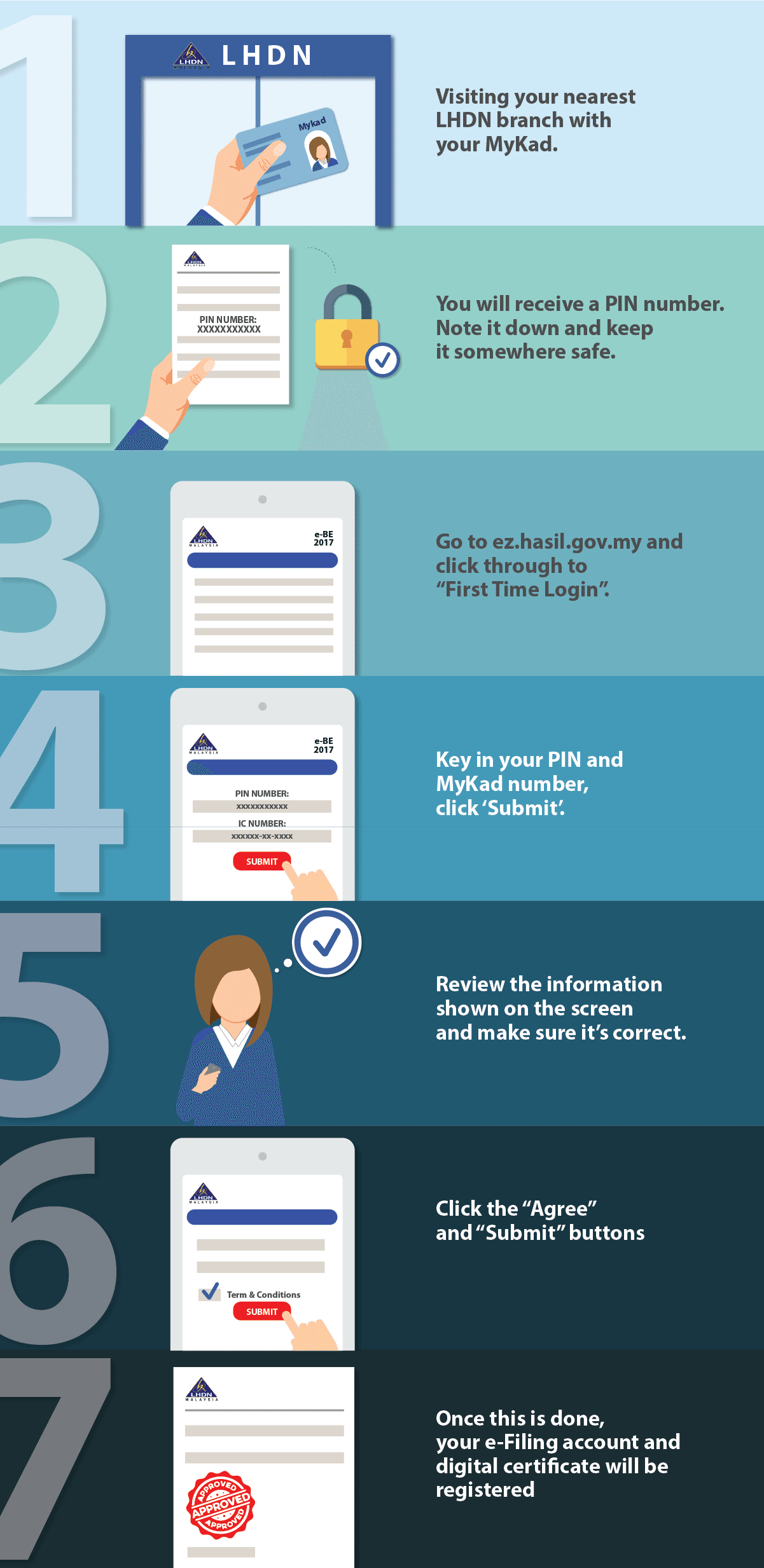

Now you need to register for ezHASiL e-Filing by:

- Visiting your nearest LHDN branch with your MyKad. You will receive a PIN number that you should note down and keep somewhere safe.

- Then, you need to go to ez.hasil.gov.my and click through to “First Time Login”.

- Fill up your PIN number and MyKad number on the page and click “Submit”.

- Review the information shown on the screen and make sure it’s correct. Click the “Agree” and “Submit” buttons.

- Once this is done, your e-Filing account and digital certificate will be registered and you are now ready to proceed with filling in the Income Tax Return Form through ezHASiL.

Here’s an illustration to help you understand how the process of first-time registration for LHDN E-Filing works:

Filing Income Tax for Individuals Who Has Experienced Recent Change of Employment

Switched jobs recently? Fret not, here’s what you need to do:

Where Should You Start?

Firstly, you need to remember and note these things: the date you left the company and the tenure you have worked at the previous employer (This is crucial later on). The next thing you need to do is to contact your previous employer and ask them about the EA form for the previous year.

If You Have Received Your EA Form From Your Previous Employer

You can proceed to file your taxes with e-filing as usual. If you change jobs any time last year, LHDN states that you would need to combine the total amount of income, EPF contribution and SOCSO contribution from the EA forms of both the previous and current employers during your e-filing.

If you change job at the start of this year (January to May), you just need to file your taxes usual without the need to combine both incomes and other components from both employers. Having said that, you would need to remember to request for the EA form from your previous employer for the upcoming year to file for your taxes for YA 2018.

If You Have Not Received Your EA Form From Your Previous Employer

You would need to be proactive and find out the status of your EA form, as in whether it has been sent out, under process or if they haven’t worked on it yet. If they have sent out your EA form, inquire them about the channel which they send it.

Some channels like courier service could have a delay in schedule or would not deliver the form to the address without your (or your authorised receiver’s) presence. Also, it is important to make inquiries from the courier service and get the previous employers to ensure the form is sent to you.

If you are not very patient or if there is little time left, you could to get the previous employer to send the EA form by e-mail.

In The Meantime…

You can start your pseudo tax filing by gathering all your salary slips from your previous employers and calculate the total income, EPF contribution and SOCSO contribution based on the length of time you have worked at that same year.

For example, you worked in the previous company for six months in 2017 before you join your new company on July 1, 2017. Your previous company pays you about RM1, 900 in net salary, with RM 99 for EPF contribution and RM1 for SOCSO contribution. Based on the six-monthly pay slips, you combined the total income, EPF contribution, and SOCSO, which amounts to Income (RM11, 400), EPF contribution (RM594) and SOCSO contribution (RM6).

However, the amount of net salary, EPF and SOCSO contribution for the last month of your work with the previous employer varies according to the date of your departure.

If you leave at the last working day of the last month working at the previous employer, then this is not much of an issue. If you leave at any random date during your last working month at the previous employer, things that you would need to pay attention to includes your income amount, EPF contribution and SOCSO contribution. This is paramount for you to avoid any mistakes when you file your taxes.

It Is March and I Have Yet To Receive My EA Form. What Should I Do?

It is always important to note that it is always in the best interest of the employers to furnish the EA form to all employees, including the resigned staffs. In fact, it is their legally binding duty to do so according to the Income Tax Act.

That said, it is also your duty and best interest to inquire about the EA form from your employer and in the situation that you did not receive any form of updates related to your EA form, it would be best to consult with a representative from your nearest LHDN office to find out what are the actions that you can take to address this issue.

You Are Entitled to An EA Form Even If You Are..

- A part-time worker

- On Probation

- A freelancer

So long as you have worked for more than 7 days and receive payment for it, then yes, it is compulsory for your employers to provide you an EA form.

Having said that, it is not compulsory for them to give you an EA form if you have signed an agreement in which you are to be employed as a contract worker. It is optional for your employer to provide you an EA form if this is the case.

What Happens If Your Previous Employer Goes Bankrupt?

It is the responsibility of every employer to furnish the EA form to all of their employees regardless of the company’s condition. Likewise, it is also your duty to notify and follow up on the status of your EA form from your former employer. Failure to do so may result in heavy repercussions in the coming months in which there will be penalties that you will be liable for such as…

Penalties for Employer and Employee

As mentioned before, both you and your employers have the responsibilities to file tax returns respectively. Depending on the severity of your offence, you may be fined and imprisoned and the same goes for your employers too as they can be penalised for not providing you your EA Form. They can be slapped with either a fine of RM20, 000, imprisonment or both. You can read more on what happens if you don’t file your income tax.

How Can I Find Out My Chargeable Income?

Chargeable income refers to the portion of your income that is taxable after deducting tax reliefs and tax exemptions. The formula which will be used to calculate your chargeable income is:

Chargeable income = Taxable income – Tax exemptions – Tax reliefs

For instance, Jill, a 38-year-old marketing executive earned RM54,000 in the tax year of 2017. She does not have any tax exemptions and other tax reliefs beyond the basic ones, meaning her chargeable income would be calculated as follows:

Taxable income: RM54,000

Tax relief: RM9,000 in individual tax relief + RM5,940 in EPF contribution tax relief (11% of RM54,000, which is RM5,940)

Combining both taxable income and tax reliefs together, the amount will arrive at:

Chargeable income = RM54,000 (Taxable Income) – RM9,000 (Individual Tax Relief) – RM5,940 (EPF contribution tax relief) = RM39,060

Her chargeable income would fall under the 35,001 – 50,000 bracket. She would need to pay RM600 on the first RM35,000 and 8% on the remaining RM4,060 (RM324.80) which totals to RM924.80.

Her tax for the tax assessment year of 2017 would be RM924.80.

What Are the 2018 Income Tax Personal Reliefs Available for Residents? (YA 2017)

Personal reliefs for resident individuals in Malaysia

| Types of relief | YA 2017 (RM) |

|---|---|

| Self | 9,000 |

| Disabled individual – additional relief for self | 6,000 |

| Husband/Wife/Alimony Payments | 4,000 (Limited) |

| Disabled spouse – additional spouse relief | 3,500 |

| Ordinary child,(below 18 years old) | 2,000 |

| Unmarried child of 18 years and above who is receiving full-time education (“A-Level”, certificate, matriculation or preparatory courses) | 2,000 |

| Unmarried child of 18 years and above receiving full-time instruction of higher education in respect of diploma level and above in Malaysia; or degree level and above in Malaysia, OR serving under article of indentures in a trade or profession in Malaysia | 8,000 |

| Per physically/mentally disabled child | 6,000 |

| Per physically/mentally disabled child receiving full-time instruction at institution of higher education in respect of diploma level and above in Malaysia; or degree level and above outside Malaysia OR serving under articles or indentures in a trade or profession in Malaysia | 8,000 |

| Life insurance premiums and EPF contributions | 6000^ |

| Private Retirement Scheme contributions and Deferred annuity scheme premium (YA 2012 to YA 2021) | 3000^ |

| Insurance premiums for education or medical benefits | 3000^ |

| Expenses on medical treatment, special needs or carer expenses for parents (evidenced by medical certification) OR parental care relief (until YA2020) for father and mother | 5000^ or 1500 per parent |

| Employee’s contribution to Social Security Organisation (SOCSO) | 250^ |

| Medical expenses for self, spouse or child suffering from a serious disease (including fees of up to RM500 incurred by self, spouse or child for complete medical examination) | 6000^ |

| Complete medical examination for self, spouse, child | 500 |

| Fee expended for any course of study up to tertiary level other than a degree at Masters or Doctorate level, which includes Law, Accounting,Islamic Financing,Technical,Vocational,Industrial,Scientific or Technological Skills | 7000^ |

| Purchase of supporting equipment for self (if a disabled person) or for disabled spouse, child or parent | 6000^ |

| Lifestyle relief consolidated with the following: purchase of books, journals, magazines, printed newspaper and other similar publications for the purpose of enhancing knowledge, purchase of personal computer, smartphone or tablet, purchase of sports equipment and gym memberships, and, internet subscription | 2500 |

| Purchase of breastfeeding equipment | 1000^ |

| Fees paid to child care and kindergarten | 1000^ |

| Deposit for child into Skim Simpanan Pendidikan 1Malaysia account established under Perbadanan Tabung Pendidikan Tinggi Nasional Act 1997 (until YA 2020)** | 6000^ |

^ Maximum relief

** Previously known as Skim Simpanan Pendidikan Nasional where the tax relief is up to YA 2017

What Are the 2018 Income Tax Rebates

Moving on to tax rebates, here are the ones that you stand to gain as resident individuals.

| Types of Rebate | RM |

|---|---|

| Individual’s chargeable income does not exceed RM35,000 | 400 |

| If husband and wife are separately assessed and each chargeable income does not exceed RM35,000 | 400 (each) |

| If husband and wife are jointly assessed and the joint chargeable income does not exceed RM35,000 | 800 |

| Rebate for Zakat, Fitrah, or other Islamic religious dues paid | Actual amount expended |

The above rebate granted is deducted from the tax charged and any excess is not refundable.

On the other hand, these are the tax rates that will apply to you if you a non-resident individual working in Malaysia.

| Types Of Income | Rate (%) |

|---|---|

| Business, trade or profession, employment, dividends and rents | 28 |

| Public Entertainer and interest | 15 |

| Royalty | 10 |

| Payments for services in connection with the use of property or installation, operation of any plant or machinery purchased from a non-resident | 10 |

| Payments for technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme | 10 |

| Rent or other payments for the use of any movable property | 10 |

*In general, only services rendered in Malaysia by non-resident individuals are liable to tax. Do note that from 17 January 2017 to 5 September 2017, certain services rendered in and outside of Malaysia are still liable to tax.

EzHASiL – What You Need to Do

• Make sure you’re logged in before you proceed with these steps:

• Under the e-Filing section, click on “e-Borang”, which will take you to the e-Filing tax forms.

• Choose the income tax form e-BE if you do not have business income from other sources), and choose the current assessment year.

• On the other hand, if you do have business income from other sources, you would need choose the income tax form e-B instead and choose the current assessment year.

• Ensure the details are up to date and correct them if necessary.

• Key in the details of your income according to the relevant categories.

• Don’t forget to fill in the total of your monthly tax deductions (potongan cukai bulanan, or PCB), if applicable.

• If you have undeclared income from previous years, you need to declare them under the “Pendapatan Tahun Kebelakangan Yang Belum Dilaporkan”.

• Remember to fill in your tax reliefs, rebates, and exemptions wherever applicable.

• After you’ve filled in all the details, the system will automatically calculate your taxes and show you how much you owe in taxes (or how much they owe you in rebates).

The last step after this is to:

• Read through the final statement and verify that all the information on it is true.

• You then need to electronically sign the form and send it in.

What Are Types of Employment Income That Are Taxable?

Here is a table to help you understand what type of employment income is taxable:

| Type of employment income | Taxable Value |

|---|---|

| Cash remuneration, e.g salary, bonus, allowances/perquisites | Total amount paid by employer. Certain allowances/ perquisites are exempted from tax. |

| Benefits-in-kind, e.g motorcar and petrol, driver, gardener and more | Based on formula or prescribed value method. Certain benefits are,exempted from tax. |

| Housing accommodation (unfurnished) for employee or service director | Lower of 30% cash of remuneration* or defined value of accommodation |

| Hotel accommodation for employee or service director | 3% of cash remuneration* |

| Withdrawal from unapproved pension fund | Employer’s contribution |

| Compensation for loss of employment | Total amount paid by employer. Exemption is available under specified conditions. |

Do note that the taxable value of employment income includes the output tax paid under GST and this will be borne by the employer.

With effect from June 1, 2018, the GST charges of 6% will be reduced to zero percent as per government directives.

How Do I File A Tax Rebate for Zakat?

Do note that Zakat, Fitrah, or other Islamic religious dues paid are only applicable to Muslim Malaysian citizens.

If you are a Muslim taxpayer, you would need to make payments levied on the same source of income every year, namely income tax and Zakat. The amount of Zakat will be applied to your tax payable as a tax rebate.

For example:

Azreen’s income tax in 2017: RM500 (let’s call it IT)

Azreen’s has made a zakat contribution in 2017: RM300 (let’s call it ZC)

(IT) – (ZC) = Amount of Income Tax that Azreen would need to pay

As zakat is a tax rebate, Azreen’s income tax in 2017 is RM200.

What Are the Perquisites (Perks) Given to Employees?

Moving on, here are the types of perquisites that are given to employees:

*Exemptions are not extended to directors of controlled companies, sole proprietors and partnerships.

Here is an example of perquisite that are given:

| Perquisites | Taxable Value |

|---|---|

| Petrol card/petrol or travel allowances and toll rates. | Total amount paid by employer. Exemption available up to RM6,000 per annum (allowances/perquisites are for official duties*) |

| Childcare subsidies/allowances | Total amount paid by employer. Exemption available up to RM2,400 per annum* |

| Parking fees/allowances | Fully exempted |

| Meal allowances | Fully exempted |

| Interest on loan subsidies | Loans totaling RM300,000 for housing/passenger motor vehicles and education* |

| Income tax borne by employer | Total amount paid by employer |

| Award | Total amount paid by employer. Exemption available up to RM2,000 per annum for the following types of award such as long service (more than 10 years of employment with the same employer),past achievement,service excellence, innovation, or productivity award |

Travel Allowance

If you would need to head out of the office for work frequently, you may have received a travel allowance from your employer. Your employer will either provide you with a set amount of funds which you will use to pay for the expenses that you have incurred for work-related purposes.

These amounts paid are perquisites which are tax-exempted up to RM6,000 annually. Having said that, work-related travel expenses can be deducted from your gross income so do make sure you keep a record of these expenses.

Example: Julia is an account manager who travels frequently for work. Her company provides her with a monthly travel allowance of RM500 and as the amount does not exceed RM6000, it’s tax exempted.

However, the same type of perquisite could not be applied if she’s not working for an employer, and that she assumes the role of a business partner, director or sole proprietor of the company. Suffice to say, if she’s working for herself, these tax exemptions would not be valid.

For more information about perquisites, you can refer to the Perquisites From Employment that’s provided by LHDN.

What are Benefits-in-Kind (BIK) and How is It Distributed to Employees?

Benefits in Kind (BIK) refers to any non-cash benefit of monetary value that is given by the employer to the employee. As such, if you are an employer, you would oversee the provision of benefits to your employees.

On the other hand, if you are an employee, you may note that these benefits may be given to you under other names such as notional pay, fringe benefits or perks. BIK have monetary value so in short, they must be treated as taxable income. Even then, it is important to take note that BIK is not convertible into money, even though they have monetary value.

The phrase not convertible into money means that when the benefit is provided to the employee, that benefit cannot be sold, assigned or exchanged for cash either because of the employment contract or due to the nature of the benefit itself

There are 2 methods which are used to determine the value of the BIK provided to an employee. The formulas are as follows:

- formula method

- prescribed value method

How Does the Formula Method work?

For the formula method, the annual value of BIK provided to an employee is computed using the following formula:

Cost of the asset provided as a benefit or amenity/ Prescribed average life span of the asset = Annual Value of the benefit

And an example below to compute with the formula:

John is a top salesman who is provided with a LED TV by his employer for his stellar work performance. The cost of the LED TV is RM2,100 and the prescribed average life span of the asset is 7 years.

Based on the above formula, the annual value of the BIK for LED TV is:

RM2,100/7 = RM300

The amount of RM300 will be a part of John’s gross income from employment and this amount should be reported by his employer in John’s CP8A (EA) / CP8C (EC).

The calculation of the prescribed average life span of the assets formula method stays the same regardless whether the asset is new or second-hand.

So yes, even if John is gifted a second-hand LED TV, the prescribed average life span of the TV is still an estimated 7 years even if you may feel that the cost of the LED TV should be lower because it’s a used asset and the nature of used assets is that it has a shorter lifespan.

How Does Prescribed Value Method works?

On the other side of the coin, the value of BIK is based on a predetermined value that have been assigned from a list of assets that have been sorted into their respective categories. For prescribed value method, the asset’s value can be reduced if the BIK is:

(a) Provided for less than a year, or/and

(b) Shared with another employee

Having said that, there will be instances that there will be no reduction in value of the BIK via prescribed value method. This is the case if the BIK is used for business.

What is the Prescribed Average Life Span Of Various Assets Provided By Employers To Employees?

What is the Prescribed Value Of Motorcar And Its Related Benefits?

| Cost Of Motorcar (RM) | Annual Prescribed Benefit Of Motorcar (RM) | Annual Prescribed Benefit Of Petrol (RM) |

|---|---|---|

| Up to 50,000 | 1,200 | 600 |

| 50,001-75,000 | 2,400 | 900 |

| 75,001-100,000 | 3,600 | 1,200 |

| 100,001-150,000 | 5,000 | 1,500 |

| 150,001-200,000 | 7,000 | 1,800 |

| 200,001-250,000 | 9,000 | 2,100 |

| 250,001-350,000 | 15,000 | 2,400 |

| 350,001-500,000 | 21,250 | 2,700 |

| 500,001 and above | 25,000 | 3,000 |

What is the Prescribed Value of Household Furnishings, Apparatus and Appliances?

Malaysia Income Tax General FAQ

Here is a list of commonly asked questions that we have compiled for your perusal.

What Is Employment Income?

Employment income in general constitutes of a situation whereby an employee is subjected to Malaysian tax by:

- Being employed in Malaysia

- Is on paid leave which is attributable to the exercise of an employment in Malaysia

- Performs duties outside Malaysia which are incidental to the exercise of an employment in Malaysia

- Is a director of a company resident in Malaysia; or

- Is employed to work on board an aircraft or ship operated by a person who is resident in Malaysia

However, there are exemptions for employment income if you are a short-term employee. To check if you fall under the category of a short-term employee, here are the qualities that you would need to take note of:

- If the aggregate of the period of periods of employment in Malaysia does not exceed 60 days in a calendar year or

- where the total period of employment which overlaps 2 calendar years does not exceed 60 days

How is Income Tax Assessed in Malaysia?

Income is assessed on a current year basis. The year of assessment is the year coinciding with the year calendar. For instance, let’s say that the year of assessment for 2017 is the year ending for 31 December 2017. In this case scenario, since you are a person and not a company, limited liability partnership or a cooperative, your income will be assessed on a calendar year basis. In Malaysia, a self-assessment system is applied so that means you, as a taxpayer, have the responsibility to determine the correct tax liability.

What Are the Classes of Income that is Tax Chargeable?

Income tax is chargeable on these classes on income:

- Gains or profits from a business

- Gains or profits from an employment

- Dividends, interests or discounts

- Rents, royalties or premium

- Pensions, annuities or other periodical payments not falling under any of the foregoing clauses

- Gains or profits not falling under any of the foregoing clauses

I Do Not Have A Business Anymore but I Am Still Receiving A B Form. What Should I Do?

In this situation, since you do not have a business anymore but you are still receiving a B form, you can choose to either:

- Use the form to declare income received by filling in the relevant columns; or

- Change to BE Form at the nearest LHDN branch.

At some point in 2017, I was Retrenched from My Job. How Do I File for My Taxes?

As per LHDN’s website, compensation for the loss of employment is a payment made by an employer to his employee before or after the date of termination, and a certain amount of this payment is exempted from tax.

This compensation is exempted from tax if compensation received is due to ill health, and the other cases:

Termination before July 1, 2008 – exemption of RM6,000 for every completed year of service with the same employer or with companies in the same group.

Termination on or after July 1, 2008 – exemption of RM10,000 for every completed year of service with the same employer or with companies in the same group.

I Have Opted for Early Retirement Due to my Illness. Do I Need to File for Income Tax?

In this situation, you would need to notify LHDN about your situation and your situation will be assessed in accordance to the taxation guidelines set by the Director General of Inland Revenue (DGIR).

Here’s an example that you can refer to:

Samy, an architect, had worked for his employer for 22 years. In 2016, he met with an accident which left him with a serious health problem. The accident has forced him to stop working and opt for early retirement at the age of 49 on 1.1.2017.

Samy’s employer accepted his request for early retirement based on the medical report from the company’s panel of doctors and paid him RM200,000 as retirement gratuity in accordance with the company’s policy.

Samy is entitled for a full tax exemption on the retirement gratuity that he has received as he was able to prove that his early retirement was due to ill health.

How Do I File My Income Tax if I Am Working in a Malaysian Company Abroad?

According to Section 13(2)(c) of the Act, the salary earned from working abroad would not be taxable unless the income received is incidental to the Malaysian employment. Having said that, you would need to notify LHDN that you are working abroad as this will help avoid the possibility of you getting penalised for not filing your taxes.

I Am an Expat Employed In Malaysia. How Is Income Tax in Malaysia for Expats ?

In general, if you are a non-Malaysian but are resident in Malaysia for tax purposes (see above ‘Do I need to pay income tax?’), you will pay income tax as a resident.

However, for certain Non-Malaysian citizens who are based in Malaysia working in Operational Headquarter (OHQ) or Regional Office (RO), or International Procurement CIPC), or Regional Distribution Center (RDC) or Treasury Management Center (TMC) status companies, your employment income will be taxable based on the number of days you are employed in Malaysia.

I Am a Muslim Revert. How Do I File for My Income Tax and Make My Zakat Contributions?

First off, you would need to keep the original receipts that you have received when you have made your zakat contribution. For example, if you have made a zakat contribution in 2017, it can be claimed as the tax rebate on the income tax return form for the year assessment 2017. Always remember that in order to receive approval for tax rebates, the payment must be made in the basis year.

However, it is important to know that the amount is subject to the maximum of tax charged (limited amount of total tax charged).

How About Employment Insurance Scheme?

When you start your work this year, you might note that your salary slip now has a section for Employee Insurance Scheme (EIS). The Employee Insurance scheme is a compulsory financial scheme to help employees who lost their jobs. The scheme will support the affected employee while they are searching for new jobs. You can get more info on EIS here.

I Have Submitted my E-Filing and Wanted to Make Changes. What Do I Do?

According to LHDN, income tax form submission made via e-filing cannot be modified online. To avoid penalties imposed, you will need to submit your appeal for amendments on / before 30 April 2018.

Here are the steps that you will need to take: –

(a) Print your e-form and make corrections in the wrong space (a brief signature next to the correction). Next, make the tax calculation manually up to the “Tax Paid” level. In the event of any balance due, the balance shall be paid on/before 30 April 2018.

(b) Attach a letter of appeal that explains the changes you wish to make along with a copy of your e-form and all original documents and receipts to confirm income, all claims and tax deductions. Once you have done that, you will need to send it to the branch that you have registered with.

Do note that LHDN will go through each error appeal as a part of the audit process and the time taken for the amendment will depend on the information and documents submitted

When Will I Get My Tax Refund?

If you have overpaid in taxes and is entitled to a refund, it will be credited to the account automatically to the taxpayer within 30 working days after the submission of income tax return form. However, if you do not receive your refund you can forward your application to the Collections Unit of the branch where your file is completed and submit it via LHDN’s Feedback Form.

Apart from that, you can also try inquiring via their toll-free number at 1-800-88-5436 (LHDN)

What Are the Benefits of Early Tax Form Submission?

Can I Submit an Appeal for Income Tax?

There are various situations where you can choose to submit an appeal for your income tax. You can submit an appeal if:

• You are not satisfied with the way in which your income has been assessed.

• Personal reliefs have not been appropriately given.

• You have forgotten to claim certain expenses or reliefs.

• There is an error in the assessment issued by the LHDN office.

I Have Received a Notice of Assessment from LHDN and I Want to Submit An Appeal. What Do I Do?

Firstly, you can submit an appeal by writing to the LHDN branch which issued the assessment within 30 days from the date of the notice. For this, you are required to fill in Q Form which is available at your LHDN branch. Your LHDN branch will oversee the handling your appeal and from here, your appeal will be forwarded to the Special Commissioners of Income Tax.

In the situation (for a valid reason) that you could not submit an appeal within the 30-day period, you can apply for an extension of time to submit the appeal using N Form which is to be forwarded for decision by the Special Commissioners of Income Tax. The Special Commissioners of Income Tax consists of an independent tribunal of panel members appointed by the Yang Di-Pertuan Agong to handle tax appeals.

However, do note that you still have to pay your tax liabilities even though you have made an appeal.

Documents required:

• Letter stating the type of mistakes/expenses claimed/deductions/exemptions

• Supporting documents for expenses claimed/deductions/reliefs

Apart from that, LHDN may request for other documents that are not listed above as well if the information received is insufficient to proceed with the amendment of assessment. After receiving the results of your appeal, should you feel dissatisfied with the decision made by the Special Commissioners of Income Tax, you can appeal further to the High Court and the Court of Appeal.

One Last Tip….

As you know, the 2017 tax assessment year follows the calendar year, so it is effective from 1st January 2017 to 31st December 2017. Once you have outlined what are the tax reliefs, deductions, and rebates that you can submit claims for, it is time to submit your income tax return form for the year of 2017. The due date for the manual submission of return forms are as follows:

1) Employers (Form E)- 31 March 2018

2) Residents and non-residents with non-business income (Form BE and M) is 30 April 2018

3) Residents and non-residents with business income (Form B and M) is 30 June 2018

4) Partnerships (Form P ) is 30 June 2018

On the other hand, here are the due dates that you will need to note if you are submitting your tax return form via E-Filing:

1) Residents and non-residents with non-business income (Form BE and M) is 15 May 2018

2) Residents and non-residents with business income (Form B and M) is 15 July 2018

To get your hand on the completed forms, you will need to visit LHDN‘s site for your tax submission. Remember, some purchases such as electronic products, books, health insurance or medical card are entitled to tax reliefs. For instance, you will receive tax relief up to RM3,000 for health insurance and medical card.

Done with your income tax submission? That’s great but don’t chuck out all your receipts and it’s duplicates yet! Do make it a habit to must keep records for 7 years from the date of filing so don’t throw away any receipts or evidence of tax reliefs, keep them in a file sorted by tax year.

What do you feel about the income tax filing for the year of assessment 2017? Let us know in the comment section below.

Comments (1)

my wife (government servant) just RETIRED last year and does not have any come since then, should i continue with Separate Assessment, or Joint Assessment or….. ?