Alex Cheong Pui Yin

19th January 2023 - 3 min read

CIMB Bank has rolled out a new self-service security feature called Lock Clicks ID, which functions as a “kill switch” for both its CIMB Clicks and CIMB OCTO mobile banking app. Intended as a way to provide better scam protection, this new feature allows the bank’s customers to immediately freeze their online banking ID if they suspect that their banking account or details have been compromised.

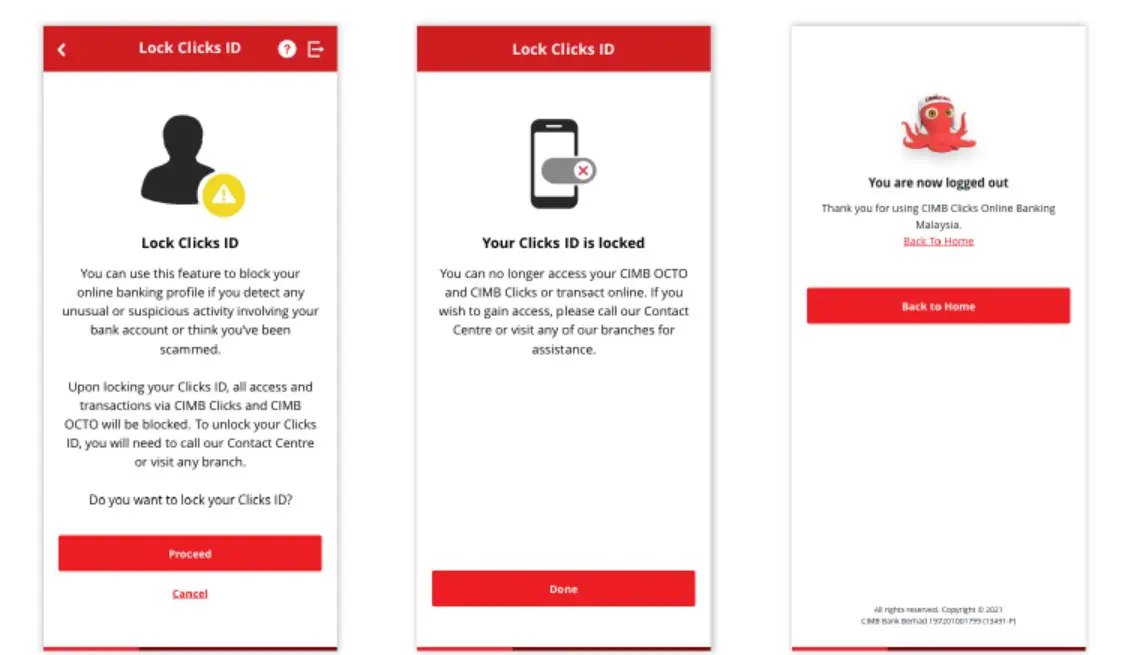

In a statement, CIMB explained that once the Lock Clicks ID has been activated, users will be automatically logged out of their banking apps, without the ability to log back in until they have reached out to CIMB’s customer service. Accordingly, any new outgoing online transactions will also be blocked. Customers will still, however, be able to access their accounts at ATMs or bank branches.

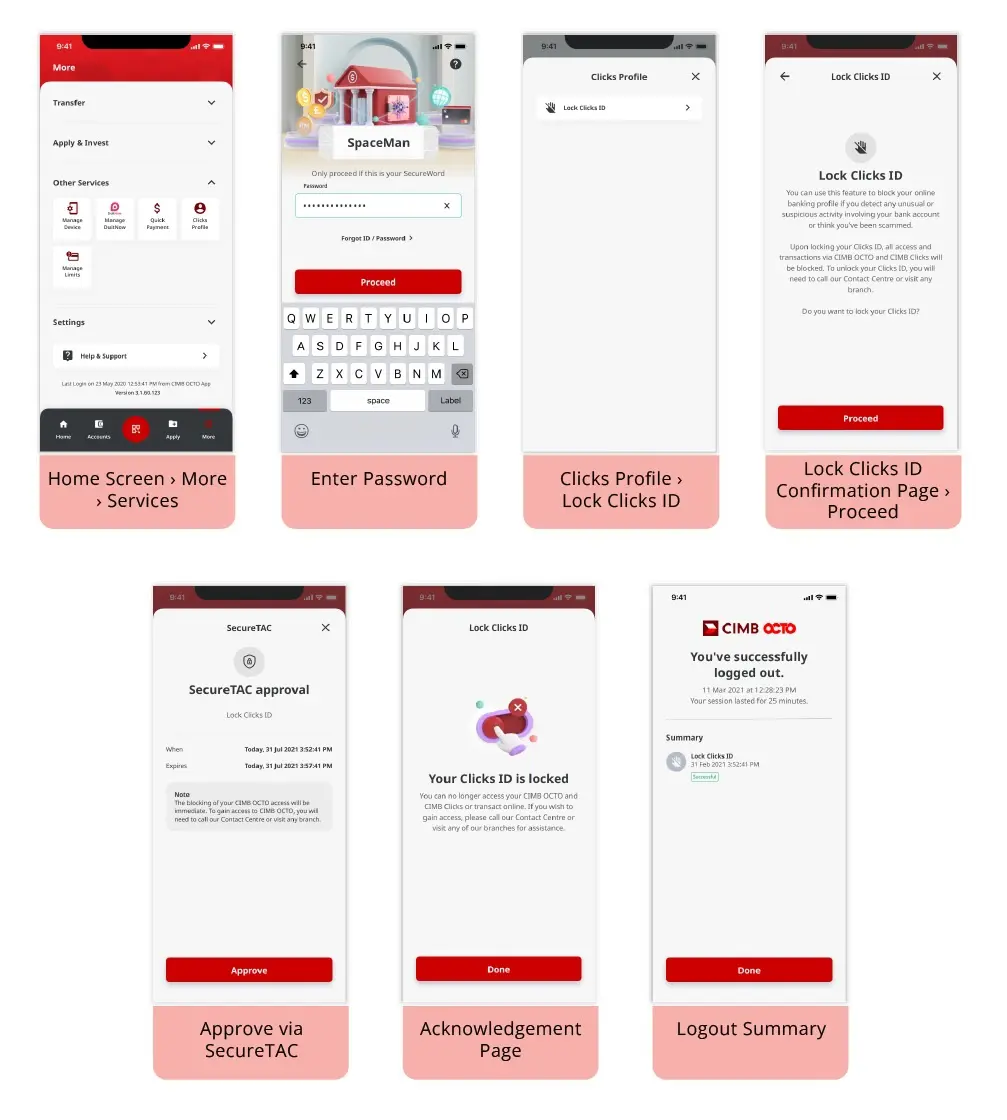

To enable the Lock Clicks ID feature on either the CIMB Clicks or CIMB OCTO app, go to “Services” once you’ve fired up your app, then tap on “Clicks Profile”, followed by “Lock Clicks ID” and “Proceed”. Depending on whether you are using the CIMB Clicks or CIMB OCTO app, you may be required to verify the action before the process is completed. You’ll also receive a notification to confirm that your Lock Clicks ID feature has been activated, and that your account is successfully locked.

As for unlocking your account, you’ll need to contact CIMB’s Consumer Contact Centre or visit a bank branch to perform the necessary verification. You should then be able to regain access using your existing credentials, but it would be best practice to change your password as soon as possible after that.

Chief executive officer of group consumer and digital banking for CIMB, Effendy Shahul Hamid further said that CIMB is the first bank in Malaysia that allows customers to freeze their digital profile entirely in-app, while still allowing banking access at ATMs or branches. “This self-initiated feature will add an additional layer of security as part of CIMB’s market leading initiatives in line with our commitment to ensure our customers can bank securely and confidently at all times,” he added.

The Lock Clicks ID is the latest addition to a series of anti-scam measures that CIMB has been rolling out over the past few months, in line with Bank Negara Malaysia’s (BNM) directive to all banks to strengthen their online banking security. Other initiatives that have also been introduced by CIMB include allowing only a single registered device for CIMB Clicks authentication and making SecureTAC authorisation mandatory for transactions of RM100 and above.

Finally, CIMB customers are urged to update the operating system of their devices and their mobile banking app to the latest version as the new security feature will only operate on up-to-date mobile operating systems.

Comments (0)