Alex Cheong Pui Yin

16th August 2023 - 5 min read

Maybank has launched a pair of new sustainability-themed credit cards called the Maybank myimpact cards, consisting of a conventional Maybank myimpact Visa Signature card and a shariah-compliant Maybank Islamic myimpact Ikhwan Mastercard Platinum card-i. Offering up to 1% cashback and up to 5x TreatsPoints for selected payments, these are also the first cards in Malaysia to come with a carbon footprint tracker and carbon offset feature.

To start, the card faces of both the Maybank myimpact cards/-i clearly emphasised the sustainability theme, featuring an image of Mother Nature and Mother Earth at the very centre of the cards.

In terms of card benefits, Maybank myimpact cardholders will be able to earn either 0.5% or 1% cashback when they make contactless payments (including Apple Pay and Samsung Pay), or spend with selected eco-friendly merchants – capped at RM70 per month. On top of that, they can also earn 1x or 5x TreatsPoints for every RM1 spent, depending on the merchant that they spend with. Here are the full details:

| Benefits | Details | Eligible categories | Examples of brands |

| Cashback (capped at RM70 per month) | 1% cashback when spending with selected ESG-friendly (environment, social & governance) merchants | – Commuter rail and bus transportation – Ride-hailing & car rental services – Electric vehicle (EV) charging and solar energy services – Education – Sporting goods/membership and pharmaceutical items – Used merchandise stores and repair services | – KLIA Express – Grab – Trevo – ChargeHere EV Solution – Tenby Schools – Open University Malaysia – Celebrity Fitness – ClassPass – Guardian Pharmacy – Caring Pharmacy – Mister Minit – Cash Converters – 99 Leather Kraft |

| 0.5% cashback on other retail spend paid using contactless payment, Apple Pay, and Samsung Pay | N/A | N/A | |

| TreatsPoints (three-year validity from issuance date) | 5x TreatsPoints for every RM1 spent with selected merchants | – Electric vehicle (EV) – Eateries – Books – Organic skincare – Local organic grocers – Local fashion & lifestyle merchants | – Tesla – O’Briens Irish Sandwich Café – Kindle – Aesop – Innisfree – Justlife Shop – The Hive Bulk Food – Hello Natural Co |

| 1x TreatsPoint for every RM1 spent on other retail expenses* * not applicable for petrol, airlines, government bodies/JomPAY, e-wallet reloads, and cash advances | N/A | N/A |

As you can see, the cards’ higher 1% cashback and 5x TreatsPoints benefits are reserved primarily for expenses made with eco-friendly and sustainable merchants, essentially conforming to the cards’ theme. Of course, in addition to this, remember that the Maybank Islamic myimpact Ikhwan Mastercard Platinum card-i comes with the usual restrictions for spending with non-shariah compliant merchants (such as alcohol and gambling).

Both the Maybank myimpact cards/-i also come with additional travel and e-commerce perks, although the exact benefits will differ for the Maybank myimpact Visa Signature and the Maybank Islamic myimpact Ikhwan Mastercard Platinum card-i. This is because these perks are provided as complimentary benefits/packages by the respective card issuers (Visa and Mastercard). Here’s a quick review for your convenience, as listed by Maybank on its page:

| Maybank myimpact Visa Signature | Maybank Islamic myimpact Ikhwan Mastercard Platinum-i |

| – Maybank Visa Signature customer service (24/7) – Visa Airport Speed Pass for fast-track immigration at over 280 international airports – Visa Signature Concierge – Travel insurance coverage of up to RM2 million | – E-commerce protection – Mastercard Global services – Mastercard Concierge – Exclusive deals on Mastercard Priceless page |

In addition to these benefits, Maybank myimpact cardholders also will not need to worry about any of the following fees:

- Compounding fees/effective management fees (especially beneficial for Maybank myimpact Visa Signature cardholders, as conventional cards will typically compound its interest charges)

- Late payment charges

- Annual fees

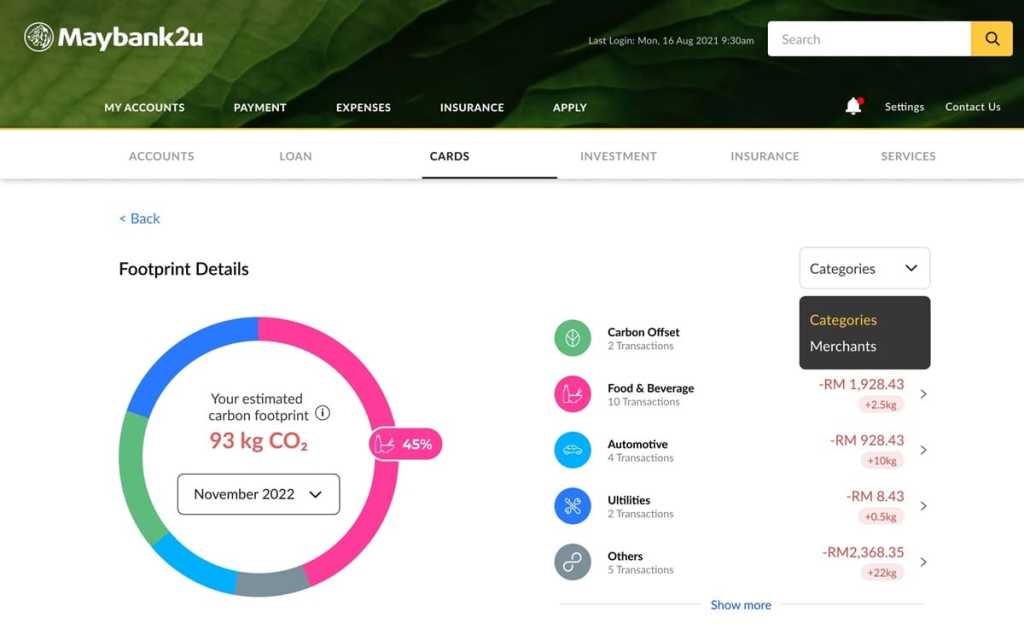

The one exclusive feature that makes the Maybank myimpact cards/-i a unique proposition in the market, however, is the carbon footprint tracker and carbon offset function that come with the card. The carbon footprint tracker will be enabled for you on your MAE by Maybank2u (MAE) app and the Maybank2u website when your card application is approved, and you’ll then be able to calculate your carbon dioxide emission (assessed via your transactions with the merchants whom you shop with).

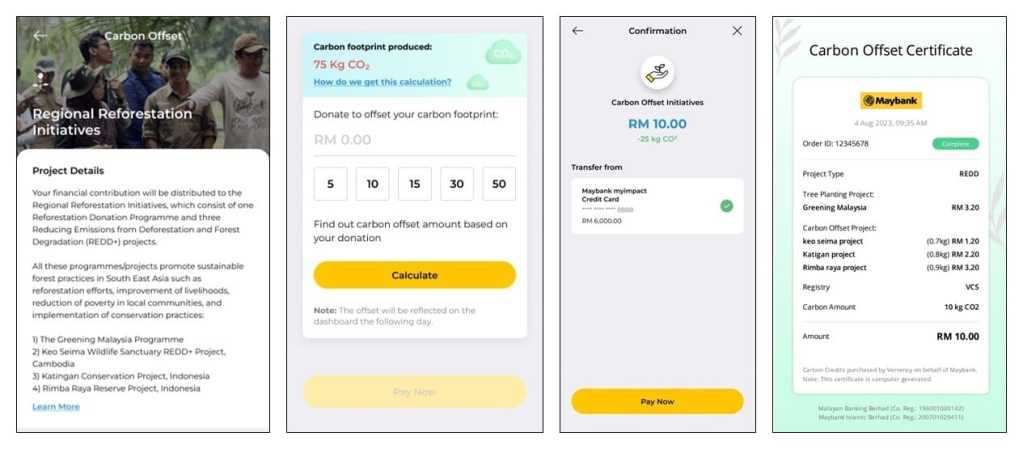

From there, you can then choose to offset your carbon footprint through a Carbon Offset feature in your account. This involves making a financial contribution, which will go towards regional reforestation initiatives such as The Greening Malaysia Programme, Keo Seima Wildlife Sanctuary REDD+ Project (Cambodia), and Katingan Conservation Project (Indonesia) – just to name a few.

Finally, the Maybank myimpact cards/-i themselves are produced from eco-friendly and biodegradable material, where parts of the cards are made from renewable bio-sourced polylactic acid (PLA). Notably, Maybank has announced back in 2022 that it is adopting this particular material for its Amex, Mastercard, and Visa Ikhwan cards as part of its sustainability drive.

With an annual income requirement of RM36,000 (RM3,000 per month), the Maybank myimpact credit cards/-i are essentially entry-level cards. If you’re someone who’s highly conscious about your carbon footprint and is eager to play a part in protecting the environment, these cards may be a good option for you to adopt sustainable spending.

If you apply now, you can earn a welcome bonus cashback of RM50 when you spend a minimum of RM1,500 within 90 days from card approval (must include three transactions in ESG-friendly categories). You can also earn entries to win a range of eco-friendly prizes – such as the Mercedes Benz EQA 250, energy-efficient home appliances or RM5,000 worth of Grab vouchers – when you transact with your Maybank myimpact credit cards.

Comments (0)