Alex Cheong Pui Yin

10th January 2022 - 3 min read

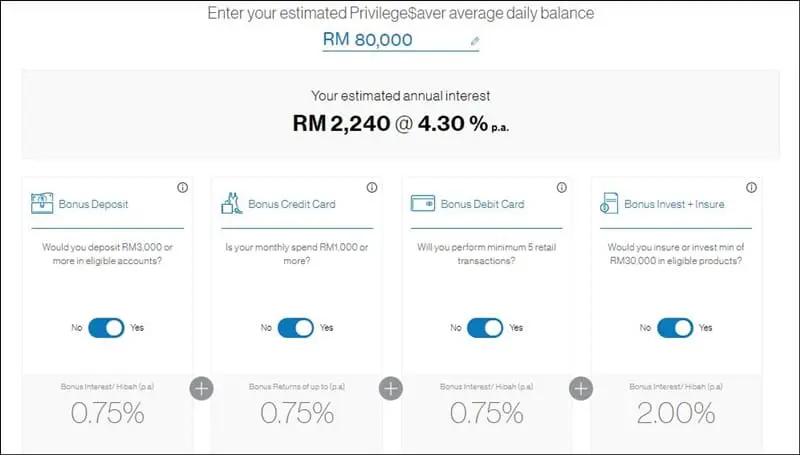

Come 1 February 2022, Standard Chartered is revising the bonus interest rates that can be earned via the Save and Spend categories in its Privilege$aver campaign, bringing the total interest that can be earned down from 4.30% p.a. to 4.15% p.a.. This is on top of a separate amendment to the earning requirements of the Invest/Insure category, and the introduction of a special offer for new Privilege$aver customers.

Firstly, Standard Chartered is reducing the bonus interest rates for its Save and Spend categories from 0.75% p.a. to 0.70% p.a. This means you’ll now earn 0.05% p.a. less under the Save category, and 0.10% p.a. less under the Spend category (0.05% for both debit and credit card spend, respectively).

Additionally, the bank is also increasing the minimum amount that you must invest in unit trust, or the minimum annual premium/contribution value insurance that must be purchased in order to be eligible for the 2.00% bonus interest earned under Invest/Insure. Currently, it is set at a minimum of RM30,000, but from February onwards the minimum amount will increase to RM40,000.

Here’s a table to better capture the breakdown of the changes, in comparison with the current rate and requirements:

| Category | Existing earning requirement | Earning requirement after 1 February | Existing interest rate | Interest rate after 1 February |

| Base interest | – | – | 0.05% p.a. | 0.05% p.a. |

| Save | Single deposit of minimum RM3,000 in fresh funds | Single deposit of minimum RM3,000 in fresh funds | 0.75% p.a. | 0.70% p.a. |

| Spend (i) Credit card | Minimum spend of RM1,000 | Minimum spend of RM1,000 | 0.75% p.a. | 0.70% p.a. |

| (ii) Debit card | Minimum 5 transactions per month | Minimum 5 transactions per month | 0.75% p.a. | 0.70% p.a. |

| Invest/Insure | (i) Minimum RM30,000 investment in unit trust, or (ii) RM30,000 annual premium in insurance products | (i) Minimum RM40,000 investment in unit trust, or (ii) RM40,000 annual premium in insurance products | 2.00% p.a. | 2.00% p.a. |

| Total | 4.30% p.a. | 4.15% p.a. |

Aside from these changes, Standard Chartered is also introducing an additional offer for new current and savings account customers, including those who sign up for the Privilege$aver campaign. Under this special offer, new-to-bank customers who maintain a monthly average of RM10,000 in their accounts will enjoy another bonus rate of 0.70% p.a. (capped at a maximum of RM100,000) – applicable for three months upon the opening of the account.

In other words, if you’re a new Privilege$aver customer who ticks all of the eligibility criteria mentioned above starting from 1 February, you will be entitled to earn 4.85% p.a. for the first three months. After that, the interest earned will lessen to the revised 4.15% p.a..

Over the last two years, Standard Chartered’s Privilege$aver campaign has seen several revisions that brought its once-high rate of 6% p.a. to the current 4.30% p.a.. Despite the reduced interest rates, however, it is expected to remain as one of the best high-interest savings accounts in Malaysia, given that it continues to offer rates that exceed 4.00% p.a..

Standard Chartered’s Privilege$aver also provides perks such as unlimited fee waivers for withdrawals at all MEPS automated teller machines (ATMs) nationwide (subject to a minimum deposit of RM1,500 in fresh fund during the month), and unlimited free instant interbank fund transfers.

(Source: Standard Chartered)

Comments (0)