Samuel Chua

6th November 2024 - 3 min read

GXBank has marked its first anniversary with the launch of “GX 2.0 – Next Starts Now”, unveiling its product roadmap of new financial products aimed at empowering Malaysians and micro, small, and medium enterprises (MSMEs) for the next phase of its operations.

Over the past year, the first digital bank to launch in Malaysia has marked various milestones, with nearly one million Malaysians customers, over 24 million debit and QR transactions, and more than 900,000 Savings Pockets created.

GXBank’s next phase, dubbed GX 2.0, brings a suite of new and innovative products to serve an expanded segment of the population and support their financial goals. Here are the major announcements:

GX FlexiCredit

Launching progressively in November, GX FlexiCredit offers Malaysians instant approval for credit lines of up to RM150,000, with cash disbursed in minutes. A hybrid product that’s neither a traditional personal loan nor a credit card, GX FlexiCredit acts as a flexible credit solution allowing immediate cash drawdown while charging interest only on the drawn amount.

There are still various details not mentioned about this product, and we expect additional info to be shared to customers closer to its rollout.

GX Biz Banking for MSMEs

In line with the government’s Belanjawan Madani 2025 to help bridge the financing gap for MSMEs, GX Biz Banking aims to be a one-stop digital solution for businesses, specifically addressing challenges faced by MSMEs in Malaysia.

GXBank will be the first bank in Malaysia to offer fully digital-only business account opening and onboarding process, without requiring physical documentation and any visit to a physical branch. It will also be the first to offer daily interest payouts.

On top of that, customers can seamlessly apply for the GX Biz FlexiLoan via the GXBank app, with instant approval on credit lines of up to RM150,000. Featuring flexible loan tenures of up to three years and zero fees on early repayment, GX Biz Banking allows entrepreneurs to manage their business finances with ease, with nationwide rollout scheduled in Q1 2025.

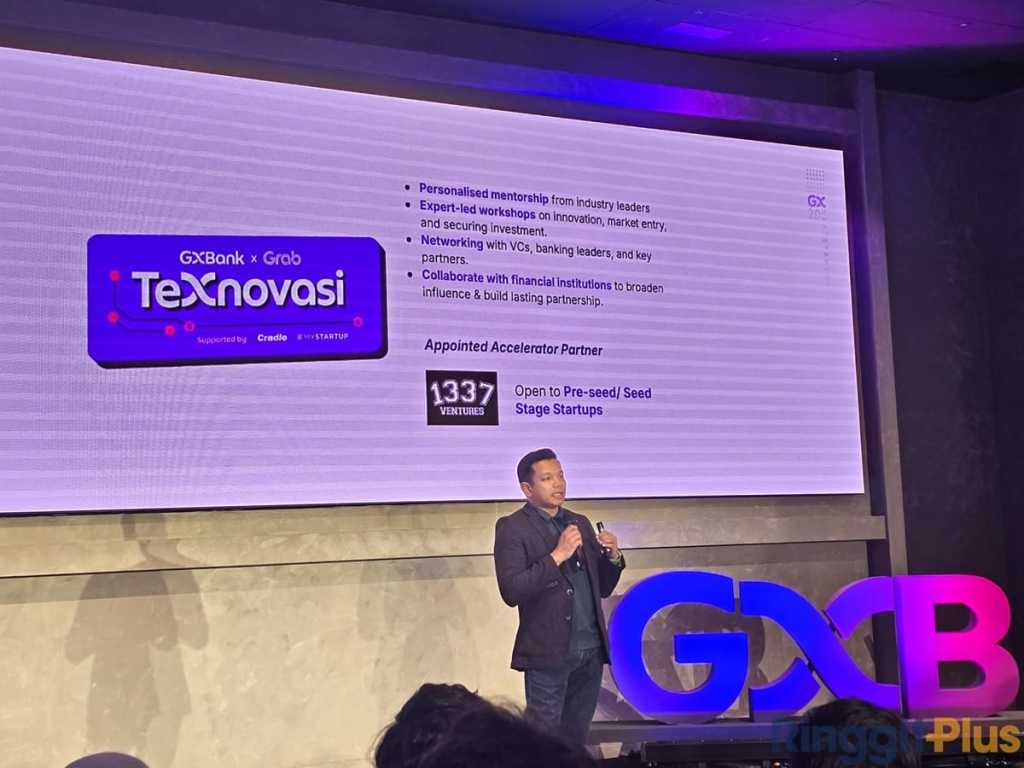

TeXnovasi: Empowering Tech Startups

In collaboration with Grab Malaysia and supported by Cradle, MYStartup, and 1337 Ventures, GXBank’s TeXnovasi programme is a pioneering accelerator programme aimed at uplifting Malaysia’s tech startup ecosystem through public-private partnerships.

The accelerator programme’s mission is to empower tech startups with tailored mentorship from industry leaders, expert-led workshops on innovations, market entry support, and resources to secure investments.

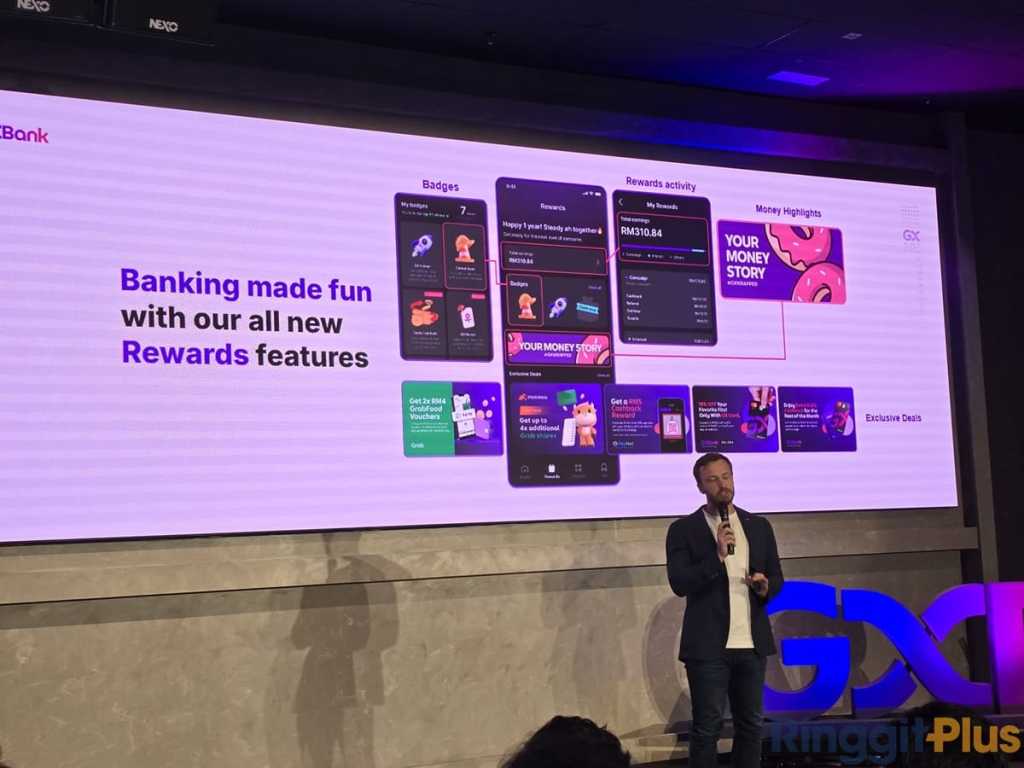

Personalised Banking with GX 2.0

Lastly, GXBank will also introduce new features designed to make banking more engaging, including:

• Alni – GXBank’s multilingual AI chatbot: Alni offers seamless support in both Bahasa Malaysia and English, claiming that the chatbot can understand our colloquial Bahasa Rojak. It would efficiently handle queries and, when needed, connect users to a human “GXBuddy” for further assistance.

• #GXWrapped: Similar to the popular Spotify Wrapped feature, users can explore their Money Story, a fun, easy-to-understand summary of their save and spend behaviour throughout the year, as well as discover their “Money Personality”.

• Collectible Badges: Customers can earn badges by completing various challenges, which come with perks and access to exclusive deals, allowing them to showcase their achievements.

*****

With its first year of operations now over, GXBank’s product roadmap for the next year and beyond shares a glimpse of its innovative solutions designed to empower Malaysians and MSMEs, marking a new phase in its commitment as a digital bank to serve the underserved and underbanked communities in Malaysia.

Comments (0)