Alex Cheong Pui Yin

18th December 2023 - 3 min read

RHB Bank is running its Smart Move Balance Transfer (BT) via RHB Online Banking campaign, which allows eligible credit cardholders to tap into balance transfer plans with special interest rates of 0% or 3.88% p.a.. Set to run until 30 June 2024, this is in conjunction with RHB’s launch of its new online channel for the application of balance transfers.

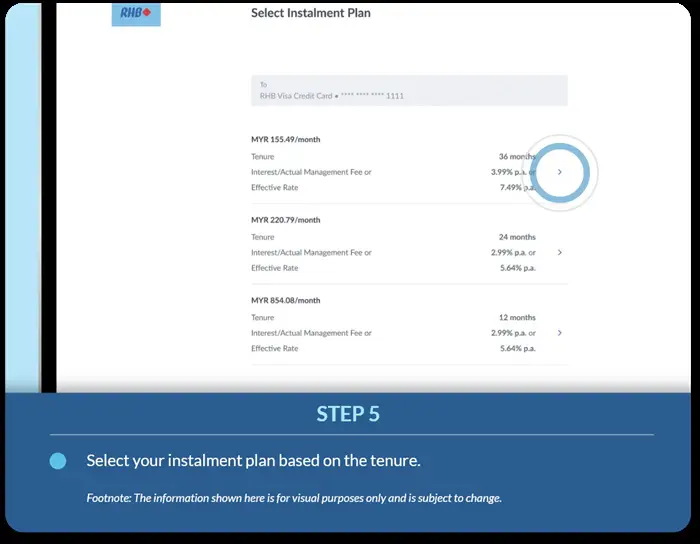

Open to all RHB principal credit cardholders, you’ll be able to enjoy the following special interest rates when you apply for balance transfer plans with 12-, 24-, or 36-month tenure through the new online channel – but note that there are two phases to the campaign, as you can see below:

| Campaign period | Tenure | Interest rate/actual management fee | Effective rate |

| Phase 1 (9 Dec 2023 – 31 Jan 2024) | 12 months 24 months 36 months | 0.00% p.a. 3.88% p.a. 3.88% p.a. | 0.00% p.a. 7.28% p.a. 7.29% p.a. |

| Phase 2 (1 Feb – 30 June 2024) | 12 months 24 months 36 months | 3.88% p.a. 3.88% p.a. 3.88% p.a. | 7.09% p.a. 7.28% p.a. 7.29% p.a. |

For comparison, the current interest rates for RHB’s Smart Move Balance Transfer plans range between 4.88% p.a. to 6.88% p.a., depending on whether you are taking up the 6-, 12-, 24-, or 36-month plan.

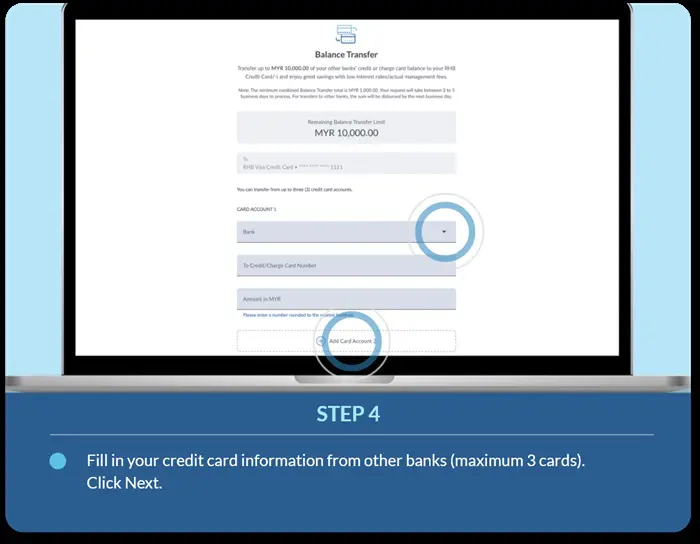

RHB further clarified that the minimum balance transfer amount allowed under this campaign is set at RM1,000, whereas the maximum amount is limited to 80% of your available credit limit. Additionally, the bank shared that there will be a late payment charge of up to 1% on the outstanding balance or RM10 – whichever is higher – if you fail to pay at least the minimum monthly amount when you take up any balance transfer plans from RHB.

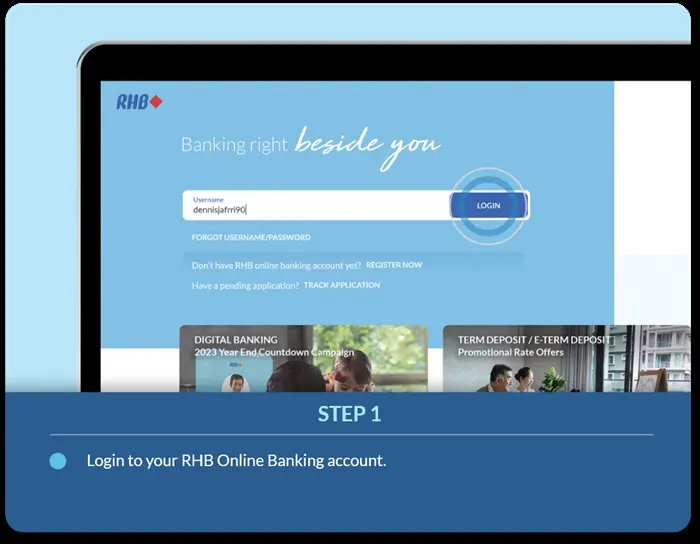

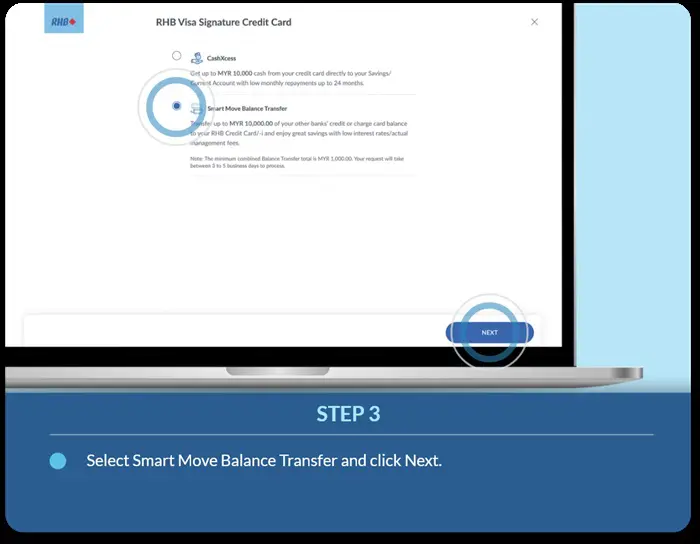

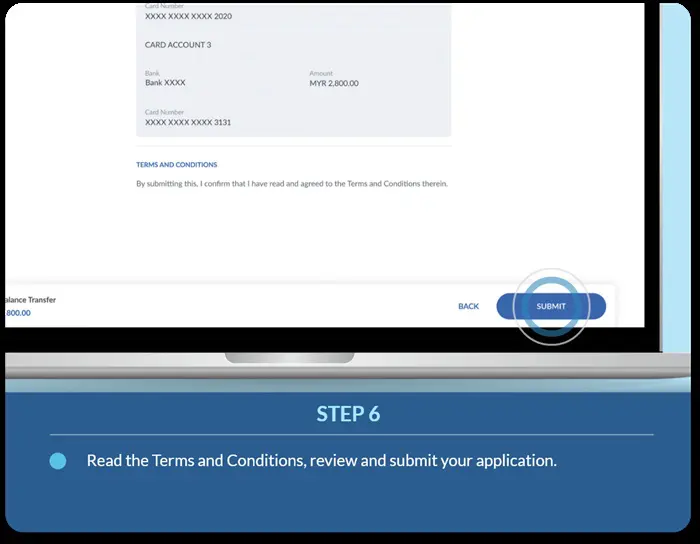

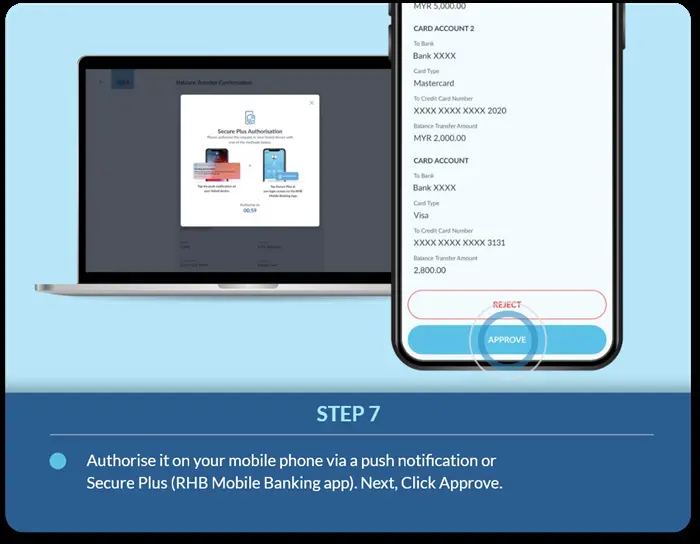

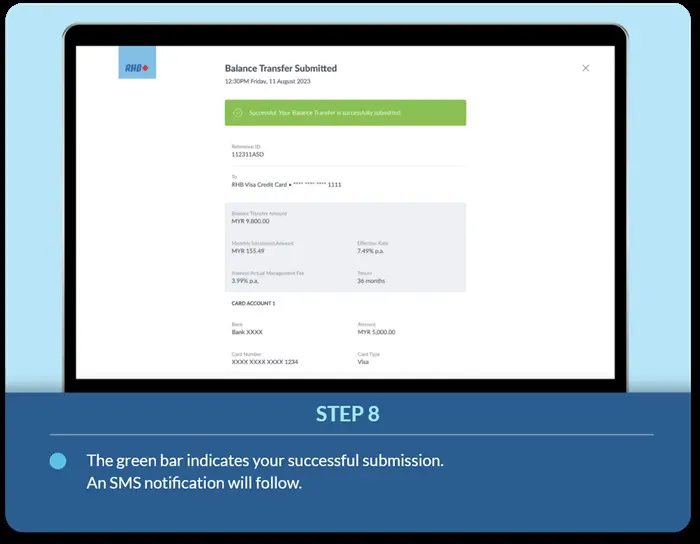

If you’d like to take advantage of these special rates under the campaign, you’ll need to make sure to apply for RHB’s Smart Move Balance Transfer plans via the new online banking method. To do so, log in to your RHB Online Banking account, and follow the visual guide below that was provided by RHB Bank:

Do be aware that supporting documents may be needed for certain applications, depending on the nature of your occupation. These include your NRIC, as well as your latest payslips and Employees Provident Fund (EPF) statement.

For context, customers were previously not able to apply for RHB’s Smart Move Balance Transfer on their own via online channels. Instead, they could only do so by sending an SMS or email to the bank, or by calling the customer contact centre to submit a request. Alternatively, they could leave their contact details online for bank personnel to get in touch with them.

With the introduction of the new online application method, RHB said that customers can benefit from instant approvals for their applications, as well as enjoy immediate transfers once approval has been granted. No processing fee is charged for the service as well.

You can find out more about RHB’s Smart Move Balance Transfer here, and the campaign here.

(Source: RHB Bank)

Comments (0)