Pang Tun Yau

25th June 2020 - 4 min read

Editor’s Note: our original article from 19 June has been updated to include more details and edited for clarity. CIMB has also renamed the card from “e Platinum Credit Card” to “e Credit Card”.

CIMB Bank has launched a new credit card called the e Credit Card. This entry-level card offers bonus points multipliers of up to 12x on specific partners, and up to 10x points when topping up on every 10th of the month. CIMB also claims it offers the “best bank point conversion value” – and from our quick analysis, it does seem to be true.

CIMB e Credit Card – Huge Bonuses On Every 10th Of The Month

The standout feature of this card is the 12x Bonus Points multiplier with “strategic partners”, and 10x Bonus Points for online shopping, e-wallet, auto-billing payment, and in-store contactless spend. These bonuses happen only once a month – on the 10th of each month. CIMB calls it eDay, and cardholders will be rewarded with a slew of interesting offers.

In addition to the increased Bonus Points, CIMB will also offer exclusive deals that will only be valid on the 10th of each month. These offers certainly look interesting, such as RM49 off minimum spend of RM50 on Lazada, Shopee, and Taobao, or RM1 for a second beverage at Coffee Bean. All eDay deals can be found here.

Up To 5x Bonus Points For Everyday Use

For every day besides the eDay, cardholders earn 5x Bonus Points for online shopping, e-wallet, and auto-billing payment, and 1x Bonus Points for in-store payment (both contactless and PIN payments).

Given the scarcity of credit cards that offer any benefits for using them with e-wallets (both reloads and direct payment), it is refreshing to see this benefit featured prominently on the CIMB e Credit Card.

“Best Bank Point Conversion Value” – Is It True?

In its footnotes, CIMB states that its claim of this card having the “best bank point conversion value” is “in comparison against other consumer banks in Malaysia published as of 1 June 2020”.

At a rate of 400 Bonus Points = RM1, the actual value of the Bonus Point (and effective returns) will differ depending on the various points multipliers that this card offers:

| Bonus Points Multiplier | Value of 1 Bonus Point | Effective Returns (based on 400 BP = RM1) |

| 1x | 0.0025 sen | 0.25% |

| 5x | 0.0125 sen | 1.25% |

| 10x | 0.025 sen | 2.5% |

| 12x | 0.03 sen | 3% |

From the card’s terms and conditions, cardholders can earn a maximum of 20,000 Bonus Points per statement cycle – this means any additional use of the card won’t yield additional Bonus Points once you’ve hit the 20,000 mark.

That being said, with no minimum spend requirement to unlock any cashback tiers, you can earn up to 3% returns as long as you spend on the 10th of the month with the featured partners.

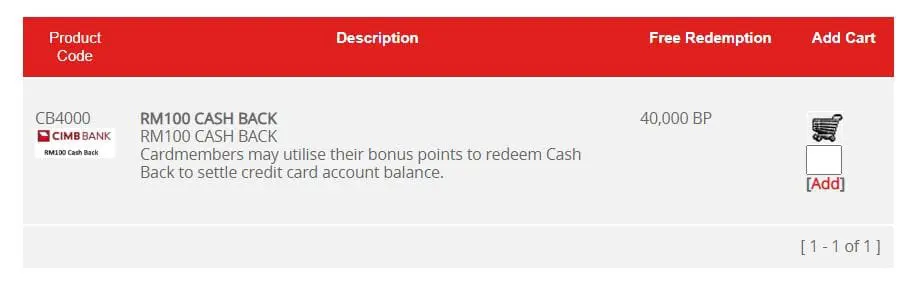

RM100 cash back redemption on the CIMB Rewards catalogue

CIMB also makes it easy to redeem the Bonus Points earned on the e Credit Card. The rate of 400 Bonus Points = RM1 applies to both CIMB Pay With Points and cashback redemption to offset the card statement. CIMB has a list of over 9,000 offline retail outlets that accept CIMB Pay With Points.

Other CIMB e Card Perks

CIMB e Credit Card has an “earth loving” feature, which covers features such as 100% e-statement policy, curated deals with eco-conscious brands, and a point donation programme with sustainability-driven NGOs.

In addition, this card also offers 0% Easy Payment Plans with tenures of up to 36 months, but only with selected outlets. According to CIMB, this 0% EPP covers over 4,000 outlets.

Entry-Level Requirements

The CIMB e Credit Card has a minimum annual income requirement of just RM24,000 – that’s RM2,000 a month.

The card also has a RM100 annual fee, but is waived upon an annual spending of RM12,000. As with most credit cards, the first-year annual fee is waived.

Comments (0)