Alex Cheong Pui Yin

2nd September 2022 - 4 min read

Several banks in Malaysia are currently running a survey, which aims to reassess the financial situation of customers who had applied for repayment assistance due to the Covid-19 pandemic back in 2020 and 2021. It also sought to gauge affected customers’ readiness to revise their monthly repayment amounts and shorten their tenure so that they can save on borrowing or financing costs – if their current financial circumstances allow it.

If you’ve been banking with Public Bank, UOB Bank, or Bank Rakyat – and have tapped into their Covid-19 repayment assistance – then you may have been contacted by them to take part in the survey. Some key things that you should note about the surveys from each bank include:

Public Bank

Public Bank’s survey is quite detailed, with two sets prepared for different groups of customers:

| Survey form | Customer group | Deadline |

| Retail loan survey form | Only for targeted repayment assistance (TRA) customers | Survey must be completed within 7 days from receiving invite from the bank (in the last week of August 2022) |

| Hire purchase survey form | For hire purchase customers | Survey must be completed by 31 March 2023 |

Customers can choose to complete the survey online, or download the survey form to manually fill it in. If you opt to download and fill in the form manually, your completed form must then be emailed to either CCS@publicbank.com.my (retail loan survey form) or hpcovidsupport@publicbank.com.my (hire purchase survey form).

PBB also noted that customers who indicate a desire to revise their monthly instalment upwards may be contacted at a later date. In fact, customers who wish to do so can approach the bank anytime during the loan/financing tenure if their financial circumstances have improved.

If you’d like a clear clarification as to how an increased monthly repayment with shortened tenure may benefit you, Public Bank’s survey page has prepared clear illustrations as well.

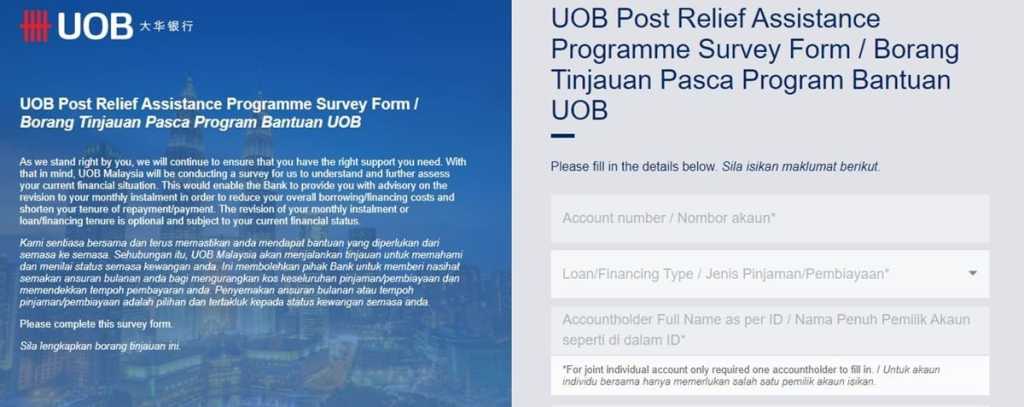

UOB Bank

UOB’s post-relief assistance survey is equally – if not more – concise. Customers are only required to fill in their banking and personal details, and inform the bank whether they would consider shortening their loan or financing tenure in order to reduce their total interest or financing costs.

UOB said that the survey will enable the bank to advise customers on whether they can or should opt to increase their monthly repayments, and by how much (if they are able to). It also noted that the revision of customers’ monthly instalment or loan/financing tenure is optional, and is subject to their current financial status.

Bank Rakyat

Similarly, Bank Rakyat is also hosting its own post-relief assistance survey. Unlike Public Bank and UOB – who both built an online platform for it – Bank Rakyat said that it will identify and contact affected customers instead.

In an FAQ, Bank Rakyat explained that it will reach out to customers who requested for repayment assistance between 1 October 2020 to 31 December 2021, and who meet the following criteria:

- Customers with floating-rate financing

- Financing with no arrears as of the survey date

Identified customers will first be informed of the bank’s decision to select them for the survey via SMS or email, and then subsequently be contacted for the actual survey at a later date.

Bank Rakyat also reiterated that this particular survey only aims to collect information; those who are interested in revising their repayment amounts will be contacted a second time after the survey to discuss matters in detail.

***

Between 2020 to 2021, banks in Malaysia had rolled out numerous repayment assistance programmes to assist customers who were badly affected by the Covid-19 pandemic and subsequent movement control order (MCO) restrictions that were put in place. On top of two blanket moratoriums (in April 2020, and then June 2021), there were also various targeted repayment assistances.

Comments (0)