Alex Cheong Pui Yin

17th October 2023 - 2 min read

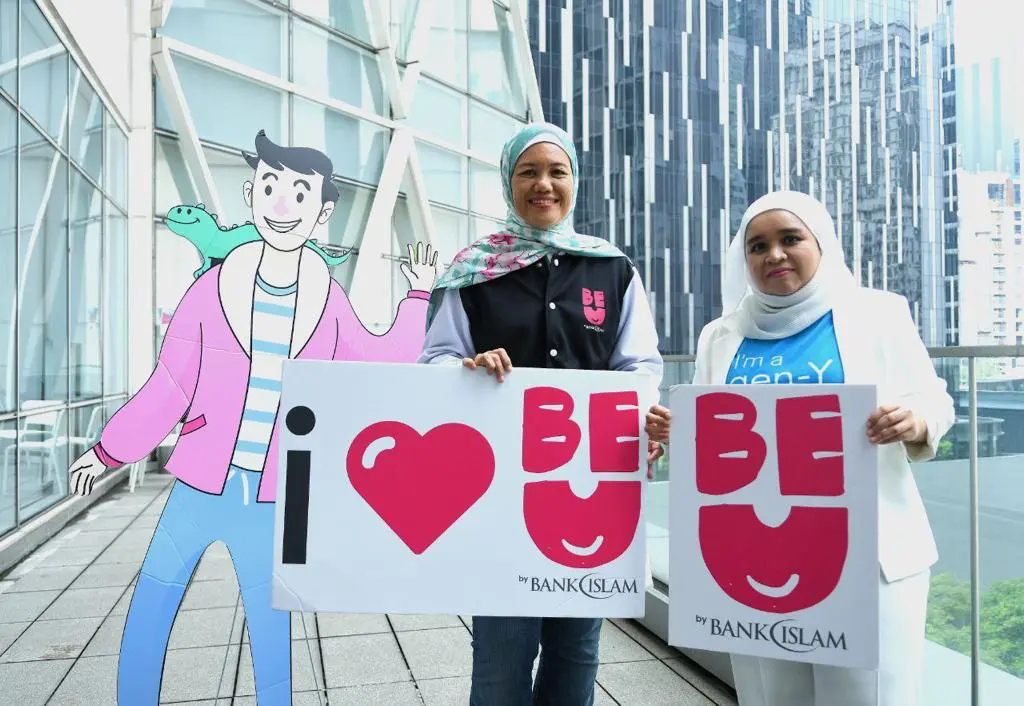

Bank Islam has entered into a partnership with digital recruitment platform for gig workers, Qwork, to provide flexible financial solutions tailored to freelancers’ needs. At the same time, Qwork can also tap into the Be U by Bank Islam (Be U) mobile banking app to share its available job listings.

In a statement, Bank Islam said that with this partnership, freelancers on Qwork will be able to access shariah-compliant banking products and services. In turn, this will help to address certain economic challenges faced by the growing gig workforce.

On top of that, Bank Islam will also help to promote Qwork’s advertised jobs within its Be U app, with the opportunities to be listed under the “Gig Marketplace” feature within the app. This aligns with Be U’s objective in catering to the needs of its younger customers – many of whom are seeking ways to earn extra income via short-term jobs.

Both Bank Islam and Qwork believe that this partnership will significantly impact the freelance community, unlocking new growth opportunities for gig workers to pave a way towards financial stability.

“We are delighted to collaborate with Qwork in our ongoing efforts to bolster the overall Be U app. Incorporating this use case into the app will empower users to handle their finances and earn their living. With everything on a single platform, users can easily track and manage their finances and access tailored solutions that cater to freelancers,” said the chief digital officer of Bank Islam Group, Noor Farilla Abdullah.

Similarly, the chief executive officer of Qwork, Muna Munirah said that the collaboration will empower freelancers and provide them with convenient access to Islamic banking products and services. “This collaboration aims to democratise benefits with the likes of working for an MNC for the gig workers, aka freelancers on Qwork,” she said.

For context, the Be U app by Bank Islam was officially launched back in mid-2022, followed subsequently by a debit card offering in September 2023. There are also upcoming plans to introduce new features on the Be U mobile banking app, such as flexible financing options, digital payment solutions, and financial planning services.

Comments (0)