Alex Cheong Pui Yin

2nd February 2023 - 3 min read

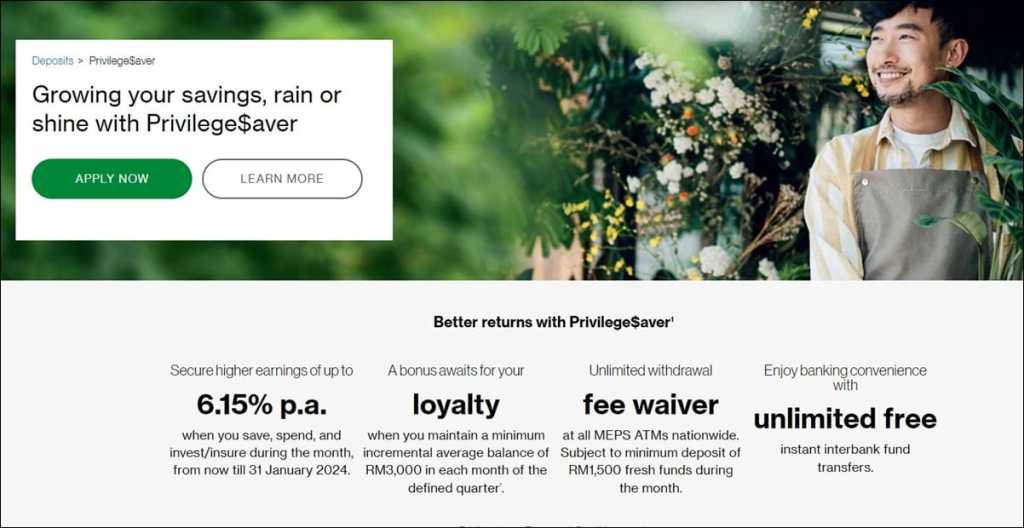

Standard Chartered has revised its Privilege$aver campaign to introduce a new Loyalty Bonus category that allows accountholders to unlock yet another 2% additional interest, thereby raising the total interest rate that can be earned from 4.15% p.a. to 6.15% p.a.. This is set to take effect immediately.

For context, existing Standard Chartered Privilege$aver accountholders are able to increase their interest from a base 0.05% p.a. to 4.15% p.a. by fulfilling three requirements: Save (0.70% p.a.), Spend (0.70% p.a. for credit and debit card spend, respectively), and Invest/Insure (2.00% p.a.). Starting from this month, however, you can earn up to 6.15% p.a. by meeting a new fourth Loyalty Bonus requirement (additional 2% p.a.), which involves increasing the balance in your Privilege$aver account by a minimum of RM3,000 every month.

Note, though, that while the bonus interest for the Save, Spend, and Invest/Insure categories are calculated for each calendar month, the new Loyalty Bonus will only be awarded on a quarterly basis (provided you meet the requirement for all three months in the quarter). It will be calculated based on your monthly average balance (MAB) for each quarter.

Here’s a table to quickly summarise the new earning structure for Standard Chartered’s Privilege$aver campaign, as compared to the existing conditions:

| Category | Existing earning requirement | Earning requirement after 1 February 2023 | Existing interest rate | Interest rate after 1 February 2023 |

| Base interest | – | – | 0.05% p.a. | 0.05% p.a. |

| Save | Single deposit of minimum RM3,000 in fresh funds | Single deposit of minimum RM3,000 in fresh funds | 0.70% p.a. (calculated monthly) | 0.70% p.a. (calculated monthly) |

| Spend: Credit card bonus | Minimum spend of RM1,000 | Minimum spend of RM1,000 | 0.70% p.a. (calculated monthly) | 0.70% p.a. (calculated monthly) |

| Spend: Debit card bonus | Minimum 5 transactions per month | Minimum 5 transactions per month | 0.70% p.a. (calculated monthly) | 0.70% p.a. (calculated monthly) |

| Invest/Insure | – Minimum RM40,000 investment in unit trust, or – RM40,000 annual premium in insurance products | – Minimum RM40,000 investment in unit trust, or – RM40,000 annual premium in insurance products | 2.00% p.a. (calculated monthly, but only for 3 months) | 2.00% p.a. (calculated monthly, but only for 3 months) |

| Loyalty Bonus | N/A | Maintain a minimum incremental average balance of RM3,000 in each month | N/A | 2.00% p.a. (calculated quarterly) |

| Total interest | 4.15% p.a. | 6.15% p.a. |

In addition to the introduction of the new Loyalty Bonus category, Standard Chartered has also decided to remove a special offer for new Privilege$aver customers, which was introduced back in January 2022. This offer enabled new-to-bank customers who maintain a monthly average of RM10,000 in their Privilege$aver accounts to enjoy another bonus rate of 0.70% p.a.– on top of all the bonus interest that they can earn via the Save, Spend, and Invest/Insure categories. This special bonus was previously payable on a monthly basis, for the first three months upon opening their accounts.

With this update, Standard Chartered is bringing the interest rate of its Privilege$aver campaign back to its heyday; prior to multiple revisions in 2021 and 2022 due to the reduction of the overnight policy rate (OPR), Privilege$aver accountholders were able to earn up to 6% p.a. interest. Of course, there are now also more hoops to jump through to unlock this new high rate of 6.15% p.a – which may, understandably, deter some customers – but if you’re able to do it, the Privilege$aver campaign remains one of the most rewarding high-interest savings accounts in Malaysia.

(Source: Standard Chartered)

Comments (1)

Ridiculously complicated.