Alex Cheong Pui Yin

30th June 2023 - 2 min read

OCBC Bank said that it has updated its list of transactions that are not eligible to enjoy its credit card benefits, such as earning cashback and rewards points, as well as conversion to 0% interest auto instalment payment plans (auto-IPP). Cardholders will see the addition of several new exclusions, including FPX and DuitNow QR transactions.

Set to take effect from 20 July 2023, the following transactions will soon be excluded for rewards calculation and auto-IPP under OCBC’s credit cards:

- JomPAY transactions

- FPX transactions

- DuitNow QR transactions

- Any transactions made in the United Kingdom, or in a country that is a member of the European Economic Community (EEC) or European Union (EU). These include Austria, Belgium, France, Germany, and Italy – among others. You can find the full list here.

These aforementioned transactions will be added to the existing list of exclusions, which includes balance transfer, donations to charities, and government-related payments – all of which also do not qualify for your credit cards’ rewards calculations and benefits. To note, transactions like balance transfers, charity donations, and government-related payments are standard exclusions for most credit card benefits, implemented by banks in general.

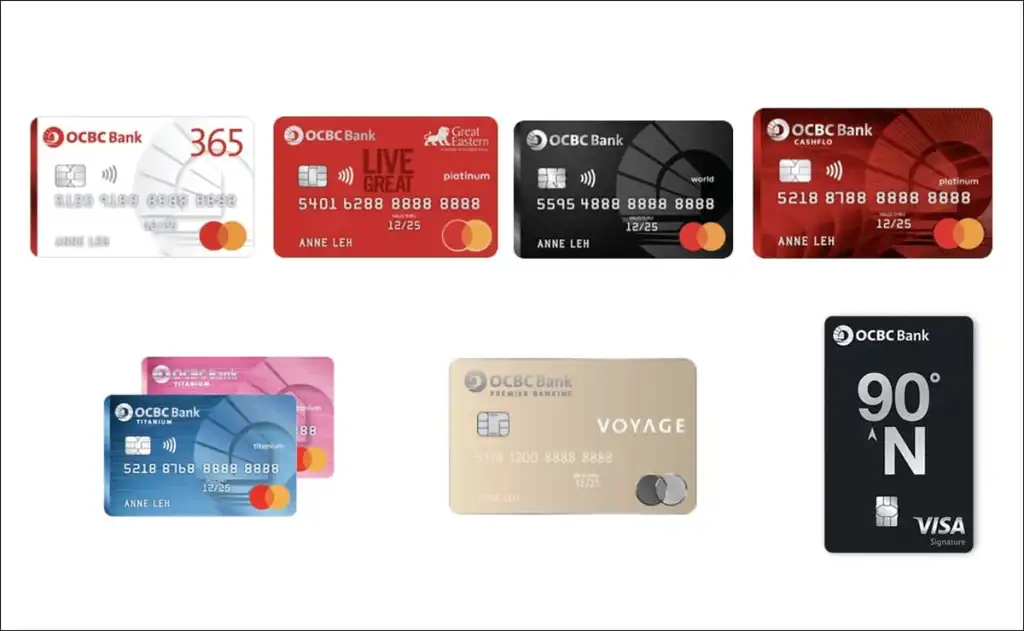

For additional clarity, the updated list of exclusions will apply to all of OCBC’s credit cards, including its cashback cards, rewards points cards (which earn points in the form of Travel$ and Voyage Miles, depending on the card), as well as auto-IPP credit card. Here are all the available cards under OCBC’s current credit card portfolio:

| Cashback credit cards | Rewards points credit card | Auto-IPP credit card (0% interest) |

| – OCBC 365 Mastercard – OCBC Great Eastern Platinum Mastercard – OCBC World Mastercard – OCBC Titanium Mastercard | – OCBC Premier Voyage (earning Voyage Miles) – OCBC 90°N Visa (earning Travel$) | OCBC Cashflo Mastercard |

If you have any enquiries regarding this latest update, you can reach out to OCBC’s contact centre at 03-8317 5000. Alternatively, you can contact them via their official Facebook page.

(Source: OCBC)

Comments (0)