Samuel Chua

23rd December 2025 - 3 min read

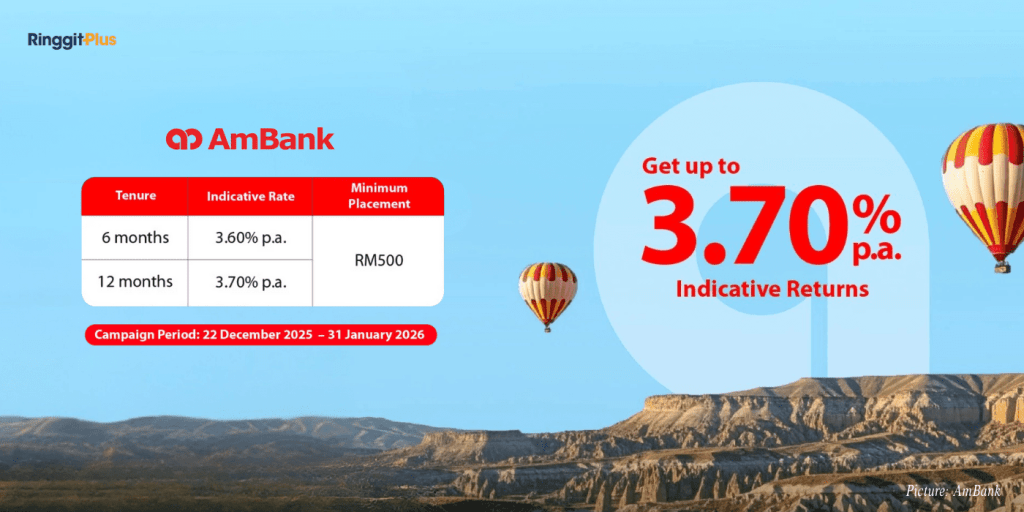

AmBank Islamic is offering a limited-time promotion for its Mudarabah Term Investment Account-i, or MTIA-i, with indicative rates of up to 3.70% per annum. The promotion applies to over-the-counter placements made between 22 December 2025 and 31 January 2026.

MTIA-i is an Islamic investment account structured under the Mudarabah concept, where profits are shared between the customer and the bank based on a pre-agreed arrangement. This product is not protected by Perbadanan Insurans Deposit Malaysia (PIDM).

Promotion Overview

The promotion is available to individual retail banking customers of AmBank Islamic. Both new and existing customers are eligible to participate. Employees of the AmBank Group and their immediate family members may also take part, although staff rates do not apply.

Only the Mudarabah Term Investment Account-i qualifies under this campaign. Other deposit or investment products are excluded.

Indicative Rates And Investment Tenure

Two investment tenures are available under the promotion. A six-month tenure offers a promotional indicative rate of 3.60% per annum, where 72% of the profit is allocated to the customer and 28% to the bank. A twelve-month tenure offers a higher promotional indicative rate of 3.70% per annum, where 74% of the profit is allocated to the customer and 26% to the bank.

The minimum placement amount is RM500. The promotional indicative rate applies for one investment cycle only.

For reference, a placement of RM5,000 into a twelve-month MTIA-i at an indicative rate of 3.70% per annum, starting on 24 December 2025, would generate an indicative profit of RM185 upon maturity on 24 December 2026, based on a 365-day investment period. Indicative profits are not guaranteed and depend on the performance of the underlying investment.

Maturity And Profit Credit

Upon maturity, the principal amount will be automatically renewed for the same tenure at the prevailing indicative board rate. The promotional indicative rate will not apply to the renewed placement.

Any profit earned during the promotional tenure will be credited to the customer’s nominated current or savings account held with AmBank or AmBank Islamic.

Early Withdrawal Terms

Withdrawals made within seven calendar days from the placement date will not earn any profit. If an early withdrawal is made after seven days but before maturity, customers are entitled to receive 50% of the attributed profit, if any.

In the case of partial withdrawals, the remaining balance will continue until maturity under the original tenure.

Placements under this promotion must be made over the counter. The promotion cannot be combined with other AmBank Islamic campaigns, and no additional or preferential rates apply.

Customers are advised to review the official terms and conditions provided by AmBank Islamic, as the bank’s decision on all matters relating to the promotion is final and binding.

Those who require assistance may contact AmBank’s Contact Centre daily from 7.00 a.m. to 11.00 p.m. For the latest updates and full terms, customers should refer to AmBank Islamic’s official website.

Those looking to compare other Islamic fixed deposit and similar investment options available in Malaysia may find it helpful to review a broader range of offerings.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)