Jacie Tan

1st March 2020 - 15 min read

NOTE: This is the income tax guide for the year of assessment 2019. If you are filing your taxes in 2021, then head on over to our income tax guide for YA2020 here.

Income tax season has arrived in Malaysia, so let’s see how ready you are to file your taxes. Have you gotten your EA form from your employer(s) yet? Do you know how to figure out your income tax rate, add up your tax reliefs, and calculate your tax refund? Have you registered as a taxpayer with LHDN, logged yourself into e-Daftar, and familiarised yourself the right e-Borang to fill? Do you even know what any of these income tax terms mean?

If you’re still in the dark, here’s our complete guide to filing your income taxes in Malaysia 2020 for the year of assessment (YA) 2019.

Who Needs To Pay Income Tax?

Any individual earning more than RM34,000 per annum (or roughly RM2,833.33 per month) after EPF deductions has to register a tax file. You must pay income tax on all types of income, including income from your business or profession, employment, dividends, interest, discounts, rent, royalties, premiums, pensions, annuities, and others.

So for salaried employees, this not only includes your monthly salary, but also things like bonuses, overtime, commissions, and all other taxable income. If you’re not sure what counts as income that you have to declare for tax purposes or not, scroll down to our section on stating your income below.

You don’t have to pay taxes in Malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside Malaysia.

Income Taxes in Malaysia For Foreigners

What about foreigners or expatriates who are working and earning income in Malaysia? Any foreigners who have been working in Malaysia for more than 182 days are eligible to be taxed under normal Malaysian income tax laws and rates, just like Malaysian nationals. According to LHDN, foreigners employed in Malaysia must give notice of their chargeability to the Non-Resident Branch or nearest LHDN branch within 2 months of their arrival in Malaysia.

Understanding Tax Rates And Chargeable Income

Here are the income tax rates for personal income tax in Malaysia for YA 2019.

| Chargeable Income (RM) | Calculations (RM) | Rate % | Tax (RM) |

| 0 – 5,000 | On the first 5,000 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000

Next 15,000 |

1 |

0

150 |

| 20,001 – 35,000 | On the first 20,000

Next 15,000 |

3 |

150

450 |

| 35,001 – 50,000 | On the first 35,000

Next 15,000 |

8 |

600

1,200 |

| 50,001 – 70,000 | On the first 50,000

Next 20,000 |

14 |

1,800

2,800 |

| 70,001 – 100,000 | On the first 70,000

Next 30,000 |

21 |

4,600

6,300 |

| 100,001 – 250,000 | On the first 100,000

Next 150,000 |

24 |

10,900

36,000 |

| 250,001 – 400,000 | On the first 250,000

Next 150,000 |

24.5 |

46,900

36,750 |

| 400,001 – 600,000

|

On the first 400,000

Next 200,000 |

25 |

83,650

50,000 |

| 600,001 – 1,000,000 | On the first 600,000

Next 400,000 |

26 |

133,650

104,000 |

| 1,000,001 – 2,000,000 | On the first 1,000,000

Next 1,000,000 |

28 |

237,650

280,000 |

| Exceeding 2,000,000 | On First 2,000,000

Next ringgit |

30 |

517,650

……….. |

For example, let’s say your annual taxable income is RM48,000. Based on this amount, the income tax to pay the government is RM1,640 (at a rate of 8%). However, if you claimed RM13,500 in tax deductions and tax reliefs, your chargeable income would reduce to RM34,500. This would enable you to drop down a tax bracket, lower your tax rate to 3%, and reduce the amount of taxes you are required to pay from RM1,640 to RM585. That’s a difference of RM1,055 in taxes!

Based on this table, there are a few things that you’ll have to understand. First of all, you have to understand what chargeable income is. Chargeable income is your taxable income minus any tax deductions and tax relief. It’s very important you know how it works because as you can see, the tax rate you are charged with increases as your chargeable income does. The more you reduce your chargeable income (through tax reliefs and such), the lesser your final tax amount will be.

Income Taxes in Malaysia For Non-Residents

You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia for less than 182 days in a year, regardless of nationality. You’ll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents.

Therefore, whether you are a Malaysian or a foreign national, as long as you reside in Malaysia for less than 182 years in a year, any income you earn in Malaysia is taxable under non-resident income tax rates.

Here are the income tax rates for non-residents in Malaysia.

| Types of Income | Rate (%) |

| · Business, trade or profession

· Employment · Dividends · Rent |

28 |

| · Public entertainer

· Interest |

15 |

| · Royalty

· Payments for services in connection with the use of property or installation, operation of any plant or machinery purchased from a non-resident · Payments for technical advice, assistance, or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme · Rent or other payments for the use of any movable property |

10 |

The Income Tax Filing Process in Malaysia

Now that you’re up to speed on whether you’re eligible for taxes and how the tax rates work, let’s get down to the business of actually filing your taxes. The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing.

For the BE form (resident individuals who do not carry on business), the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. Meanwhile, for the B form (resident individuals who carry on business) the deadline is 15 July for e-Filing and 30 June for manual filing. You can file your taxes on ezHASiL on the LHDN website.

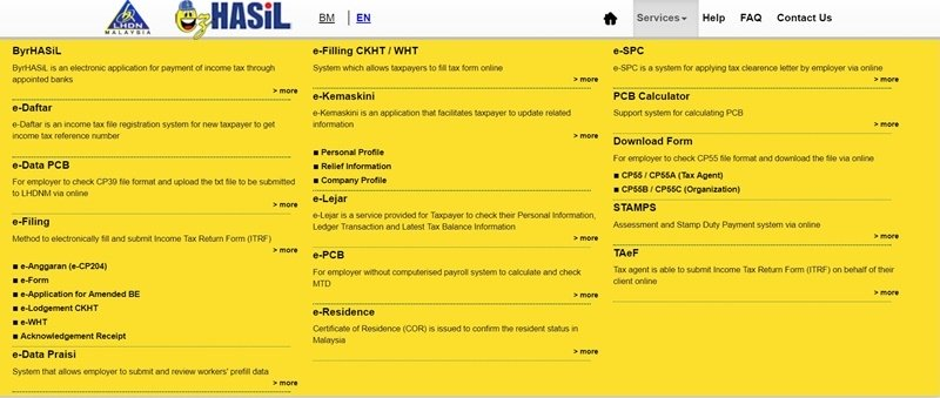

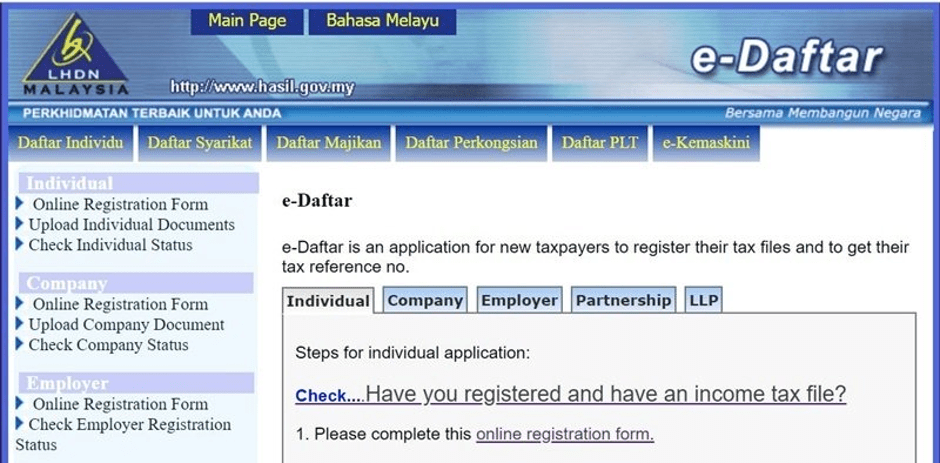

Registering as a first-time taxpayer on e-Daftar

Before you can file your taxes online, there are two things you’ll need to do first: i) register as a taxpayer on e-Daftar to get your income tax number and ii) get your PIN number from the nearest LHDN branch so you can log in to ezHASiL for the first time. If you need help on this, here’s a step-by-step guide on how to file your taxes for the first time.

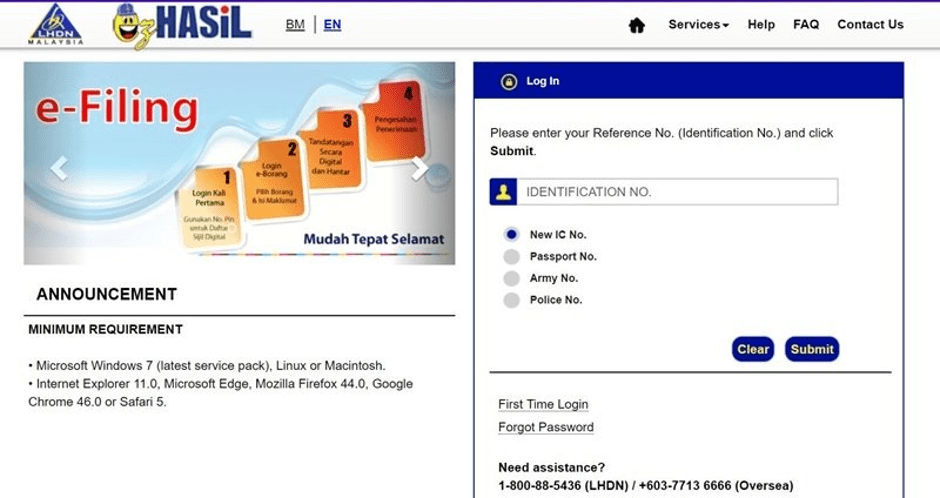

Log in to ezHASiL and access e-Filing

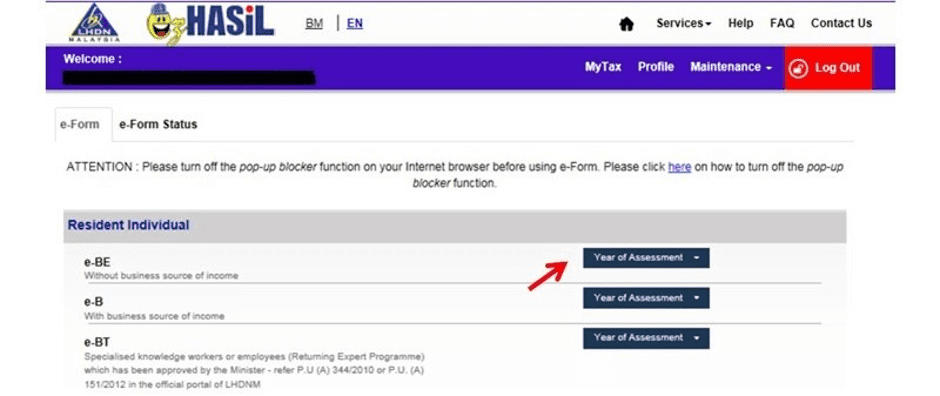

Once you’ve successfully logged into ezHASiL, click on e-Filing to start filling up your Income Tax Return Form (ITRF). Here are the different types of ITRFs depending on how which category you fall under:

| Income Tax Return Form (ITRF) | Category |

| e-B/e-BT | For residents earning income from business/knowledge or expert worker |

| e-BE | For residents earning income without a business |

| e-M/e-MT | For non-resident individuals/knowledge workers |

Choose the right form and select the year of assessment 2019 (remember, you are declaring your income earned for the year before).

Fill up your income tax return form

Now that you’ve gotten access to the right form, let’s get right down to the bottom of filling it out. You can choose to view your form (and in fact the entire LHDN website) in either English or BM, so language shouldn’t be an issue. Here’s a breakdown of what your BE form for residents earning income without a business will look like.

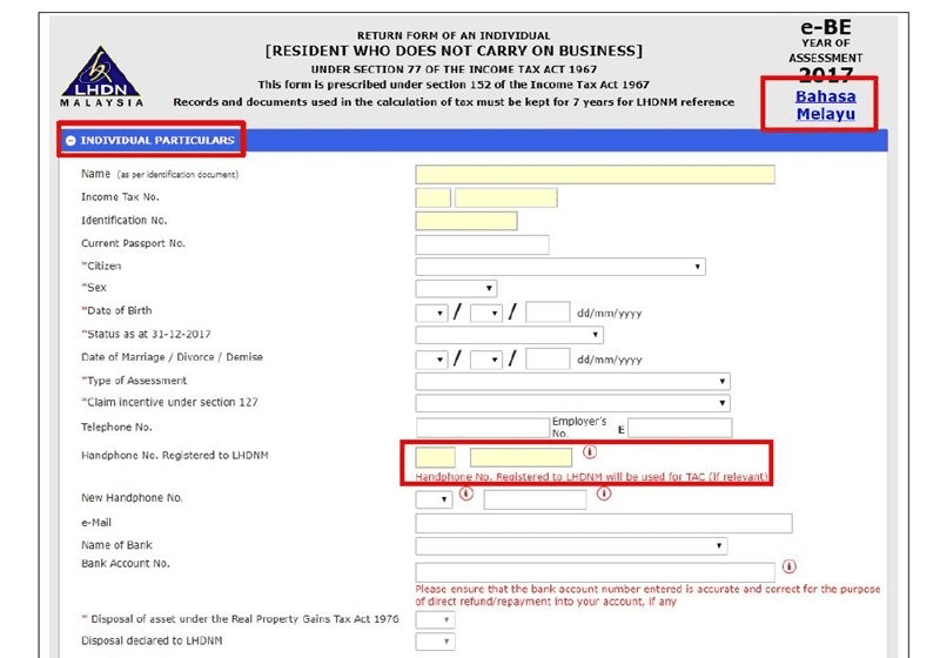

Individual Particulars

In this section, check to see that your personal details are displayed correctly on the form. Here are a few things to take note of:

- Your type of assessment depends on how you have decided to file your taxes – whether you’re single, filing together or separately with your spouse, and so on.

- Incentive under section 127 refers to the Income Tax Act 1976. It is only applicable to those who have incentives claimable as per government gazette or with a minister’s approval letter.

- A TAC which is needed to sign and submit your e-form will be sent to your handphone number registered to LHDN, so ensure it is correct.

- Your tax refund (if any) will be returned to the bank account number provided.

- Disposal of asset under the Real Property Gains Tax Act 1976 will be relevant to you if you’ve sold any property in the last year.

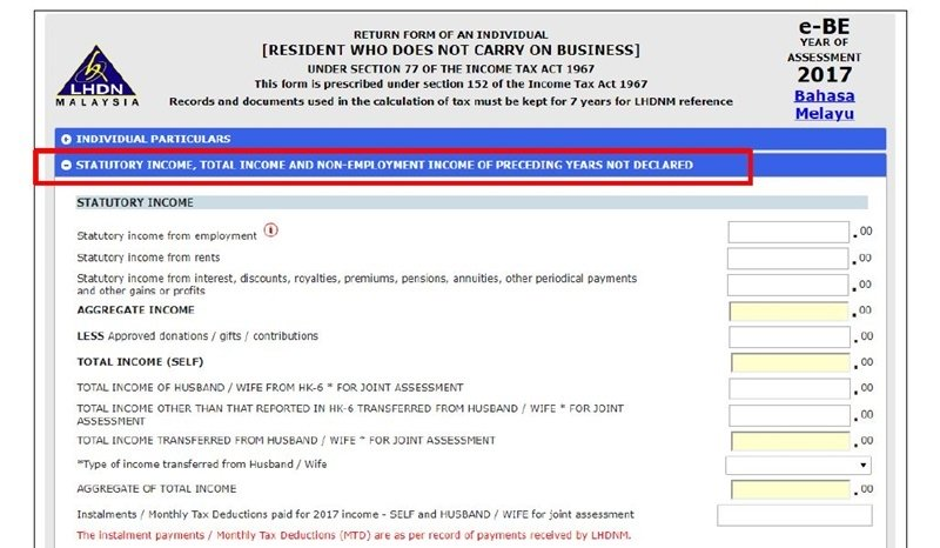

State Your Income

Under statutory income, fill out all the money you earn from employment, rents, and other sources in the respective boxes. The form will automatically calculate your aggregate income for you. This is where your EA form comes into play as it states your annual income earned from your employer. However, there are several reasons why you shouldn’t accept the annual income stated on your EA form as the final figure for your statutory income from employment.

When it comes to declaring your income, you don’t want to miss out any non-salary related benefits that can count as “income from employment” and may need to be added on to your income figure. Similarly, you wouldn’t want to include any income that is entitled to tax exemptions on your form either.

For example, perquisites (which cover things like parking, medical, and transport allowances) and benefits-in-kind (such as cars, personal drivers, accommodation, and so on) are taxable under law, but the government has provided some tax exemptions for them. If you want to find the answer to whether or not your RM100 monthly travel allowance is tax exempt, check out our article on tax exemptions.

Once you’ve keyed in all your statutory income, the form will automatically total it up to show your aggregate income. The next step will be to move on to any tax deductions you may be eligible for so you can lessen your aggregate income. For example, you can make a tax deduction from your aggregate income if you have made a contribution of gifts or donations to the government or a government-approved charitable organisation.

At the bottom of this section, you’ll have to key in the total monthly tax deductions (MTD) paid during your year of assessment. MTD or Potongan Cukai Bulan (PCB) is the compulsory mechanism where employers deduct monthly tax payments from a taxable employee’s salary. You can find this amount on your EA form.

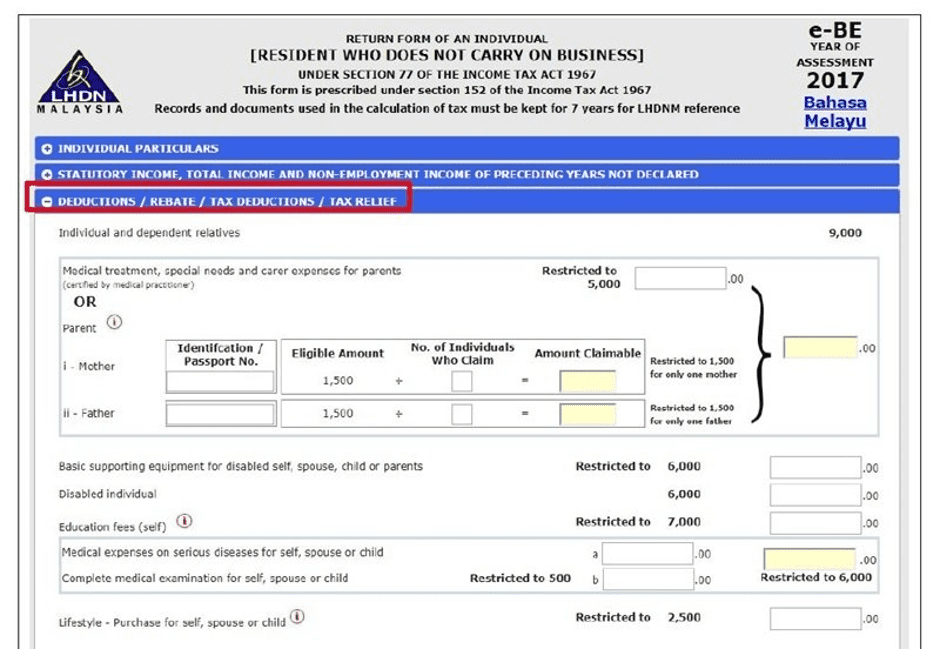

Tax Reliefs and Rebates

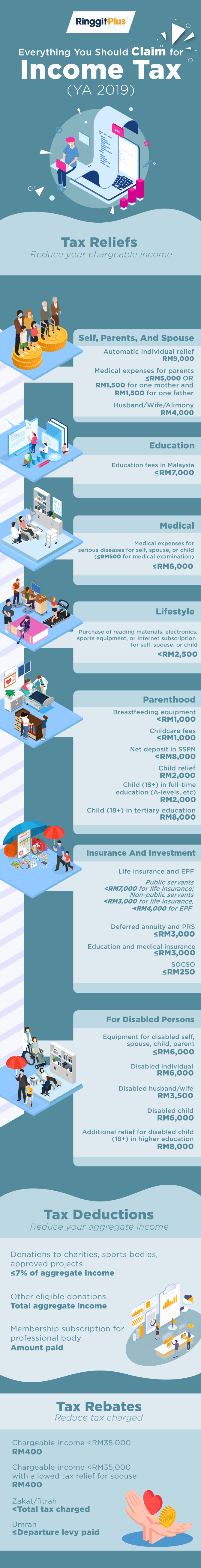

We’ve already explained how tax reliefs can reduce your chargeable income (and thus your tax rate and tax amount) above. Well, here’s the part of the form where you can go ahead and claim for all the tax reliefs you’re eligible for. The full list of tax reliefs you can claim for is on the LHDN website, but you can also refer to our post on everything you should be claiming for here or refer to this infographic below.

Once all your tax reliefs have been claimed, your chargeable income determined, and your tax rate and amount decided, you can claim for any tax rebates you are eligible for. Zakat and fitrah can be claimed as a tax rebate for the actual amount expended up until the total tax amount.

For example, say your employment income is RM50,000 a year and you have claimed RM15,000 in tax reliefs. This would bring your chargeable income down to RM35,000 and the amount of tax you have to pay is RM600. If you have contributed RM400 in the last year on zakat, you can minus that amount from the RM600 and end up with a final tax amount of RM200 to pay.

Besides zakat and fitrah, you are also eligible for a tax rebate of RM400 for yourself if your chargeable income does not exceed RM35,000. To find out more about the tax rebates that you could be eligible for, you should check our article on it here.

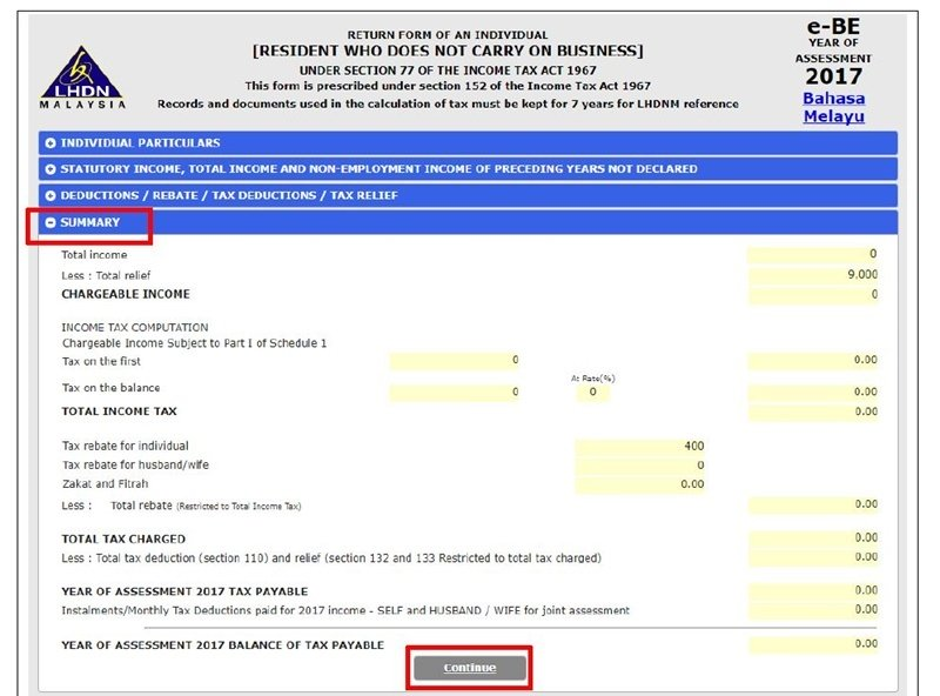

Summary

Now that you’ve reached the summary page, your work is almost done. On this page, you should see the final tax amount displayed. Don’t worry if your tax amount is in the negative, this is due to what you have already paid through MTD – this means you will get a tax refund from the government. If you’re worried that you overlooked something, you can always go back through the form at this stage and amend any details that you may have missed out on; the form will make the necessary changes to the final tax amount automatically as you do so. Once you’re certain your form is free from errors, click “Continue”.

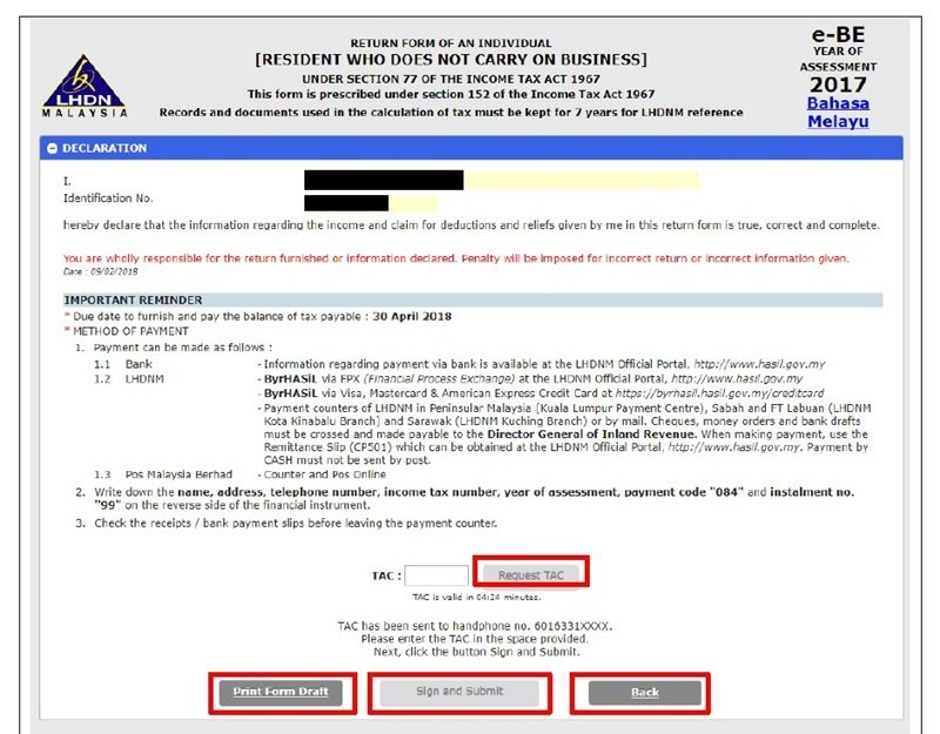

On the declaration page, request a TAC from the number you’ve registered with LHDN and key it in. Next, click the sign and submit button, enter your identification number and password in the pop-up, and press the sign button. Finally, you’re done with filing your income taxes for YA 2019!

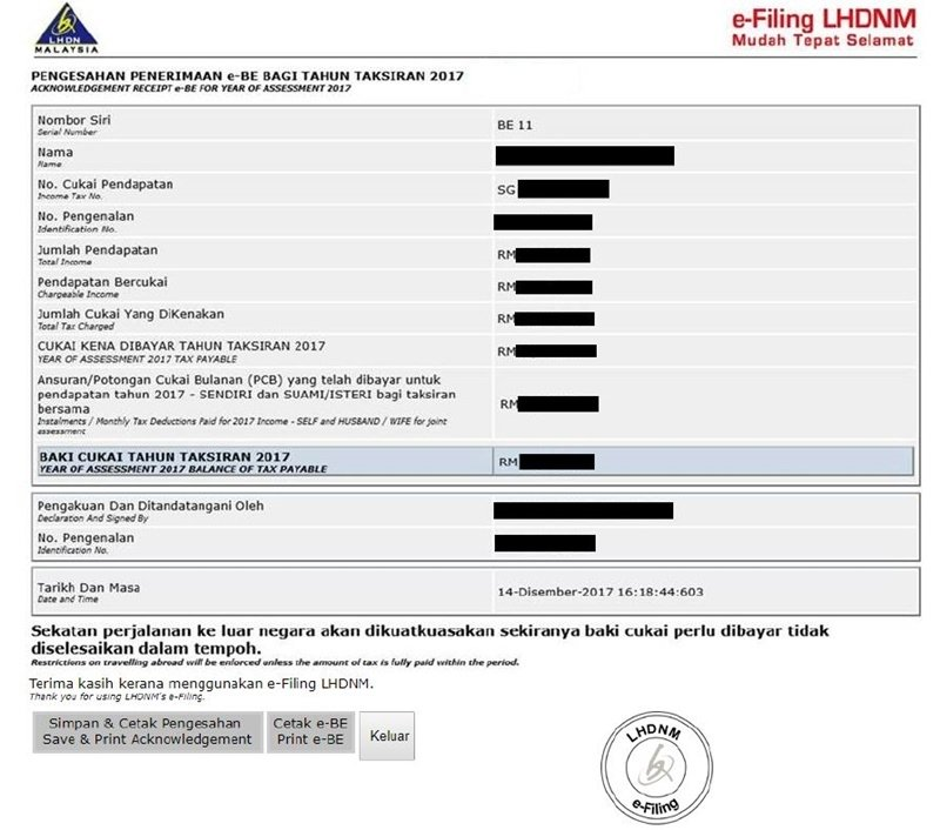

Before you exit the website and say goodbye to income taxes for the rest of the year, make sure to save and print the acknowledgement and e-BE form for records purposes.

Amending Your Income Tax Form

Once you’ve submitted your form, you can’t make any further changes to it online via e-Filing. If you wish to make any amendments to your income tax declaration, you need to submit an appeal for amendments on or before 30 April 2020.

Here are the steps that you will need to take:

- Print your e-form and make corrections in the wrong space (a brief signature next to the correction). Next, make the tax calculation manually up to the “Tax Paid” level. In the event of any balance due, the balance shall be paid on/before 30 April 2019.

- Attach a letter of appeal that explains the changes you wish to make along with a copy of your e-form and all original documents and receipts to confirm income, all claims and tax deductions. Once you have done that, you will need to send it to the branch that you have registered with.

- Do note that LHDN will go through each error appeal as a part of the audit process and the time taken for the amendment will depend on the information and documents submitted.

How Do You Pay Your Income Taxes?

Now that you’ve filed your taxes and determined your final tax amount, you’ll find yourself in either one of two situations.

For those subject to MTD, you may find that your final tax amount while filing is lesser compared to what was has been deducted, perhaps thanks to tax reliefs and so on. Thus, you will be eligible for a tax refund from the government. It will be credited to the bank account you’ve provided in your tax form within 30 working days after submission.

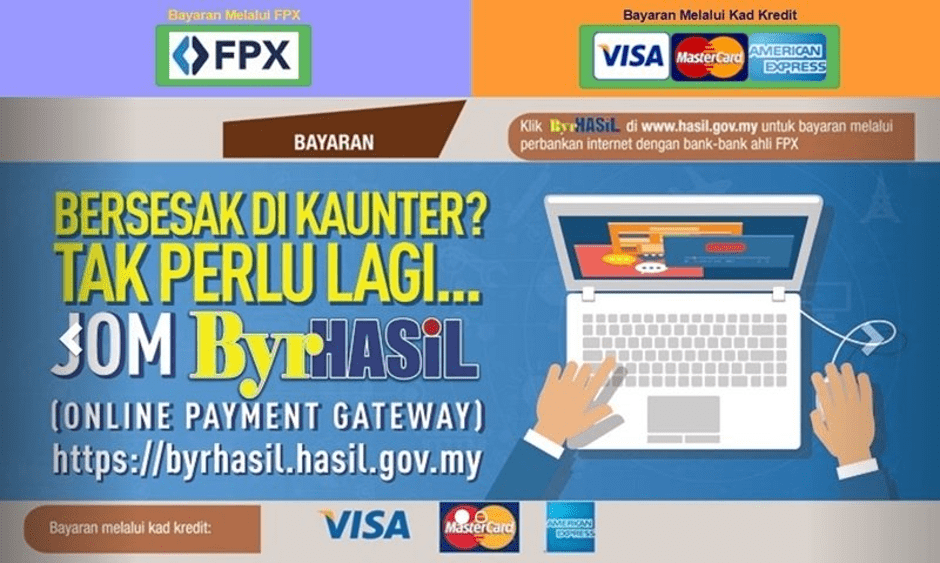

On the other hand, if you find after filing that you still owe the government unpaid taxes, you’ll have to pay them before the due date which is 30 April 2020. Here are a few of the ways you can pay your income taxes in Malaysia:

| Method | Details |

| Online banking through FPX | Requires a bank account with AffinBank, Alliance Bank, Ambank, Bank Islam, Bank Muamalat, BankRakyat, BSN, CIMB, Citibank, Maybank, OCBC, Public Bank, Deutsche Bank, HLB, HSBC, KFH, RHB, Standard Chartered, or UOB |

| Online using credit card on ByrHASiL | Visa, Mastercard, American Express accepted |

| Pos Malaysia | Over the counter (cash only) or online |

| Via ATM | Only at Public Bank, Maybank, and CIMB |

If you pay your taxes late, a penalty of 10% will be imposed on the balance of tax unpaid after the deadline of 30 April 2020. If the tax and penalty is not paid within 60 days, a further penalty of 5% will be imposed on the amount owed.

If you disagree with the late payment penalty, you can forward an appeal in writing to the Collection Unit of LHDN within 30 days of being issued a Notice of Increased Assessment. However, the penalty imposed has to be settled regardless of any appeal – if you are successful, LHDN will refund you the relevant amount.

Appealing Your Income Tax Notice of Assessment

After you file your taxes, there is a possibility that LHDN may serve you a notice of assessment. What is a notice of assessment? It is a written statement by LHDN that states your taxable income, amount of tax due, and so on. If you disagree with the information laid out in this notice of assessment, you can file an income tax appeal – perhaps because personal reliefs have not been appropriately given, you’ve forgotten to claim certain expenses, or an error has been made by the LHDN office.

The appeal must be made within 30 days from the date of notice in writing to the LHDN branch which issued the assessment. You’re required to fill in the Q form, write a letter stating the type of mistakes and clearly specify where they lie, and submit supporting documents for any expenses, deductions, or reliefs claimed. The appeal will be forwarded to the Special Commissioners of Income Tax. Should you have a valid reason for requiring more than 30 days to file an appeal, then the N form is the one you’ll need. Both Q and N forms are available at the LHDN office.

More On Malaysia Income Tax 2020 (YA 2019)

Hopefully, this guide has helped answer your main questions about filing personal income taxes in Malaysia for YA 2019. For more in-depth information about all things income tax-related, check out our other articles below:

- How To File Your Taxes For The First Time

- Everything You Should Claim As Income Tax Relief Malaysia 2020 (YA 2019)

- Income Tax Glossary

- Understanding Income Tax Reliefs, Rebates, Deductions, And Exemptions In Malaysia

Comments (35)

My Canadian principal company listed on Canadian stock exchange plans to reward key management in the Malaysia office with share allocation. It is calculated based on our annual earnings. Total amount will be split 75%:25% with 75% paid out as bonus and 25% in allocated to shares with vesting periods. I am clear that 75% when we pay out will be taxable income but what about the 25% that is vested in shares. Is the 25% also taxable?

1. Is the GKP grant of RM3,000.00 received from LHDN tax exempt or taxable?

2. If tax exempt, amount credited into the enterprise’s bank and reported as other income, should this amount to be deducted out of the Net Profit in order to arrive at the Adjusted Income?

Hi there, do you happen to know if personal training comes under Lifestyle tax relief for sports?

could you explain as how is it below 34000 p.a. no need file with reference to the table

Hi, I am currently a third year uni student and recently I have quite a lot of money (>RM100k) from stocks and crypto. Do i have to pay tax in this case?

in Malaysia there are no capital gains tax. but if your income is derived from other bourses it’ll follow the tax laws of that country. for crypto, it’s a pretty grey area. while overall it sounds like you won’t be taxed, it’s best to double check with a tax consultant or a certified financial advisor.

I missed filing my income tax return of 2019, appreciate if you can explain how I could do it now.

Hi Jacie may I ask. From what I can see 8% of RM48 000 is RM3 840, which is different from the calculation shown in the example here. Am I missing something?

Jacie Tan you make everything so much better. Thank you!

I was told tax office don’t issue or give out hard copy of Form BE, Is that correct?

How can I get a hard copy of Form BE for manual filing?

Is it compulsory to do e-filing?

I am an Australian retiree living in Malaysia under the Malaysia My 2nd Home program. Am I liable to pay Malaysian income tax on bank interest and share dividends earned in Malaysia?

Hi would like to know if i work overseas ,how do i declare my income tax details? and do i need to pay income tax? i work in the company is not Malaysian company.

Hi, would like to know about non-resident tax income. if the person is oversea most of the time but working and getting paid (director fee) for the company in Malaysia, is it still under non-resident tax income?

Hi,

Can you assist me i have a question for regarding EA form Section F , in the Form BE which category under put in?

Dear Sirs,

I hv not receive my EA form for the 2019 income due to MCO the reason given to me.

I retired last April 2019 and my hsehold total income is less RM4,000.

Is my husband entitle for the RM1,600 relief from the goverment ?

How about this provision?

Mempunyai akaun kewangan di institusi kewangan di luar negara

If I have a restricted brokerage account in US opened by my company for managing company shares purchase at discounted price, do I need to pick Y?

i had purchased a unit of mobile phone of RM1,200 from a telco thru instalments (24 mths) in May 2019 and i do not have a receipt. How do I proof the purchase to LHDN?

for the parents reliet, if they have 4 children, one claiming with hospital n med receipts. the other 3 can still divide the remaing 1500/3=500 right?

If my Unifi bill is under my wife’s name but I’m paying for it, can I still claim it for my personal tax relief under the Lifestyle Tax Relief?

No 🙁 It has to be under your name

How do i know which branch should i go if i need to do amendment to my e-filling ? Where to check which brand i registered ?

Best thing to do is to call LHDN and ask! 🙂

Your summary really make my life easier. Great thanks to you !

This is so comprehensive and easy to read for me. Thank you Jacie Tan!

We’re glad it helped! 🙂

Can I claim my parents cataract operation under parents medical expenses?

It doesn’t look like it’s covered under what is expressly mentioned in the explanatory notes, but please do check with LHDN directly for confirmation.

Hi, would like to know if buying laptop with an installment plan, can claim for income tax?

Yeap, the original invoice should show the full price of your laptop.

Just want to know two things. 1] Can i get a rebate for Tall Tax paid for official tour ? and 2] Can i get a rebate for badminton shuttle expanses ? if yes than pl guide me under which section ?

Hi there, we’re not very sure what your first query is referring to, so it’s probably best if you contact LHDN directly. As for the shuttlecocks, yes you can claim them as tax relief under “Lifestyle” as they count as sports equipment – just make sure you keep the receipt.

Hi, what does Membership subscription for Professional Body mean? Does it only apply to medic and legal? What about audit or IT Professional Body like ISACA, CISSP, etc

It says that the deduction is allowed for “membership subscription paid to professional bodies to ensure the continuance of a professional standing for practice”. For further clarification, it’s best to email or call LHDN directly to check!

can i claim for the braces which caused by overbite problem?

It’s unlikely that it would fall under any of the tax relief claims allowed.